Table of Contents

Edentree is an asset manager specialized in responsible and sustainable investment.

There are no tricks or hints of greenwashing: those mutual funds that are labeled green are anything but when their holdings are examined.

The investment business, which started as Ecclesiastical Investment Management, is 100 per cent committed to its specialty and is part of the charity-owned Benefact Group which strives to do the right thing for its clients across all brands and businesses. .

EdenTree currently manages £3.5 billion in assets. Its products are diverse (spanning multi-asset funds, bonds and stocks), but all are backed by its commitment to responsible and sustainable investing.

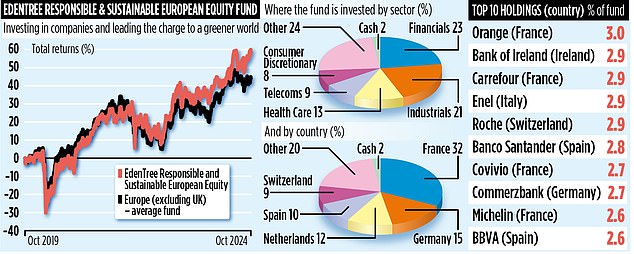

Among its offerings is the EdenTree Responsible And Sustainable European Equity Fund.

Launched 17 years ago, this £200m fund strives to make money by investing in European companies that make a “positive contribution to society and the environment”, but excludes UK shares from its portfolio.

It is run by Chris Hiorns and David Osfield and their investment track record is impressive. Over the past one, three, five and ten years it has outperformed the average of its peers with respective returns of 16, 29.3, 61.5 and 143.7 percent.

“Our goal,” says Hiorns, “is to offer investors a good return without taking too much risk.”

‘We look for good companies that behave responsibly and lead the way towards a greener world. It means avoiding companies involved in oil and gas production, alcohol and tobacco manufacturing. But the companies we buy must also represent good value and be backed by strong cash flows that are in growth mode.’

Its main holdings include Italian energy giant Enel, a global leader in green energy, and Covivio, a French real estate company focused on the development of eco-friendly offices and stores.

Recent additions include German-listed Technotrans, which develops cooling systems for large data centers and electric vehicle charging stations.

The fund’s investment risk is controlled by keeping no more than 3 percent of its assets in any stock, although managers have room to go as high as 5 percent.

The largest current position is in French telecommunications giant Orange, and the fund has stakes in 67 companies, mainly large-cap stocks.

In terms of sector positions, Hiorns says financial stocks remain an attractive “contrary play.” Bank of Ireland, Banco Santander, Commerzbank and BBVA are among the top ten holding companies.

Although income is not a goal of the fund, Hiorns says many of the undervalued European stocks he likes currently offer attractive dividends. For example, Orange shares offer a dividend yield of 7.4 percent.

It says 45 percent of the portfolio’s stocks are “high yield,” although the fund’s overall dividend yield is a modest 2.9 percent.

The funds that EdenTree specializes in are now subject to new rules introduced by the regulator, the Financial Conduct Authority. Starting in December, they will be allowed to use one of the four FCA-

approved “sustainable” labels, demonstrating their commitment to this investment approach.

Funds that make sustainable claims, but do not carry such a badge, will have to provide investors with clear information about how they invest and why they do not have a label.

Hiorns says the company is actively looking to secure these types of labels for its funds. The annual charges from the European fund are 0.8 percent.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.