Gisele Bundchen broke down in tears as she reflected on her divorce from Tom Brady in a candid new interview.

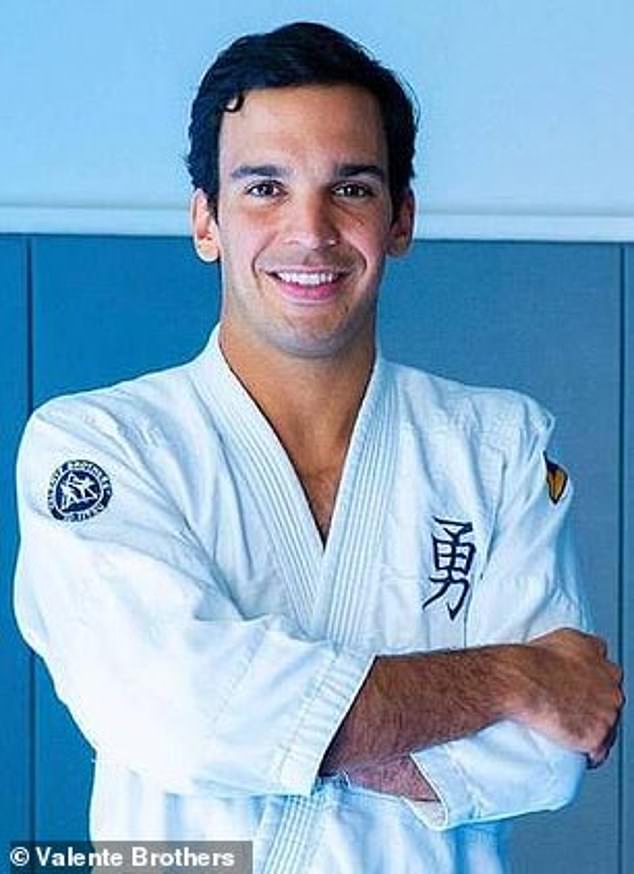

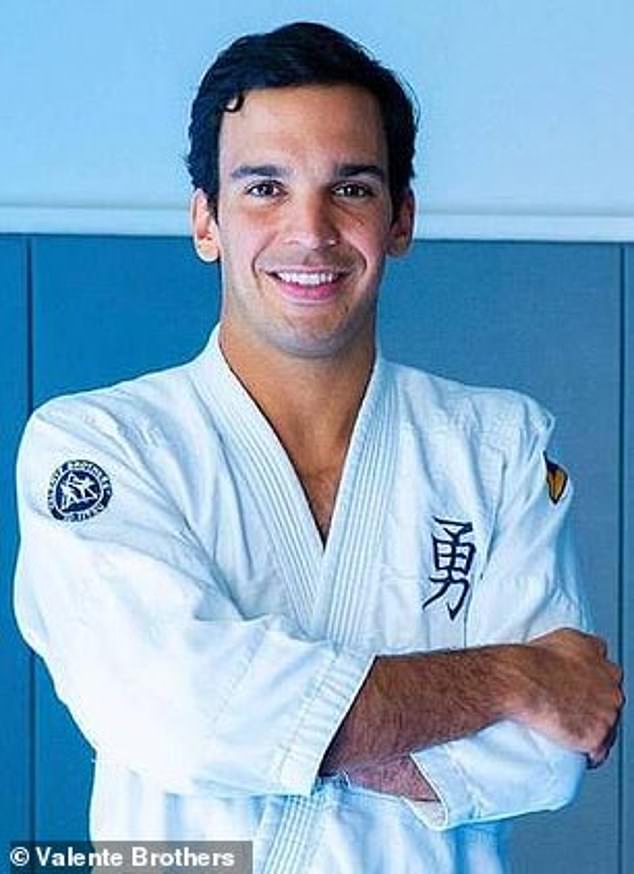

The supermodel, 43 years old – who was recently seen kissing the boyfriend of jitsu instructor Joaquim Valente – cried in a preview of her talk with Robin Roberts on IMPACT x Nightline: Gisele Bündchen: Climbing the Mountain.

