Table of Contents

Energy customers will have to wait longer for cheaper deals after regulator Ofgem has decided to maintain a ban on companies undercutting each other.

Ofgem rules mean energy companies cannot offer cheaper deals to new customers unless they also offer them to existing ones.

Ofgem introduced this “ban on acquisition-only tariffs”, or BAT, in October 2022 to stop energy companies from using the classic tactic of undercutting each other’s prices to win new customers as prices soared.

U-turn: Ofgem previously said it would remove the ban on cheaper tariffs for switching customers in October 2024, but will now keep it in place until at least March 2025

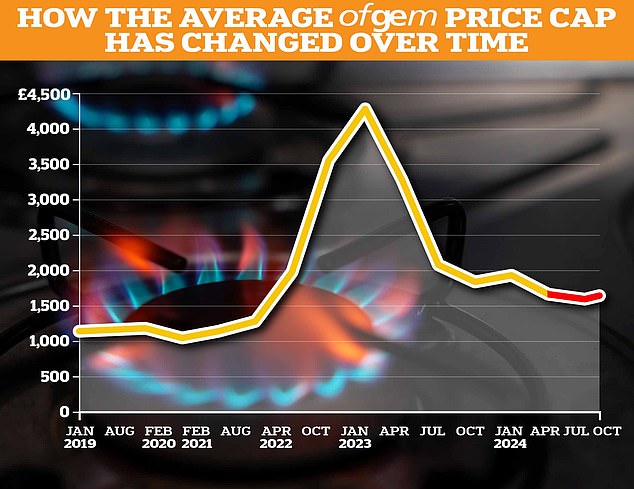

The BAT is part of the reason energy bills remain at £1,568 a year for a typical home (the level of Ofgem’s price cap), as companies have no incentive to go back to offering cheaper deals.

But Ofgem said today it will keep this ban in place until at least 31 March 2025, a U-turn on its previous position of removing it in October 2024.

The only positive news is that customers who remain with their energy company will not be penalized with higher bills.

Ofgem decided to keep the BAT to ensure that customers do not end up paying a “loyalty penalty”, where prices rise unless they switch suppliers.

The regulator also said maintaining BAT was good news for indebted customers who would otherwise be unable to switch but can still access cheaper deals through their current provider.

Charlotte Friel, Ofgem’s acting director for consumer protection and retail markets, said: “We have heard the voices of consumers loud and clear and we have responded.

‘We are committed to acting in the best interests of all customers and the feedback we receive from the public, industry, consumer groups and charities is vital in shaping the work we do.

‘The responses we received showed strong sentiment against short-term reduced rates that exclude a provider’s existing customers.

‘While competition is an important factor in driving better standards, so is consumer confidence, and it is clear that denying the best deals to everyone risks undermining the progress we have made in restoring trust in the energy market.’

But energy experts said maintaining the BAT was a “severe blow” to households who desperately needed to pay less for energy.

Richard Neudegg, Uswitch’s director of regulation, said: ‘The decision to continue with BAT is a blow to households looking for cheaper energy bills, especially as a difficult winter approaches.

‘The ban was introduced as a temporary measure to help stabilise the market during the energy crisis and protect suppliers, but it has done nothing for consumers other than artificially increase prices.

‘Ofgem’s own analysis concludes that maintaining BAT is “likely to result in net costs to consumers through price increases”. It is disappointing to see an economic regulator acting against the evidence, especially on options that could reduce household bills.’

SAVE MONEY, EARN MONEY

Boosting investment

Boosting investment

5.09% cash for Isa investors

Cash Isa at 5.17%

Cash Isa at 5.17%

Includes 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.21% cash Isa

5.21% cash Isa

Use code ISABOOST before July 31st to get a 0.11% boost

Transaction fee refund

Transaction fee refund

Get £200 back in trading commissions

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.