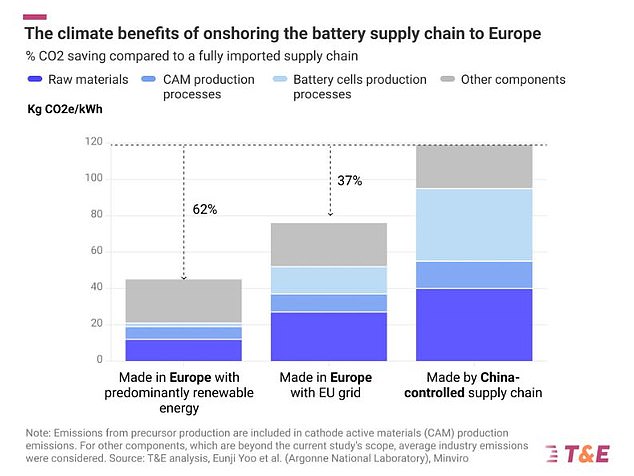

European production of electric vehicle batteries would dramatically reduce carbon emissions compared to manufacturing in China, but the market will still rely on imports from the Far East, according to a new report.

Strengthening the electric vehicle A supply chain to Europe would reduce emissions from battery manufacturing by 37 percent compared to a supply chain controlled by China, and by up to 60 percent when using renewable electricity, says green think tank Transport & Environment.

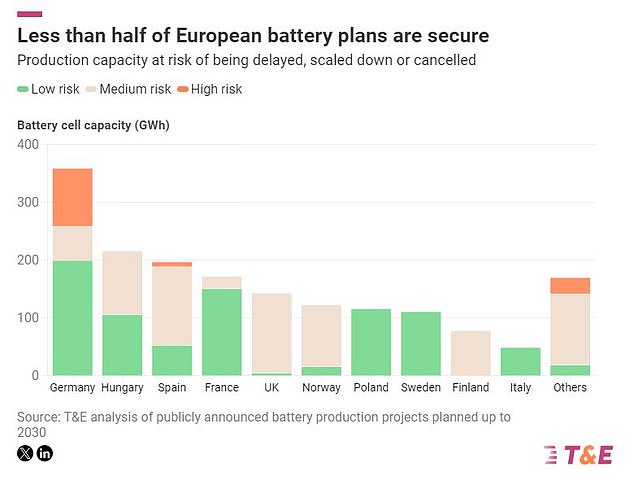

However, it warns that less than half of EV battery production planned for Europe by 2030 is safe, meaning manufacturers will continue to source parts made primarily in Asia.

A new report claims that electric vehicle batteries made in Europe would dramatically reduce carbon emissions compared to China and the Far East. Pictured: inside the VinFast battery factory in Haiphong, Vietnam

Locally producing European demand for battery cells and components would save approximately 133 metric tons of CO2 between 2024 and 2030.

The activist group claimed that these savings would be equivalent to the Czech Republic’s total annual emissions today.

However, a lack of commitment to the transition to electric vehicles is said to be extending the period in which automakers rely on sourcing components from the Asian market.

This is because only 47 percent of the lithium-ion battery production plants planned in Europe until 2030 are safe.

While this is an improvement from a year ago – when it was closer to a third – the remaining 53 percent of announced cell manufacturing capacity is still at medium or high risk of being delayed, reduced or canceled without a stronger government action.

Julia Poliscanova, senior director of vehicle and electric mobility supply chains at T&E, said: “Batteries and the metals they contain are the new oil. European leaders will need razor-sharp focus and joined-up thinking to reap its climate and industrial benefits.

“Strict sustainability requirements, such as upcoming battery carbon footprint standards, can reward local clean manufacturing. Fundamentally, Europe needs better instruments under the European Investment Bank and the EU Battery Fund to support investments in gigafactories.’

The lack of commitment to the transition to electric vehicles is said to be extending the period in which automakers rely on sourcing components from the Asian market.

France, Germany and Hungary are the countries that have made the most progress in securing gigafactory capacity.

In France, ACC started production in Pas-de-Calais last year, while Verkor’s plants in Dunkirk and Northvolt in Schleswig-Holstein, Germany, continue thanks to generous government subsidies.

The UK is among other European nations, including Finland, Norway and Spain, where most production capacity is at medium or high risk due to project questions.

This is due to the current uncertainty around the West Midlands Gigafactory, despite a huge £1 billion investment by Nissan and its EV battery partner Envision AESC to build two plants near the West Midlands car factory. Sunderland.

Tata, owners of Jaguar Land Rover, also confirmed last year that they will build a huge £4bn electric car battery site in Somerset with financial backing from the government.

Many European automakers are sourcing batteries from overseas markets, especially China, as they await the completion of a series of battery “gigafactories” on the continent. This includes the £1bn EnvisionAESC-Nissan battery plant in Sunderland (pictured) due to open in 2025.

A model of JLR owner Tata’s proposed new electric battery factory has been confirmed in Somerset. It will cost £4bn and be operational in 2026, the company says.

The report goes on to warn that securing other parts of the battery value chain will be even more difficult given China’s dominance and the EU’s “nascent expertise”.

For example, Europe currently only has the potential to manufacture 56 percent of its demand for cathodes (the most valuable battery components) by 2030, but so far only two plants have started commercial operations.

By the end of this decade, the region could also meet all its processed lithium needs and ensure that between 8 and 27 percent of battery minerals are recycled in Europe.

But T&E said processing and recycling plants need state and EU support to scale quickly.

The report warns that securing other parts of the battery value chain will be even more difficult given China’s dominance and the EU’s “nascent expertise”.

The study found that most EV battery production plans in the UK are at medium risk.

Poliscanova added: ‘The race for batteries between China, Europe and the United States is intensifying.

“While some battery investments that were at risk of being diverted by US subsidies have been saved since last year, about half of planned production is still available.”

He went on to add that the European Union’s decision last year to allow sales of combustion engines to continue after 2035 as long as they use climate-neutral ‘e-fuels’ has added uncertainty and says it is essential to have clarity on phasing out gasoline and diesel to “set corporate EV targets to assure gigafactory investors that they will have a guaranteed market for their product.”

The UK government has said it will commit to banning the sale of new petrol and diesel cars by 2035, although it has kept the door open to green e-fuels if they are proven to dramatically reduce emissions.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.