Table of Contents

Rio Tinto exported its four billionth tonne of iron ore from the Pilbara in Western Australia to China this summer.

The giant cargo ship, which left the port of Dampier on July 19 loaded with the raw material used to make steel, was heading to its largest

Client: The world’s largest steel producer, Baowu Steel Group.

In a press release to celebrate the milestone, the Anglo-Australian firm said 4 billion tonnes of iron ore would produce enough steel to build around 45,000 Sydney Harbour bridges.

And it reflected that 51 years had passed since its first shipment from its iron ore cores in north-west Australia to China, then ruled by Chairman Mao, who oversaw a country that is a shadow of the economic powerhouse it is today.

Exports: It is 51 years since Rio Tinto first shipped from its iron ore plants in the Pilbara in north-west Australia (pictured) to China.

China’s meteoric rise to become the world’s second-biggest economy, and the insatiable thirst for steel that has accompanied it, have brought enormous riches to Rio and its former FTSE 100 rival BHP.

But as investors have been reminded in recent months, relying too heavily on one commodity and one customer, even a very large one, carries risks.

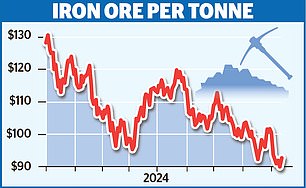

After falling 10% last week, iron ore prices fell below $90 a tonne this week for the first time.

time in nearly two years amid fresh fears that China will fail to meet its 5% annual growth target.

In addition, fears of a US recession have intensified following the publication of disappointing employment figures last Friday.

The result is that iron ore has fallen by a third since the beginning of the year, when it was trading at around $132 a tonne.

And although it has now returned to above $90 (it rose to $92.30 yesterday), it is now worth significantly less than half of the $233 per tonne it reached in May 2021.

Rio, which produces about 330m tonnes of iron ore a year (virtually all of it in the Pilbara (pictured above)) and sells about three-quarters to China, has seen its share price fall by almost a fifth since the start of this year to 4,720.5p.

China’s property market, which accounts for the bulk (about 30 percent) of steel demand, has deteriorated dramatically, as seen most clearly in the implosion of apartment construction giant Evergrande, the heavily indebted Chinese company that was liquidated earlier this year.

More gloomy than expected property data from China shows the value of new home sales by the 100 largest property companies is down 26.8% from a year ago.

Meanwhile, as the economy falters, Xi Jinping’s communist government has not spent as much money on giant infrastructure projects, such as roads, railways and airports, as it used to.

“This has made the situation worse,” said Vivek Dhar, senior commodities and mining analyst at Commonwealth Bank of Australia.

‘Typically, the main sector that counteracts what happens in the real estate sector has been infrastructure, but recently this too has gone from bad to worse.’

To make matters worse, falling demand for iron ore has coincided with a supply glut, led by Australia and the world’s second-largest producer, Brazil.

Baowu, which is Rio’s largest client, is owned by the

The Chinese government put investors on notice last month by warning that a “long, hard winter” was ahead for the steel industry.

According to Chinese news agency Mysteel, only 1% of Chinese steel mills are making a profit, as some have closed their blast furnaces and iron ore remains idle in Chinese ports.

Pressure: Rio CEO Jakob Stausholm (pictured) has overseen massive investment in new iron ore mines in Africa and Australia

Long-term investors should be accustomed to wild swings in the price of iron ore and, by extension, in Rio’s share price.

But for some industry experts, this crisis looks a little different and could finally herald the end of the long iron ore boom.

The most prominent of these is BHP Chief Executive Mike Henry, who has argued that Chinese demand for iron ore has peaked and will remain near current levels for several years before beginning to decline, and that the days of breakneck growth are numbered.

This drop in demand will coincide with an increase in supply, and Rio expects production to begin next year at its giant Simandou mine in Guinea, West Africa, and its Western Range deposit in the Pilbara. Both are joint ventures with Baowu.

Henry has warned that smaller, higher-cost iron ore miners will fall by the wayside if prices continue to fall as Chinese steel demand stagnates.

There is no doubt that this will happen to giants like BHP and Rio, which will continue to make most of their profits from iron ore for the foreseeable future and earn substantial margins even when prices are lower.

But Henry stressed that the end of the golden age of the iron ore boom further underlines the importance of “future-oriented” raw materials needed to power renewable energy and electrification, such as copper, lithium, nickel and potash.

As for Rio, its chief executive, Jakob Stausholm, has been a little more optimistic.

This is perhaps unsurprising given the company’s massive investment in new iron ore mines in Africa and Australia.

It has told investors it is confident iron ore prices will remain high enough to ensure these investments pay off.

Time will tell.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.