- ECB interest rate cut next week ‘almost guaranteed’ after German CPI data

- Markets expect cuts of between 50 and 75 basis points this year, but analysts warn of uncertainty

The European Central Bank is expected to press ahead with its first interest rate cut in June despite signs that inflation has not yet been defeated.

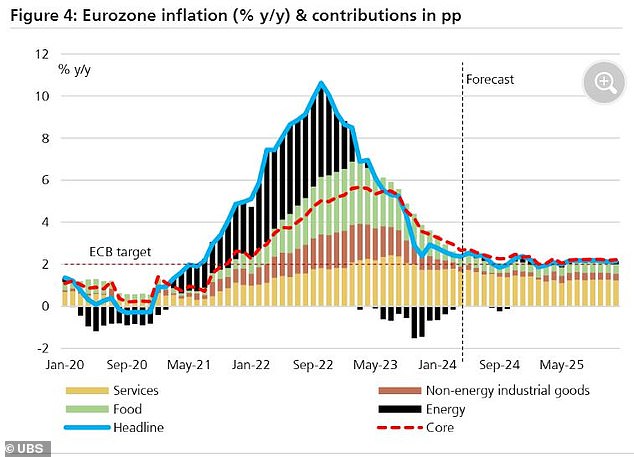

A preliminary estimate released on Wednesday shows consumer price inflation in Germany was 2.4 percent year-on-year in May, up from 2.2 percent in April, due to higher services inflation.

But the important measure of core inflation, which excludes energy and food costs, remained stable at 3 percent during the month despite expectations of a slight increase.

And, barring any major shocks from EU-wide inflation data due out on Friday, analysts say prospects for the ECB to outperform both the US Federal Reserve and the Bank of England with its first Interest rate cuts next week appear all but confirmed.

ECB President Christine Lagarde is expected to pull the trigger on the first cut next week

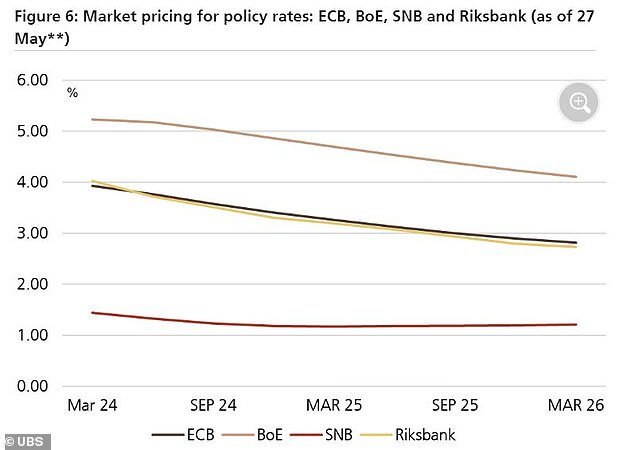

UBS said: “The signals emerging from the ECB meeting on April 11 and subsequent public comments from ECB officials have been clear: the ECB is on track to cut rates by 25 basis points (bps) until 3.75 percent at the next meeting on June 6.’

The bank expects the EU’s May headline inflation figure to “temporarily rise” due to higher energy inflation, forecasting a year-on-year inflation figure of 2.5 percent for the month.

He added: “(But) even disappointing May inflation data… would not stop the ECB.”

Felix Feather, economist at asset manager Abrdn, agreed that next week’s rate cut “is almost guaranteed.”

While markets are confident about next week’s cut, there is much less certainty about the ECB’s policy outlook for the rest of this year amid concerns about persistent inflationary pressures and the potential impact of a decoupling of US policy.

Feather said: “Data on services inflation and wage growth remains too interesting for back-to-back cuts in June and July, so this could be an ‘aggressive cut’.

“A spike in the headline rate is widely expected, but would have to be extremely large to divert the ECB from a June cut.

‘However, what happens with core services inflation will be key to setting expectations about the ECB’s path beyond June. The recent strength in labor cost growth could mean services inflation strengthens, leaving the ECB on hold for a period after the initial cut.

Eurozone inflation struggles to return to the ECB’s 2% target

Current market prices suggest the ECB will cut its key interest rate by 25 basis points two or three times by the end of the year, taking it to between 3.25 and 3.5 percent.

Carsten Brzeski, global head of macroeconomics at ING, said: “It appears to be a question of pace, not whether the ECB will remove more restrictions.”

‘The risk of reflation has clearly increased… (while) the cyclical rebound in economic activity, as well as structural labor shortages and upward pressure on wages, could easily put the inflation projections themselves at risk. ECB inflation.

“The question of whether next week’s rate cut will fall into the ‘one is none’ or ‘one and done’ category will remain unanswered, but one thing is clear: a longer and more substantial cycle of rate cuts will only will materialize if inflation quickly returns to 2 percent levels.

“Any sign of reflation and also of greater economic activity would limit the ECB’s room for maneuver.”

The ECB and the Bank of England are expected to start cutting interest rates this summer