- Dwayne Johnson has served on TKO’s executive board since late January.

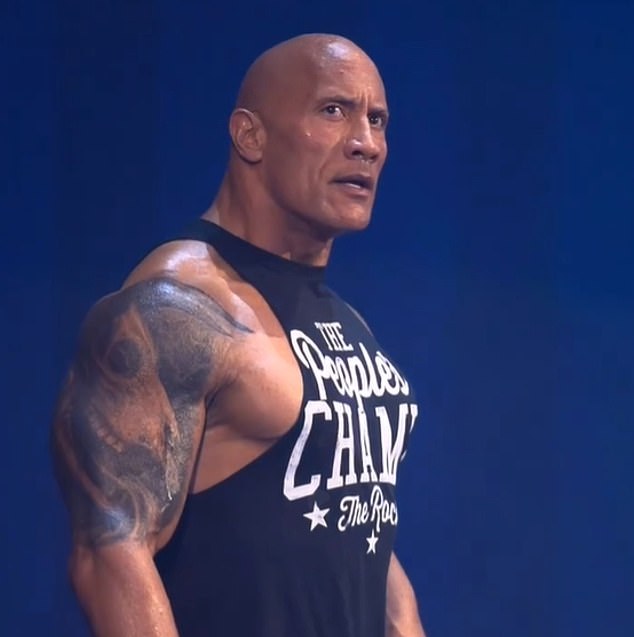

- The Rock is one of the most popular professional wrestlers of all time.

- DailyMail.com provides the latest international sports news.

<!–

<!–

<!–

<!–

<!–

<!–

The Rock trademarked and took ownership of 20 of his popular nicknames and phrases as part of his agreement to join the executive board of TKO, the joint effort that oversees WWE and the UFC.

Dwayne Johnson joined TKO in late January, days before new sexual assault allegations against former WWE CEO and Chairman Vince McMahon came to light, forcing the 78-year-old to leave wrestling. free professional again.

Johnson now owns ‘The Rock’ as an entity unto himself and his nicknames such as ‘The Great One’, ‘The Brahma Bull’ and ‘The People’s Champion’. She also owns the trademarks for the names of her two signature moves: ‘The People’s Elbow’ and ‘Rock Bottom’.

Several of his signature catchphrases were also trademarked according to an SEC filing, including “If you smell what The Rock is cooking” and “Know your role and shut your mouth.”

A notable part of the trademarks is that Johnson has control of those phrases only within the walls of WWE, meaning anyone can say them publicly, but within the universe of sports entertainment, only The Rock has access to those phrases. and nicknames.

In addition to his careers in Hollywood and wrestling, The Rock now has power on the TKO board

Johnson rose to prominence in WWE in the late 1990s before transitioning into his acting career.

Additionally, as part of his executive role at TKO, Johnson has decision-making power and stock options worth up to $30 million. according to TMZ.

Johnson is one of the most popular professional wrestlers of all time and translated his success with WWE into a long career as an actor, where he is one of the most in-demand actors in Hollywood.

The Rock began focusing on acting full-time and left WWE on the back burner in 2004, after starting with the company in 1996.

He began making sporadic in-ring appearances for WWE again in 2012, where he began a feud with fellow wrestler and Hollywood actor John Cena, which culminated in two WrestleMania main events in consecutive years.

Johnson is back on WWE television, currently playing a villainous role for the first time in two decades, in the lead-up to the company’s biggest show of the year, WrestleMania 40, in April.

Johnson is seen here with McMahon at the New York Stock Exchange in late January.

The Rock is expected to compete during WrestleMania, and Johnson’s last recognized match in WWE was a six-second victory over Erick Rowan in 2016. Before that, it was the last of his WrestleMania main events with Cena in 2013.

Johnson returned to active storylines in January with the lure of a match against current WWE Universal Champion and member of the Anoa’i family, Roman Reigns, as the plan.

The WWE fan base had a negative reaction to The Rock supplanting other full-time wrestlers in the company’s main event scene, such as Cody Rhodes, forcing a change in creative plans and Johnson playing a heel or a villain.

Off camera, Johnson owns those trademarks, making him one of the most powerful people in combat sports.