Boot maker Dr Martens fell 29.4% as the group said it faced another tough year.

dr Martens shares fell to a record low after it issued its fifth profit warning in three years.

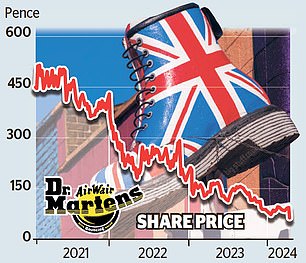

Shares in the FTSE 250 boot maker fell 29.4 per cent as the group said it faced another difficult year in the US and revealed its chief executive would resign. The drop put Dr Martens at a record low of 67p, a far cry from its floating price of 370p in January 2021.

After a difficult few months, Dr Martens yesterday issued its fifth profit warning since 2021 as it grapples with rising costs and fewer orders across the Atlantic.

“The outlook is challenging and the entire organization is focused on our action plan to revive demand for boots, particularly in the US, our largest market,” a company spokesperson said.

“The nature of US wholesale trade is that when customers gain confidence in the market, we will see a significant improvement in our business performance, but we do not take this for granted.”

Dr Martens said its autumn and winter order book is “significantly lower year on year” and is estimated to have a £20m impact on profits, while cost inflation is forecast to have a £35m impact. millions.

Analysts at Peel Hunt said that while the profit warning was not a surprise, it was “much worse” than expected.

And Susannah Streeter, director of money and markets at Hargreaves Lansdown, said: “The US had been seen as the key market for the company’s growth, but rather than being a source of income, it has appeared to be a cash hoarder, with supply Entanglements in the chain, operational problems, increasing costs and falling demand.

“While Dr Martens will always remain an iconic force in British fashion, it’s clear that treading new fashion terrain abroad is no easy feat.”

Separately, Chief Kenny Wilson will leave his position before the end of the fiscal year. He said “the time has come” to hang up his boots. He will be replaced by brand director, Ije Nwokorie.