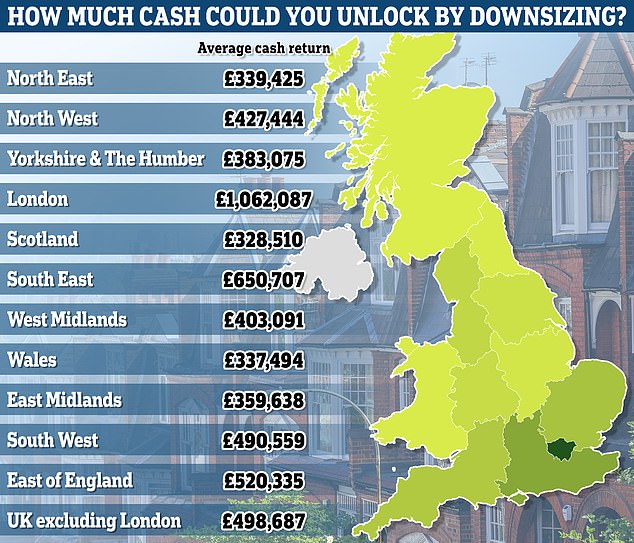

Homeowners could gain almost £500,000 in cash on average by upgrading from a five-bedroom home to a three-bedroom one, according to new data.

Those who own their homes in London could make the biggest return, earning almost £1.1m in cash by downsizing from an average five-bedroom home of £1.7m to a three-bedroom home averaging £635,149, according to Rightmove data.

However, the best returns in percentage terms can be found in the Northeast, where homeowners would keep 65 percent of their home’s value in cash.

The UK average would be £498,687 for homeowners, although that figure does not take into account costs incurred in the moving process, such as stamp duty.

Empty Nest: Homeowners may be thinking about downsizing after their children leave home. The regions on this list are ranked by highest return percentage; see table below for more details

The data is based on current average property values and asking prices in each region, and assumes moving to a smaller home in a comparable area.

Tim Bannister, property expert at Rightmove, said: ‘Downsizing is a sensitive subject for many homeowners, with the emotional ties and inconvenience of moving often putting them off selling their family homes.

‘However, people who no longer have children at home may overlook the significant benefits of downsizing their homes, such as lower energy bills and the cash boost from buying a smaller home, which can still cover the costs of moving with remaining income.’

The firm said homeowners stand to gain as a result of a 36 percent increase in property values since 2014.

Although the cash value is lower, those living in the North East can get the highest percentage return, recovering up to 65 per cent of the value of their five-bedroom home, representing a return of £339,425 from a five-bedroom home with an average value of £520,873.

In the North West, homeowners would recover 64 per cent of the value of their home, while in Yorkshire and the Humber they would recover 63 per cent.

Meanwhile, residents in the east of England, the south west and the east Midlands would get back just 58 per cent of their home’s value, while homeowners in Wales and the west Midlands could get back 59 per cent.

| Region | Average sale price of a 5-bedroom house | Median sale price of a 3-bedroom home | % difference in sales prices | Average cash yield |

|---|---|---|---|---|

| Northeast | £520,873 | £181,448 | -65% | £339,425 |

| Northwest | £671,644 | £244,200 | -64% | £427,444 |

| Yorkshire and the Humber | £611,725 | £228,650 | -63% | £383,075 |

| London | £1,697,236 | £635,149 | -63% | £1,062,087 |

| United Kingdom except London | £805,804 | £307,117 | -62% | £498,687 |

| Scotland | £543,476 | £214,966 | -60% | £328,510 |

| Southeast | £1,089,597 | £438,890 | -60% | £650,707 |

| West Midlands | £679,449 | £276,358 | -59% | £403,091 |

| Welsh | £574,934 | £237,440 | -59% | £337,494 |

| East Midlands | £617,709 | £258,071 | -58% | £359,638 |

| Southwest | £846,630 | £356,071 | -58% | £490,559 |

| Source: Rightmove | ||||

James Linder, regional sales director at Leaders Romans Group, said: “We have seen a trend towards downsizing among homeowners, particularly in cities with family homes and larger urban areas. Many people are downsizing to free up equity, often using the significant cash benefits to help their children get into home ownership.

“We are also seeing a demographic shift: more people in their 60s are choosing to downsize compared to the traditional 70-80 age group. This younger group is proactive about securing their financial future and reducing their monthly expenses.”

As well as the potential cash savings that come from selling a smaller property, people looking to downsize could also benefit from significant savings on energy and council tax bills by moving to a smaller property.

According to Rightmove, moving from a five-bedroom flat with an EPC rating of E to a three-bedroom flat with a C rating would save homeowners an average of £3,806 a year.

“The potential savings on energy bills, council tax and maintenance costs are considerable. Downsizing can save homeowners a significant amount each year on energy costs alone. Reduced council tax and maintenance costs further increase the appeal of downsizing,” said Linder.

Bannister added: “By moving from a five-bedroom home to a three-bedroom home, homeowners could still retain spare rooms for guests and free up on average half a million in cash for other uses before moving costs.”

What are the costs of downsizing?

Those who downsize typically do not pay capital gains taxes if both the home they sell and the one they move into are used as their primary residence.

Normally, you will have to pay stamp duty on the purchase. Calculate how much you would have to pay using our stamp duty calculator.

They will also have to pay all the usual costs of moving, such as agency fees, transfer of ownership and removals.

The average cost of a move is around £12,000, according to Halifax.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.