Table of Contents

The Labor Party is considering ways to help struggling carmakers meet electric vehicle sales targets by looking at “flexibilities”, as manufacturers warn of the possibility of withdrawing production from the UK.

Transport Secretary Louise Haigh and Business Secretary Joshua Reynolds will meet auto industry leaders on Wednesday to discuss ways to help beleaguered companies meet the strict thresholds of the Zero Emission Vehicle (ZEV) Mandate ) introduced this year.

Many carmakers are struggling to meet binding targets, introduced by the Conservatives and continued by Labour, requiring more than a fifth of all sales by major manufacturers to be electric vehicles this year.

Failure to meet the 22 per cent threshold could result in fines of £15,000 per car below the target, with some manufacturers said to be reaching “crisis point” as the end of the year approaches.

Some carmakers, including Vauxhall owner Stellantis, have threatened to pull out of UK production entirely amid the row over sales targets, while Nissan is expected to warn MPs it could do the same if they don’t. government support is provided.

This comes after the Chancellor did little to help encourage the uptake of electric vehicles in the October budget.

Transport Secretary Louise Haigh and Business Secretary Joshua Reynolds will meet automotive industry leaders to discuss the strict zero-emission vehicle mandate.

It is not yet clear to what extent the government will relax electric vehicle sales targets.

He Financial times reports that while the Secretary of Transportation is in “listening mode,” she is reluctant to adjust EV sales targets.

On Saturday, The times reported that Haigh and Reynolds are expected to tell industry players that “all options” are on the table.

Discussing the matter on LBC Radio, Haigh doubled down on existing targets and said the mandate requirements will not be weakened.

Ms Haigh said: ‘There are flexibilities in the current mandate but we want to work with the manufacturing sector to determine if they are working and if we can address them.

“But the level of our ambition and our mandate will not be weakened.”

“Options” to be discussed on Wednesday are said to include: bringing back electric vehicle subsidies for private customers; allow exported electric vehicles to count towards targets; allow reducing carbon emissions in factories to count towards targets and; equalizing the ZEV percentage difference between passenger cars and vans.

Motorists in general have received very little financial support in the form of government subsidies when it comes to purchasing electric vehicles, especially since the plug-in vehicle subsidy was prematurely removed in June 2022.

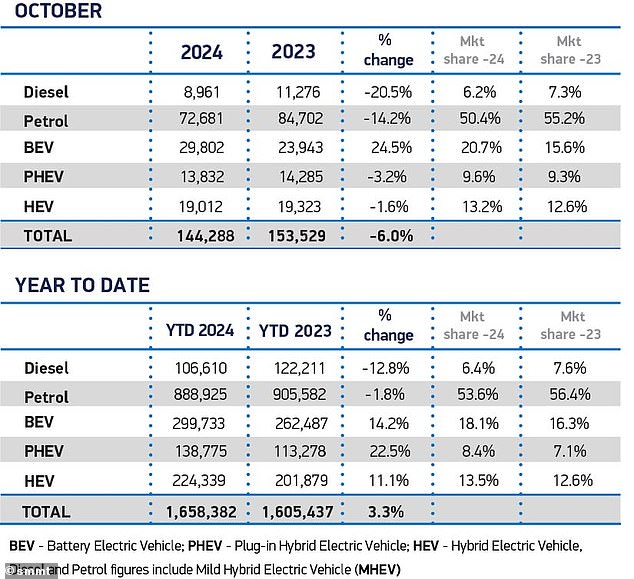

The latest car sales figures show more electric vehicles are being sold, but the numbers are lagging behind target.

Carmakers threaten to pull out of UK over binding EV sales targets

The upcoming consultation comes after a very challenging year for manufacturers.

Stellantis is reportedly considering withdrawing its investment in UK manufacturing, and former boss Maria Grazia Davino said in June it could end vehicle production at its Ellesmere Port and Luton factories, putting ministers on notice. saying that the decision will be made in “less than a year.”

He FOOT It also suggests Nissan will warn ministers this week that the country’s car industry has reached a “crisis point”, with jobs and competitiveness at risk unless the government relaxes rules on electric vehicles.

This is Money has reported how car brands are resorting to “desperate” tactics to try to hit “binding year-end sales”, including cutting prices of new electric vehicles by up to a third, using the Motability marketplace to increase sales and generate more dealer protestors to artificially increase EV registrations.

