Elizabeth Warren slammed the CEO of a major student loan company after he said he would not attend a Senate committee hearing on the company’s performance.

In March, the Massachusetts senator invited Scott Giles, CEO of embattled trustee Mohela, to testify before the Senate banking committee on Wednesday.

But according to a letter Written by lawyers on behalf of the company, Giles will not testify before Congress and instead requested closed-door briefings instead of a public hearing.

Senator Warren invited him to explain Mohela’s handling of repayments that resumed after the Covid-19 pandemic pause and his management of the Public Service Loan Forgiveness (PSLF) program.

The PSLF program, created in 2007, forgives the remaining balance for borrowers who work in the public sector or government jobs after 10 years of repayment.

Since 2022, Mohela has been the sole administrator of the program, which has been a key focus of the Biden administration’s recent forgiveness efforts.

In March, the Massachusetts senator invited Scott Giles, CEO of the Mohela trustee, to testify before the Senate banking committee on Wednesday.

Senator Warren invitation It followed reports of “widespread service failures” by Mohela affecting “at least 40 per cent of its borrowers”.

She said Business Insider: ‘Mohela botched student loan payments for millions of people, forcing them to pay incorrect and higher amounts, delaying student loan forgiveness, and forcing some people to make payments on debts that should have already been paid off.

“The millions of Americans affected by Mohela’s mistakes deserve answers.”

Elizabeth Warren criticized CEO Scott Giles (pictured) after he said he would not attend a Senate hearing on the company’s performance.

For example, one borrower said the outlet earlier this year, how he received notification from Mohela in May 2023 that his debts had been canceled under the PSLF program, only then was he told that his $93,000 balance had been restored in full in February of this year.

In the letter from lawyers at law firm Kirkland & Ellis to Senator Warren last week, they said that while Giles would not attend the public hearing, “senior members of his team would welcome the opportunity” to hold bipartisan briefings. private parties to address the issues you raised in your invitation.

Mohela (Missouri Higher Education Loan Authority) is one of the largest student loan servicers in the country, serving more than eight billion borrower accounts.

In her hearing request, Warren outlined a variety of concerns she hoped to address.

“Your testimony will provide you with the opportunity to offer context about Mohela’s role as a student loan servicer at a time of significant transition for the federal student loan program,” he wrote.

She cited a recent report which said Mohela’s “failure to perform basic service functions” meant thousands of nurses, teachers, firefighters, service members and other public servants were unable to get the help to which they were legally entitled.

He said the company engaged in a “call diversion scheme” strategically avoiding borrowers who needed help.

Following the report’s publication in March, Mohela sent the authors of the Student Borrower Protection Center a cease and desist. letter demanding that the advocacy group remove the report from its website.

Since 2022, Mohela has been the sole administrator of the Public Service Loan Forgiveness (PSLF) program, which has been a key focus of the Biden administration’s recent forgiveness efforts.

Mohela was also the first federal servicer to be sanctioned for service delivery failures after returning loan payments to borrowers in October last year, and faces a class-action lawsuit from borrowers.

The Department of Education withheld more than $7 million in payments to the company in October 2023 after it failed to send timely billing statements to 2.5 million borrowers.

The error meant that more than 800,000 borrowers were in default on their loans.

Starting in May, Mohela will no longer be the sole administrator of the PSLF program and the Department of Education will transfer borrowers’ accounts to several different providers.

The program will also be “fully managed” by the department as it revamps its operations.

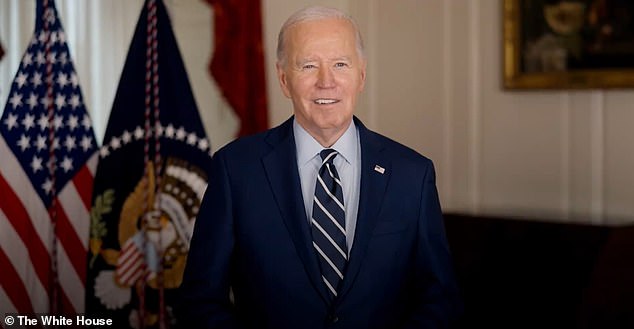

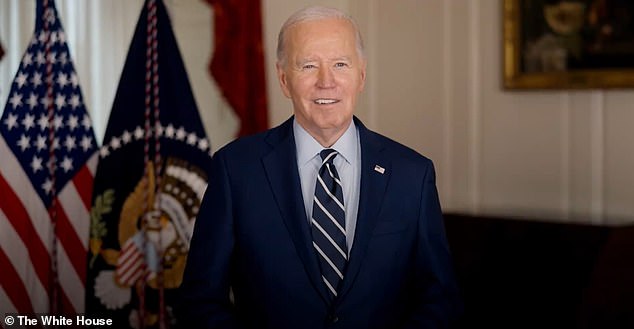

It comes as President Biden on Monday unveiled his latest effort to cancel millions in student loan debt, which the White House believes would provide relief to up to 30 million borrowers.

President Biden released a video Monday talking about his latest student loan debt forgiveness plan.

The effort comes after the Supreme Court last year blocked President Biden’s first plan for widespread student loan debt forgiveness.

Since then, the administration has still managed to pay off about $146 billion in debt despite the threat of legal challenges.

After the original plan was rescinded, the Biden administration began looking for other ways to pay off the debt. Monday’s new proposals are the result of those efforts.

“From day one, my administration has been committed to fixing the broken student loan system and ensuring that higher education is a ticket to the middle class, not a barrier,” Biden said in a video posted online Monday.

“In total, these plans will cancel some or all of the student debt of 30 million Americans when combined with everything we have done so far,” he said.