We were prepared for the worst: a devastating fiscal impact on central England. But today’s budget, presented by an energetic Finance Minister, was not as bad as most of us expected.

Perhaps more financial pain lies ahead when Labour’s ambitious economic growth plans are reversed and its debt plans implode. But for now, it seems as if Rachel Reeves hasn’t ruined our personal finances as much as she could have.

While the detrimental impact of £40 billion of extra taxes on household and corporate wealth cannot be underestimated, it could have been much worse – especially for those struggling to build wealth to survive their retirement – and not been a burden for the State.

“My faith in Britain shines brighter than ever,” said Mrs Reeves. Pictured holding the red Budget box as he leaves 11 Downing Street.

For example, there was no restrictive limit placed on the tax-free cash we can withdraw from our pensions when we turn 55.

Given that Ms Reeves and her Treasury officials leaked details of many ‘noes’ and ‘yeses’ ahead of today’s budget, it is a shame she did not confirm from the outset that tax-free pension cash was not in her sights (at least for the moment). be). Surely many people accessed it in a panic and will regret doing so for years to come.

There was also no limit placed on the amount that can be saved in tax-free individual savings accounts, as some experts feared. There was also no reduction in the amount you can spend per year (£20,000 per adult) on these duty-free wrappers.

But make no mistake: there was still a lot of pain to go through for the prudent and those striving to create wealth for their families.

As far as Central Englanders are concerned, the biggest budget “nasties” were the changes to both capital gains tax (CGT) and inheritance tax (IHT).

The immediate – yes, immediate – increase in CGT on share sales will inhibit investors’ ability to build wealth by investing in the stock market, eroding the profits they make through sensible investments.

The tax rate will increase from 10 per cent to 18 per cent for basic rate taxpayers, while higher and additional rate taxpayers will pay 24 per cent on profits instead of the current 20 per cent. Fortunately, the £3,000 annual exemption remains.

These higher taxes will discourage the habit of saving at a time when the Government should be encouraging more people to build wealth in retirement to ensure we are not a future burden on the State.

Inheritance tax, taxed at 40 per cent, will also trap more estates as the £325,000 nil rate band threshold is frozen once again (now until 2030 and unchanged since 2009) – and pensions They join the IHT network from 2027.

It will also be harder for farmers and small business owners to pass on their businesses from generation to generation as a result of the removal of relief that allowed them to escape large IHT bills.

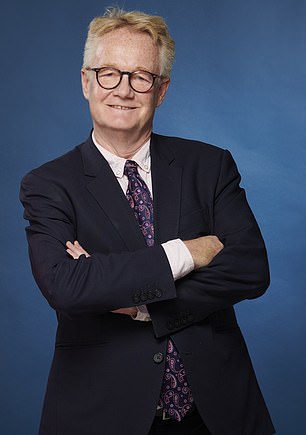

Jeff Prestridge says we were prepared for a worse budget than actually materialized

While the Chancellor has fulfilled her party’s election manifesto commitment not to increase income tax, the freeze on income tax thresholds remains in place until 2028. That will mean more people (many of them older) They will be forced to pay the tax or see cuts of their income. taxed at a higher rate. A horrible stealth tax.

After all, it is business owners who will bear the brunt of the financial pain caused by Mrs Reeves, with a £25bn increase in national insurance bills.

As if that weren’t bad enough, the 6.7 percent increase in the minimum wage (welcomed by those in low-paying jobs) will be another cost they will have to bear, on top of the cost of complying with new legislation protecting workers. workers’ rights.

For many companies, their response to this fiscal hit will be to reduce staff, limit salary increases and simplify the pension arrangements they have for workers.

“My faith in Britain shines brighter than ever,” said Mrs Reeves. It’s a positive thought, but I’m not sure it’s a view widely shared by many people outside the Labor Party. For now, the jury is out.

This was a Halloween Eve budget with few treats and lots of tax tricks.