Calls for subsidies for new electric cars and for direct incentives for private customers went unanswered in the Chancellor’s autumn budget, as did reductions in VAT paid on public charging to align rates with those for domestic charging and eliminate the disparity between those who can charge at the entrance of their homes and those who cannot.

This has led the Government to admit to the Times that “the UK has become a difficult place for manufacturers to do business”.

Haigh told LBC that “there has been a drop in demand globally so we are absolutely in listening mode” and “we will discuss the challenges that they (manufacturers) face on a global scale.”

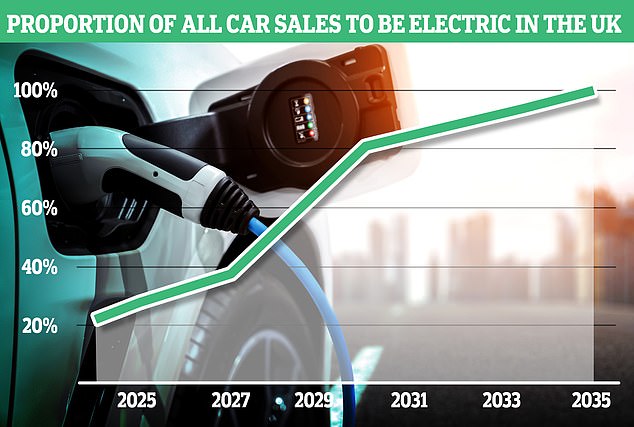

The ZEV mandate was introduced in January and sets binding electric vehicle sales targets that will increase annually over the next decade.

ZEV mandate: what are the sales targets for electric cars?

The zero-emission vehicle (ZEV) mandate, introduced by the government this year to force manufacturers to increase their share of electric vehicle sales between now and 2030, threatens fines of £15,000 per electric car below the required fee.

Electric cars should represent 22 percent of all sales in 2024.

Brands that sell fewer than 1,000 ZEVs per year are exempt from the rules.

In 2025, brands will need to increase their share of electric vehicle sales to 28 percent and the following year the threshold will increase to a third (33 percent).

By 2028, more than half (52 percent) of all models sold will need to be zero-emission.

By 2030, the requirement is that 80 percent of all new car registrations by brand be zero-emission electric vehicles.

The remaining 20 percent will be deducted only for some hybrid cars.

The DfT is due to confirm which type of hybrid will receive a five-year moratorium until 2035, although This is Money expects these to be mainly plug-in hybrid vehicles, which have the longest ranges for electric vehicles only.

How automakers are struggling to hit electric vehicle sales goals

Almost 300,000 new electric vehicles hit UK roads in 2024, representing 18.1 per cent of the market, an increase on 2023.

However, this is still well below the target of 22 per cent for this year – and the 28 per cent to be achieved in 2025 – under the Vehicle Emissions Trading Plan.

However, there are some concessions within the rules of the ZEV mandate.

If manufacturers reduce their average CO2 emissions and exceed their CO2 target, then they can “convert” this into credits towards their ZEV targets.

This is subject to an exchange rate, a cap (65 percent of the 22 percent target in 2024) and is only an option available for the first three years until the end of 2026.

Brands that fall under the same manufacturer umbrella (e.g. VW, Skoda, Seat, Porsche, Bentley and Cupra, all part of the Volkswagen Group) can share ZEV credits between brands to achieve binding targets.

Automakers that find themselves below the required threshold at the end of each year can also evade fines by purchasing credits from other manufacturers that far exceed ZEV requirements (particularly EV-only brands like Tesla and Polestar) or can defer your unfulfilled quota for future years. .

The UK is not meeting the 22% ZEV targets the government has set for this year.

Mike Hawes, chief executive of SMMT, commented on the latest new car sales figures for October: “Fleet renewal across the market remains the fastest way to decarbonise, so slowing overall adoption is not good news. for the economy, for investment or for the environment.

“Electric vehicles already work for many people and businesses, but changing the entire market at the pace required requires significant intervention in incentives, infrastructure and regulation.”

Ian Plummer, commercial director at Auto Trader, commented: “Manufacturers are making significant efforts to close the price gap with electrics, as evidenced by the 12 per cent discounts on the Auto Trader site in October, but the market is still It is not reaching the necessary volumes.

“With the 2030 ban date on the sale of new petrol and diesel vehicles re-established, we urgently need to make the positive case for electric vehicles to ensure a larger, healthier new car market.”

This is Money has contacted the Department of Transport for comment.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.