Table of Contents

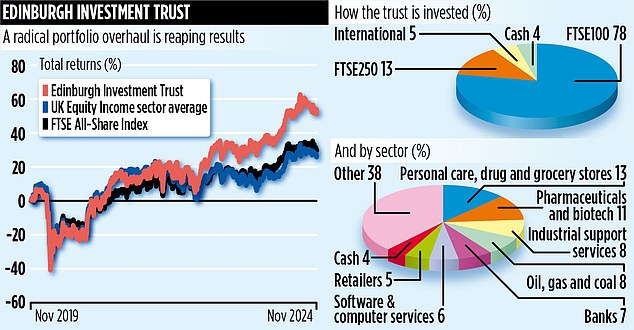

The Edinburgh investment fund has been at its best for quite some time. Last week, the £1bn listed fund (which invests in UK shares) reported its half-year results to the end of September. Over the six-month period, it said shareholders had enjoyed total returns of 10.8 per cent, ahead of the FTSE All-Share index (6.1 per cent).

Then, three days ago, it paid investors the first of its quarterly dividends for the current fiscal year. The 6.9 percent share payout was three percent higher than last year’s equivalent split.

The only disappointment is that the trust’s shares – like those of many (not all) competing UK equity trusts – continue to trade at a double-digit discount to their underlying assets. However, analysts at Investec Bank, in their latest note on the trust, describe the discount as “attractive” and the fund as a “core strategic investment”.

Fund manager Imran Sattar and deputy Emily Barnard have managed the trust’s assets since February this year. Modestly, Sattar says the trust’s good financial health is more the result of the work done by his predecessor James de Uphaugh (now retired), who transformed the portfolio when he took over in March 2020.

At the time, De Uphaugh was working for asset manager Majedie, which has since been integrated into investment group Liontrust, for whom Sattar now works.

De Uphaugh’s appointment followed the dismissal of Mark Barnett from Invesco after three years of indifferent performance.

“James made radical changes to the portfolio,” says Sattar.

‘He pulled the trigger, transforming a portfolio of out-of-favor companies that offered investors attractive dividend yields into a portfolio made up of favored companies with lower yields. When I took office, I inherited a well-positioned portfolio.’

The positive impact that both De Uphaugh and Sattar have had is seen in the performance figures.

Since March 2020, Trustnet data shows Edinburgh has achieved a total return of 65 per cent. These compare with a 38 per cent return for the FTSE All-Share Index and an average 30 per cent return for its UK equity income peer group.

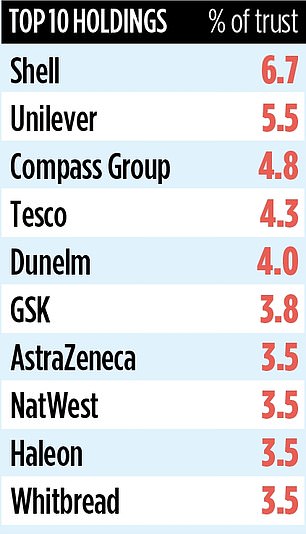

Today the trust comprises 44 shares and, although it sits in the UK equity income space, Sattar says the investment mantra is to generate total returns for shareholders, an approach put in place by De Uphaugh.

The result is a smaller dividend than that paid under Barnett’s reign, but it has grown again. Sattar is optimistic about the UK stock market.

He says: ‘If we look back two or three years, we had an economy plagued by low growth, high inflation and high interest rates. Today, we have inflation and interest rates again (inflation spiked last month, going from 1.7 percent to 2.3 percent). The high risk premium associated with investing in UK shares has disappeared.’

On inflation, Satter accepts that next year’s rise in National Insurance rates for businesses – announced in last month’s Budget – will result in higher prices. But he insists: ‘I am optimistic about the UK stock market.

“It’s a conducive environment for stock picking.”

The portfolio includes well-known UK names such as furniture giant Dunelm, NatWest bank, Shell and Auto Trader.

The trust’s annual charges total 0.48 per cent (on the low side). Its stock identification code is 0305233 and the market ticker is EDIN.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.