- Super Bowl LVIII will see the Kansas City Chiefs take on the San Francisco 49ers in Las Vegas on Sunday

- From Kelce and Swift to food consumed and touchdown stats, Mail Sport gives you the ultimate guide

Advertisement

Prepare your snacks, prepare your TV, and buckle up: Super Bowl LVIII is almost upon us as fans around the world await one of the biggest sporting events on planet Earth.

On Sunday night at 3:30 pm PST in Las Vegas (and at 11:30 pm in the UK), the Kansas City Chiefs will take on the San Francisco 49ers in a bid for glory amid a spectacle that is rarely rivaled anywhere else in sport.

More eyes are expected to be on this Super Bowl than in recent editions thanks to the power of Travis Kelce and Taylor Swift, whose romance has brought a legion of new fans to the sport as hordes of ‘Swifties’ adopt the Chiefs as their own . team in support of the pop star sensation and her boyfriend, the renowned tight end and one of the greatest players in NFL history.

Recent research has highlighted the incredible impact Swift and her loyal fan base have had on the sport, and with it, a much larger audience for this weekend’s Super Bowl. When the Chiefs faced the New York Jets in October, the first game since Kelce and Swift began dating, viewership numbers were reported at 29 million.

In the United Kingdom, a survey showed that almost 13 million Britons will tune in to the Super Bowl, and half of Swift’s fans in the country will see Kelce and company in action.

But the 34-year-old won’t be the only celebrity in attendance. R&B singer Usher will perform the iconic halftime show, although he will not be paid to do so, as is protocol for the artist chosen to perform at the chosen venue. Instead, he will use the event’s huge audience to promote his new music.

Elsewhere, celebrities who could appear include Chiefs fans such as actors Paul Rudd, Jason Sudeikis, Brad Pitt and Henry Winkler. Meanwhile, the 49ers also have esteemed company among their fan base, including rapper Lil Jon and actor Andy Samburg.

This is simply not an event to be missed. Last year’s event had 115.1 million viewers to sum up a masterpiece that brings together people from all over the United States. It’s no wonder advertisers pay a lot of money considering all eyes are on it. Last year, Amazon paid $26 million for a 120-second ad featuring its Alexa device.

Below, Mail Sport has provided a detailed graphic giving you everything you need about Sunday’s event, including head-to-head stats for both teams, what famous fans they have, who the key players are on each side, plus a breakdown of the key statistics.

This weekend’s Super Bowl will be one of the most anticipated editions of the high-profile event in its history.

Chiefs tight end Travis Kelce and Taylor Swift’s romance has helped bring a new legion of fans to the sport before the game, and more viewers than ever are expected to watch.

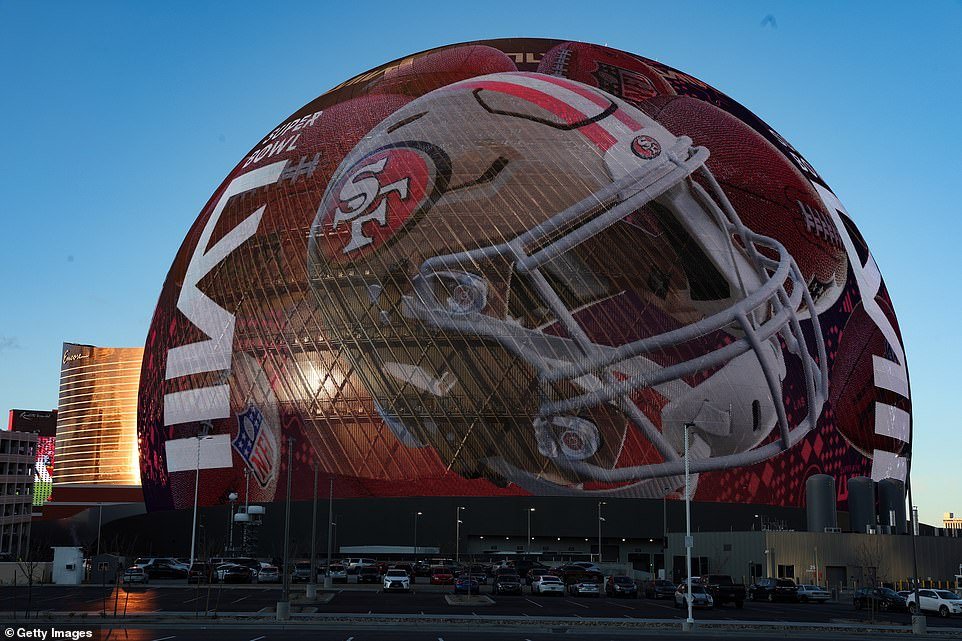

Fans flock to Las Vegas ahead of Sunday’s big showpiece, one of the most-watched sporting events in the world.