- Cristiano Ronaldo was sent off against Al-Hilal for appearing to elbow a player

- Al-Hilal boss Jesus explained his behavior by saying that “he was not used to losing”

- Could Erik ten Hag return to Ajax? Listen to the everything is beginning podcast

<!–

<!–

<!–

<!–

<!–

<!–

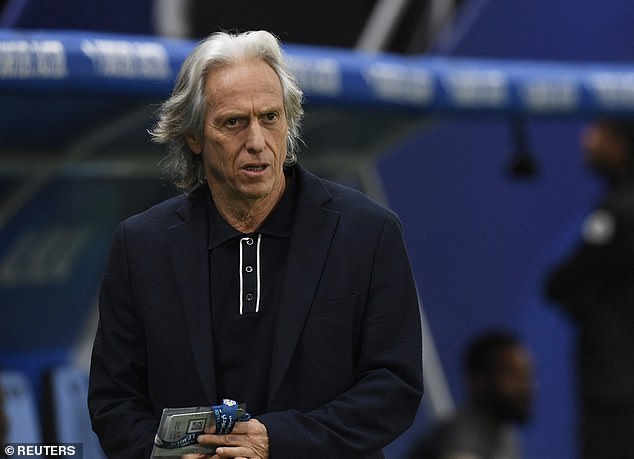

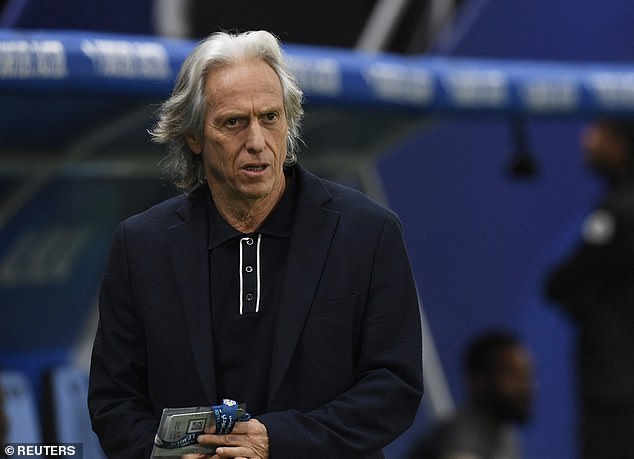

Cristiano Ronaldo is “not used to losing” and lacks “mental concentration” during defeats, Al-Hilal coach Jorge Jesús said after the Al-Nassr star was sent off during the Saudi Super Cup semi-final Saudi.

The Man United legend saw red for raising his first towards the referee after appearing to elbow an opponent and stomp on him.

Al-Nassr lost the semi-final 2-1, but Ronaldo lost his head in the 86th minute after an altercation with Al-Hilal’s Ali Al-Bulaihi, who had tried to prevent the veteran striker from taking a quick throw.

Footage then emerged showing Ronaldo throwing an elbow in the direction of the Al-Hilal defender, sending him to the ground.

Another clip then appeared showing Ronaldo trampling an already downed Al-Bulaihi, but advertising signs obstructed the view, so it was unclear if Ronaldo made contact with the player.

Cristiano Ronaldo was red for a moment of madness in which he appeared to elbow a player during Al-Nassr’s defeat to Al-Hilal.

Al-Hilal coach Jorge Jesús explained the incident by saying that Ronaldo “was not used to losing”

Your browser does not support iframes.

After a fight between both sides, Mohammed Al-Hoaish brandished a red card.

Trying to explain Ronaldo’s behavior, his Portuguese compatriot Jesus praised the five-time Ballon d’Or winner but said he lacks “mental concentration” when he loses games because he is not used to it.

“Ronaldo is one of the most important players in the world and an example for many,” he told the press after the game.

“But he is not used to losing in his career, so it is natural that he loses his mind when he loses, as well as loses emotional and mental concentration in defeats.”

He added: “It is not easy to play against (Al Hilal’s Kalidou) Koulibaly and Al-Bulayhi, they are the best central defenders in Saudi football.

“I’m not going to take credit away from Ronaldo, he’s still very strong, he has always been and will continue to be the most important player in the world, he is an example and a model.”

Jesús said the veteran forward lacked ‘mental concentration’ when losing games in his career

Ronaldo was outraged after the decision and appeared to say that fans were witnessing a “robbery.”

After his red card, Ronaldo made a gesture as if he wanted to throw a punch (or perhaps hit the ball he was holding) in the direction of the referee before withdrawing the action.

Having gotten into trouble, Ronaldo sarcastically clapped a referee on the shoulder after being shown a straight red card.

As he left the field, Ronaldo appeared to tell the crowd “you are all witnessing this robbery.”

Al-Nassr coach Luis Castro had insisted that Ronaldo did not deserve to be sent off.

He said: “We have seen several clips throughout this season where Ronaldo was provoked and, after seeing some footage, Ronaldo did nothing to merit sending off.” The rival player (Al-Bulayhi) pretended (to have been hit).

‘There was little contact between Cristiano and the rival defender. It caused a scene and the VAR should have called the referee to review the expulsion episode.