Bundchen began dating the soccer star, 46, in 2007 and was with him for more than a decade before confirming they were divorcing in October 2022. They share two children, Benjamin, 14, and Vivian , 11.

The fashion icon became visibly emotional when Roberts mentioned that the star had likened her split from Brady to “the death of a dream.”

Roberts then asked: ‘How are you?’ with Bundchen responding: ‘Well, when you say…’ before collapsing.

Gisele Bundchen broke down in tears as she reflected on her divorce from Tom Brady in a candid new interview.

He walked away from the camera and said, ‘Sorry, guys. I don’t know. Can I have a moment?

Roberts also asked Bundchen how she juggled co-parenting with Brady, and the star said, “I think some days are easier than others and I can only control what I do.’

Bündchen, who has not yet spoken publicly about her new romance, was asked: “Would you be able to open your heart to someone again?’ and the star replied: ‘Ummm.’

She said: ‘Where my heart is now is where I am now. I’m living my truth and I make no apologies for it.’

He later said that his experiences with love had made him realize “what I want and what I don’t want.”

The Victoria’s Secret Angel went public with her new love Valente when they were spotted kissing in Miami on Valentine’s Day.

Gisele claimed to have been dating Joaquim since June, and Page Six reported that they were first seen together more than a year ago.

Rumors that they were a couple began to surface in November 2022, when Joaquim was photographed on vacation with Gisele and their children in Costa Rica, just two weeks after her divorce from Tom.

The supermodel, 43, who was recently seen kissing her jitsu instructor boyfriend, Joaquim Valente, cried in a preview of her chat with Robin Roberts on IMPACT x Nightline: Gisele Bündchen: Climbing the Mountain.

Bundchen began dating the soccer star, 46, in 2007 and was with him for more than a decade before confirming they were divorcing in October 2022. They share two children, Benjamin, 14, and Vivian , 11 (pictured in 2013).

The fashion icon became visibly emotional when Roberts mentioned that the star had likened her split from Brady to “the death of a dream.” Roberts then asked: ‘How are you?’ with Bundchen responding: ‘Well, when you say…’ before collapsing

He walked away from the camera and said, ‘Sorry, guys. I don’t know. Can I have a moment?

Bündchen, who has yet to speak publicly about her new romance, was asked: “Would you be able to open your heart to someone again?” with the star responding: ‘Ummm’

Gisele Bundchen’s new ‘boyfriend’, jiu-jitsu coach Joaquim Valente, is said to more or less live in her Florida mansion.

The couple has also enjoyed trips together to their native Brazil.

Gisele shares custody of her children with her father Tom and a source said they remain her priority over romance.

The source added: “It’s very difficult with the divorce, but the kids know they are together now.” They really like Joaquim.

Meanwhile, Tom moved on with supermodel Irina Shayk, 37.

Gisele was devastated when her mother Vânia Nonnenmacher passed away on January 28 from cancer, and another source told Page Six that Joaquim has been a “stone” of support for the model amid her ongoing grief.

Another source told Page Six that Tom is just focusing on “the kids and work” for the moment, adding, “Anything he says he wants to remarry is just made up.”

Tom and Gisele share daughter Vivian Lake, 11, and son Benjamin, 14. He also has a son, Jack, 16, with ex-girlfriend Bridget Moynahan; the three recently photographed

Insiders claimed that Gisele and her new partner Joaquim started out as great friends before a romance blossomed.

A source also told People about Gisele’s relationship with Joaquim: ‘They come from similar backgrounds. They both left Brazil very young.

‘Both have created incredible lives in the United States. They both love Miami but also enjoy traveling. They both enjoy a healthy life.

‘Gisele is in a great space. She is happy and enjoys life a lot. Joaquim is perfect for her.

IMPACT x Nightline: Gisele Bündchen: Climbing the Mountain premieres Thursday, March 7 on Hulu.