Table of Contents

Let’s keep our fingers crossed that American voters will at least present a clear choice for their president, whatever that choice may be.

If they don’t, it will be a bumpy ride not only for global politics, but for all of us as investors in the world’s dominant economy. All of us? Yes, absolutely, because we are all affected in one way or another by what will happen there.

Many Britons will be direct investors, with the lucky ones owning some shares in high-tech giants such as Apple, Microsoft and Amazon, which have soared in recent years.

Anyone with a private sector pension will have some assets in the United States.

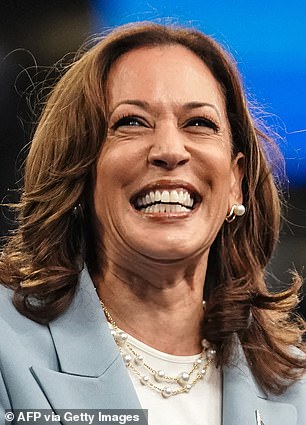

Growth: Donald Trump is seen as more pro-business than Kamala Harris

The US market accounts for 60 percent of global stocks and every balanced portfolio will own some stocks there.

Beyond that, the dollar anchors global trade and investment.

If inflation is also better controlled, that would help keep bond yields low.

US Treasury securities (IOUs issued by the US government) are the primary investment held as reserves in the world’s central banks.

And, of course, the United States is not only the largest economy in the world, far ahead of China, but it is increasing its lead over Europe.

So what will happen? There is no point in trying to predict the result or consulting opinion polls: the fog hanging over the elections is impenetrable. The message from financial markets is equally confusing.

Betting odds generally favor a Trump victory, but they were wrong in 2016, when he was the underdog. So the money was on Hillary Clinton.

By contrast, a strong stock market (the S&P 500 is up 10 percent since August) has in the past indicated that the party in power would win the presidency. The general opinion is that markets like continuity.

But the consensus now is that a Trump victory would be better for stocks and worse for bonds, while a Harris presidency would be the other way around.

The argument is that Republicans would be more pro-business than Democrats, and that the tax cuts they have promised would boost, at least in the short term, economic growth and corporate profits.

The downside would be higher inflation, leading to higher interest rates. Democrats’ emphasis would be on increasing public spending.

Either of them wins the White House, the federal deficit will increase and that is a deep concern. But it would rise a little less under the Democrats’ government.

The idea that Trump would be good for stocks and Harris would be good for bonds is interesting, but I would be wary of it for two reasons.

The first is that it is too careful. Wall Street’s thousands of smart analysts are great at creating arguments that seem to explain what’s happening in the markets.

But if we look at their history of predictions, rather than explanations, even the best ones are only right about half the time.

The second reason to be cautious is that there may not be a clear outcome this week. This should certainly be the biggest concern for all of us. Chaos is rarely good for investors. If that happened, there would eventually be a deal.

The quote attributed to Winston Churchill that “Americans can always be trusted to do the right thing, once all other possibilities have been exhausted” would be true.

American Debt: Whichever of the two wins the White House, the federal deficit will increase and that is a deep concern. But it would rise a little less with the Democrats.

But a few weeks of uncertainty would undermine the status of both the dollar and U.S. assets as the best haven for global savings. There could well be a strong bear market in stocks and a rise in bond yields.

There is an additional dimension: global politics. If there is no clear election result, it would create a window of opportunity to test the US response to some type of offensive against US interests.

There’s no point in speculating what that might be. At the same time, it would be foolish not to be aware that global financial confidence is already quite fragile right now.

Let’s look at the record price of the main safe haven in troubled lines: gold. Last night it was trading just below $2,750 an ounce, near its all-time high and up nearly 40 percent a year ago.

There could be turbulence in the bond markets regardless of who is declared the winner, but the chances of that happening are much greater if the margin of victory turns out to be really narrow.

Given all these uncertainties, how do you explain something else: that US stocks hit record highs last month? There are two possible answers to this, one positive and one negative.

The positive answer is that there is a global conviction that, whatever happens to American politics, the economy will continue to prosper.

The inventiveness, drive, scale, flexibility and energy of American businesses will combine to ensure they continue to dominate the world. The American economy is bigger than its politics – and better, too.

The negative answer is another question: where else do you put your money? Do you really want to invest your savings in China? Europe is not going to generate much growth in the coming years, although some companies will do well.

Here in the UK, it would be nice to hope for better economic performance, but last week’s budget put the brakes on that.

Emerging economies will play a larger role in the global economy over the next 20 years, but investor returns have been very disappointing of late.

You see the point. There are good reasons for investors to worry about the United States: stocks could be overvalued and bond markets will face real uncertainty.

However, as American investment guru Warren Buffett wrote in his 2022 letter to shareholders: “In its brief 232 years of existence, there has been no incubator to unleash human potential like the United States.

Despite some serious disruptions, our country’s economic progress has been impressive. Our unwavering conclusion: never bet against America.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.