- Fast-food chains report low sales as price increases deter consumers

- McDonald’s CEO has said that in 2024 he will have to focus on “affordability”

Americans are turning their backs on fast food as some of the country’s largest franchises continue to raise prices on what were once affordable meals.

Explaining its first quarterly sales failure in nearly four years, McDonald’s CEO told investors this week that consumers making less than $45,000 a year were spending less at its restaurants.

“Eating at home has become more affordable,” said boss Chris Kempczinski. “The battleground is, without a doubt, the low-income consumer.”

“I think what we’ll see as we get closer to 2024 is probably more attention to what I would describe as affordability,” he added.

Bret Kenwell, investment analyst at eToro, told DailyMail.com: “During conference calls, management teams are acknowledging the monetary pressures felt by certain consumer groups.”

Americans are turning their backs on fast food as some of the country’s largest franchises continue to raise prices on what were once affordable meals.

McDonald’s CEO Chris Kempczinski said it would focus more on affordability in 2024 to ensure it could attract low-income families.

It comes as videos showing shockingly high fast food prices have gone viral on social media, cementing the idea that the days of $1 menus are long gone.

McDonald’s recently came under fire online after one of its restaurants in Connecticut was caught for selling a Big Mac meal for $17.59.

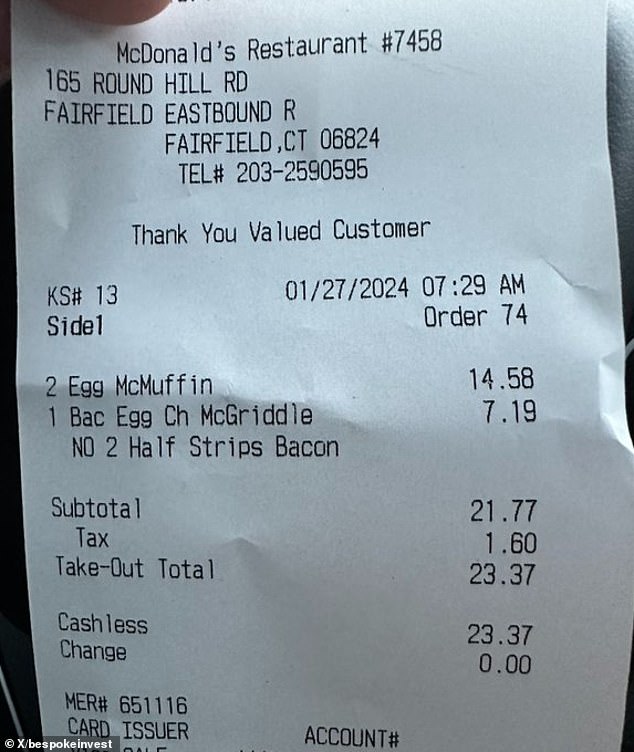

Then a photo of a receipt from another McDonald’s in Connecticut. went viral on X because he was charging $7.39 for just one Egg McMuffin.

McDonald’s sales last quarter rose just 3.4 percent from the same quarter in 2022, well below Wall Street expectations of 4.7 percent.

The problem is not unique to McDonald’s. This week, Yum Brands, parent of KFC, Pizza Hut and Taco Bell, reported similarly disappointing results.

Last month, a viral video showed someone discovering a 12-year-old Taco Bell receipt that showed Americans could once buy two of the chain’s meaty five-layer burritos for $2.59. At most restaurants, they now cost more than double.

Taco Bell is the Yum group’s main source of income in the United States and has historically been known for its value offerings. Its sales grew just 3 percent last quarter, well below the 11 percent growth it experienced a year earlier.

Pizza Hut sales fell 4 percent and KFC sales were flat.

Laura Murphy, CEO of public relations firm Bolt, which specializes in food and beverage marketing, told NBC News that people just want cheap food.

A photo of a receipt issued by a McDonald’s at a rest stop in Connecticut that charged $7.39 for an Egg McMuffin.

“People are really saying to fast food industry leaders, ‘This is what we’re looking for, this is what we want. We want efficiency. “We want affordability,” she said.

“Let’s get back to really making sure that we’re providing simple foods in a way that’s affordable, efficient, quick and really gives people the basics of what they’re looking for.”

As Kempczinski suggests, consumers’ declining appetite for fast food coincides with the growing affordability of food.

The cost of food at home, as reported by the Bureau of Labor Statistics, increased just 1.3 percent between December 2022 and December 2023. Meanwhile, the cost of food outside the home increased 5.2 percent during the same period.

“There has been a steady increase in ‘away from home’ food prices, both in recent months and over the last year,” Kenwell said.