New South Wales’s first drug testing pilot program will begin operating in an inner-city suburb from Monday, ahead of the much-anticipated Drug Summit promised later this year.

The programme, known colloquially as pill testing, will take place one day a week for around four months at the Medically Supervised Injecting Center (MSIC) in Kings Cross, and will take samples from 100 volunteers.

Participants in the pilot must already be registered to use MSIC services, managed by Uniting NSW. ACT and provide a small amount of the previously purchased medications for monitoring.

The first drug testing pilot program in New South Wales has been launched at the Medically Supervised Injection Center (MSIC) in Kings Cross.

The program, known as pill testing, will take samples from 100 volunteers, who will then undergo an analysis of their substance.

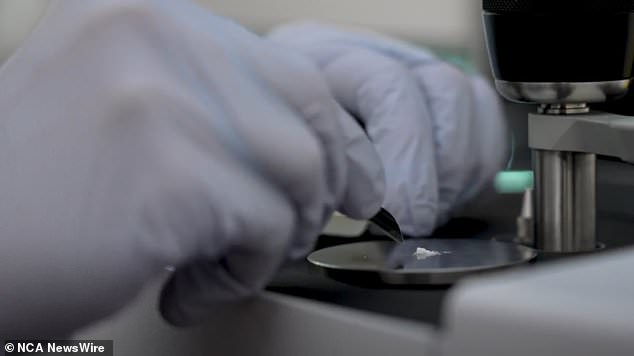

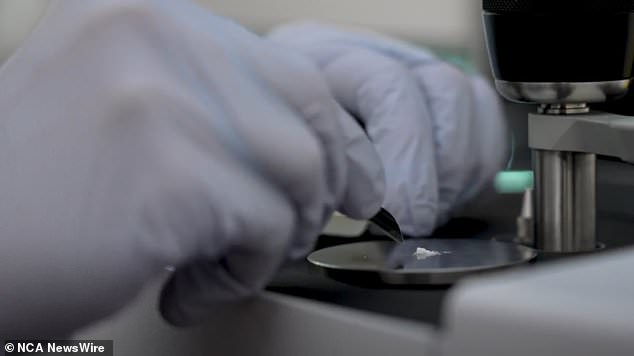

They will then undergo an analysis of their substance, which includes details of the drug mixture present, the purity of the substance, and specific harm reduction advice.

The samples will also be sent to the NSW Health Pathology Forensic and Analytical Sciences Service for further confirmatory testing and drug composition analysis.

No legislation or government approval was required to begin the pilot program, as it is a research project; However, the program received approval from the Human Research Ethics Committee of both the University of New South Wales (UNSW) and the Western Sydney Local Health District (LHD).

MSIC medical director Marianne Jauncey said the main illicit drugs passing through the center are methamphetamine and heroin, followed by a “range of other substances”.

She says the study will look at the interest, feasibility and effectiveness of testing, and whether drug screening can positively influence people’s drug-taking behaviour.

For example, whether detection of other substances will prevent users from taking the drugs.

“It will also improve surveillance of the street drug market so that unexpected or highly dangerous substances can be identified earlier, ideally before people consume them,” Dr Jauncey said.

“NSW has reason to worry as drug markets become increasingly unpredictable post-Covid.”

She hopes the program will strengthen the case for drug control, ahead of a yet-to-be-announced Drug Summit, which NSW Health Minister Ryan Park has promised later this year.

“The reality is that people use drugs, inject drugs and die as a result, so anything we can to reduce harm has to be a good thing,” he said.

The program will study whether drug control can positively influence people’s behavior around drug use, especially if the detection of harmful substances prevents the user from consuming them.

The New South Wales government has discouraged further policy announcements around drug reform until the Drug Summit; However, Health Minister Ryan Park has historically said that pill testing was not part of the government’s reform agenda and maintains that programs at music festivals were not a “silver bullet” against deaths.

“I don’t think we should take the view … that pill testing is a silver bullet that will protect everyone who attends (a music festival),” Park told a budget estimates committee in February.

Uniting New South Wales. ACT chief advocacy officer Emma Maiden said she believed New South Wales had a “narrow view” on education, resulting in missed opportunities for “meaningful engagement” around harm reduction.

Ahead of last year’s summer music festival season, Uniting joined a number of other advocacy groups in calling on NSW Premier Chris Minns to implement pill testing measures, however, this was rejected.

“New South Wales was a leader 25 years ago, I think it’s fair to say we are no longer one,” Ms Maiden said.

“In Australia and around the world, we are seeing governments take different approaches to drug laws to reduce harm.”

Nationally, the Australian Capital Territory (ACT) is the only jurisdiction to have a fixed drug testing centre; However, the Queensland Government has announced a fixed site in the Bowen Hills area of Brisbane due to open later this month.