Insurers are deregistering and scrapping electric vehicles at a rate half that of petrol and diesel cars, new analysis reveals.

It comes after several reports suggested that insurers are writing off electric vehicles at an alarming rate because minor collisions are said to cause irreparable damage to batteries.

While the latest report suggests that the payback rate is much lower than expected, current average repair costs for electric vehicles are clearly higher than those for cars with conventional internal combustion engines (ICE).

Several reports over the past 12 months have suggested that the payback rate for electric vehicles is exceptionally high due to unaffordable repair costs.

Automotive data company cap hpi has carried out analysis of DVLA data following calls from sectors of the motor industry to understand whether electric vehicles are being canceled more frequently than internal combustion engine cars.

He said there is “no conclusive evidence” to support the theory that battery-powered cars are scrapped at a higher rate than ICE models.

Looking specifically at cars up to a year old, the study found that a A total of 40 electric vehicles (0.01 percent) were scrapped out of the 334,525 on the roads last year.

This compared to 701 of 2,026,146 ICE vehicles (0.03 percent).

According to DVLA figures, 0.01% of year-old electric vehicles on British roads were scrapped last year. This compares to 0.03% for ICE cars.

Extending the age of cars to three years, 782 (0.09 percent) of 912,341 electric vehicles were scrapped in 2023, compared to 10,300 (0.18 percent) of 5,788,617 gasoline and diesel vehicles.

Finally, if engines up to five years old are analyzed, official records show that 1,433 (0.13 percent) of 1,130,581 electric vehicles were forced to be scrapped, compared to 33,700 (0.33 percent) of 10,278 .745 gasoline and diesel models.

Jonathan Clay, ID director at cap hpi, says the report highlights the essential need for the industry and consumers to have “an accurate picture of emerging trends as the electric vehicle market continues to develop.”

Electric cars ARE more expensive to fix

The data runs counter to a series of reports in the past year that have made bold claims that EV write-offs are much more common.

A Reuters investigation in March 2023 suggested that insurance companies increasingly have little or no choice but to permanently remove electric cars from the roads after minor collisions, which in turn is driving up premiums.

The report warned of scratched and slightly damaged battery packs “accumulating in scrapyards in some countries” and experts said the batteries in expensive Tesla Y SUVs have “no repairability” because they are a structural part of the car.

Additional research last year by UK-based automotive risk intelligence firm Thatcham Research also warned that electric vehicles are more expensive to repair, take longer to repair and are more common to be written off. as a result of damage to their batteries.

Is Report on the impact of BEV (battery electric vehicle) adoption on the repair and insurance sectors published last July – funded by Innovate UK, the government’s innovation agency – says that road collisions involving an electric car are often “catastrophic for the vehicle”.

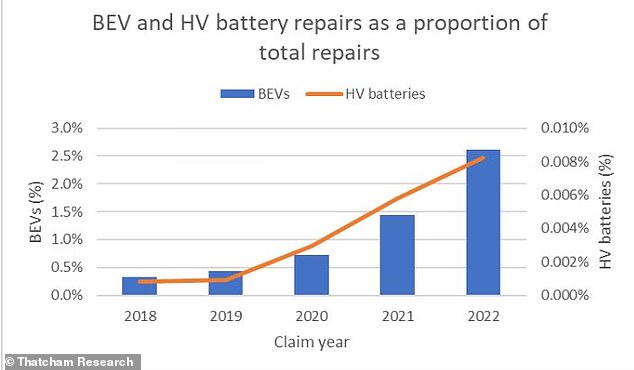

This chart shows electric vehicle and high-voltage battery repairs as a proportion of total repairs.

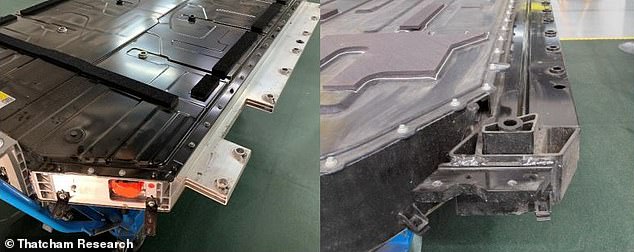

Thatcham Research showed the impact of a low-gravity impact on a Tesla and the damage it can cause to the battery case, which would then need to be repaired or replaced.

The housing in which the batteries are stored usually has a wide structure, making them especially vulnerable to side collisions.

This is due to a “worrying lack of affordable or available post-accident diagnostics and repair solutions”, which often renders discarded EVs uneconomical to return to the road.

This is usually the case if the high-voltage battery has suffered damage as a result of a collision. Electric car batteries make up a substantial percentage of the vehicle’s original value, and if they are damaged in any way, insurers often consider the cost to repair or replace them to exceed the total existing value of the car.

The study said the cost of replacing electric vehicle batteries varies widely by model, although it is an extremely expensive process regardless of the car in question.

For a premium electric car, for example, the cost of a new battery is around £29,500, Thatcham Research said. This is more than the price of a new petrol Volkswagen T-Roc SUV.

And for “cheap” electric models, it estimates the average battery replacement cost is £14,200 – more than a Dacia Sandero, Britain’s cheapest car.

Research by cap hpi parent group Solera, which specializes in vehicle lifecycle data, tells a similar story.

In November, it published the results of the analysis of some 92,000 global vehicle repair estimates between January 2021 and August 2023.

The main finding is that Electric vehicle repair costs are 29 percent higher than ICE vehicles globally.

This is mainly because, on average, electric vehicle parts are 48 percent more expensive, including components such as high-voltage batteries and control units.

In fact, electric vehicle battery systems represent the largest partial cost item in all vehicles, significantly exceeding the costs of components such as headlights.

And it also identified that certain parts, especially rear bumpers, have a noticeably higher replacement rate in electric vehicles than in internal combustion engine cars.

“With repair costs for electric vehicles being up to 29 percent higher than ICE vehicles, according to a Solera study, it is important to understand the impact on scrappage rates,” added cap hpi’s Jonathan Clay .

The lack of technicians trained to work on electric vehicles is also a major problem for the sector.

The latest prediction from the Motoring Industry Institute is that there will be a shortfall of 30,000 qualified electric vehicle mechanics when the ban on the sale of new ICE vehicles comes into force in 2035.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.