Linda Robson has spoken for the first time about her split from ex-husband Mark Dunford, admitting they “never had much in common.”

In a new interview, Loose Woman, 65, admitted there was no dramatic reason for their split and that the former couple “just broke up.”

She said OK! magazine: ‘People do it sometimes, right? We never had so much in common. I am very sociable. Mark never liked that side of things.

Linda, who shares children Louis, 32, and Bobbie, 28, with Mark, said: “I’ve been sad about it, of course I have.” But we had two lovely children together.

But now they are all adults and living their own lives. Now it’s me and Dolly the dog. (But) I’m in a very good place. The job is going well.

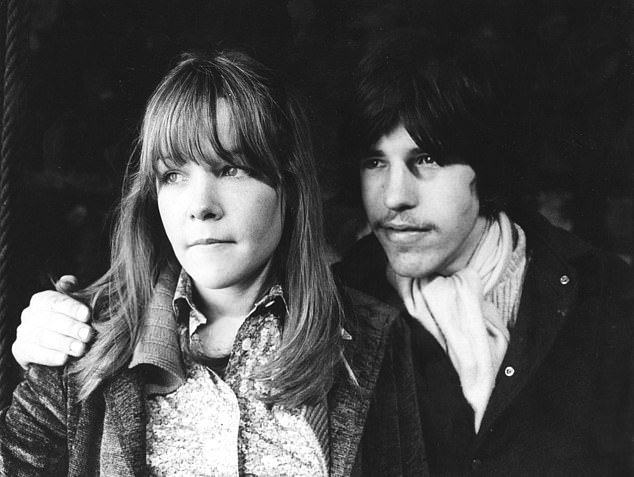

Linda Robson has spoken out for the first time about her split from ex-husband Mark Dunford, admitting they “never had much in common” (pictured together in 2015).

In a new interview, the loose woman, 65, admitted there was no dramatic reason for their split and that the former couple “just broke up.”

Linda plans to move to a two-bedroom property near her children once she sells the Islington home she shared with Mark during their marriage.

But as for her future plans, Linda said she has no desire to find love again and won’t be looking for another relationship.

She said: ‘I do not need a man. I have my friends and my family. I’m not interested in dating, I’m too old now. I can’t be bothered with all that jiggy jiggy.

Linda’s comments come after she spoke about her battle with alcohol addiction in an extract from her harrowing memoir to Mail+. the new subscription service for dailymail.co.uk and the MailOnline app.

The panelist confirmed this week in an interview with Women magazine in November last year that she and Mark had gone their separate ways.

Linda had been “keeping busy” spending time with her family while dealing with the aftermath of her separation from her husband of 33 years.

At the time, Linda assured her fans that she was “feeling good” after the breakup and was surrounded by the support of her family and friends.

She said: ‘I have my family and my children around me. And I’m going on a cruise with Lesley Joseph in November. I keep myself busy. I feel good. I just go on trips all the time.

Linda, who shares children Louis, 32, and Bobbie, 28, with Mark, said: “I’ve been sad about it, of course I have.” But we had two lovely children together.

Confirming the news of their split, Linda said: ‘“He’s a really good father and we had some good years, but enough is enough.”

Linda and window cleaning business owner Mark, 63, share two children. Linda also has a daughter, Lauren, 40, with her ex Tony Tyler.

Linda and Mark, who married in 1990, live together in London but it was recently claimed they have had difficulties in their relationship.

A source told The Sun on Sunday: ‘Linda has been quite open behind the scenes about the problems in her marriage.

“They went through a rough patch before Christmas, but they managed to overcome it.

“Linda turned to her family and close friends who supported her throughout.”

While Linda denied being in the middle of a “marriage crisis,” she admitted it hasn’t been easy with her long-term love.

When asked by The Sun about the crisis, he said: “That’s a load of rubbish.”

‘We still live together. We both love our children more than anything else in the world, obviously there are some setbacks in every marriage.

“We’ve been married 33 years, so it won’t all be easy, but we’re still together right now.”

The actress recently spoke about having gone through ‘ups and downs’ in her relationship.

She told Best magazine: ‘There have been ups and downs, obviously, like any couple. What I think we have in common is that we love our children more than anything.

Linda said of their separation: I feel good. I just go on trips all the time. ‘Honestly, I’m not interested (in dating). I can’t be screwed with all that.

Wedding day: Linda married Mark Dunford in 1990, but it was reported that they ‘hit a rough patch’ in their marriage before last Christmas which they were trying to get over.

In June, the mother-of-three admitted she hadn’t had sex with Mark for two years, while Loose Women The panel discussed whether taking a ‘sex break’ can help struggling relationships.

Linda joined the conversation and said, ‘Can I just say that I’ve been celibate for two years?’ and Denise Welch responded, “I know, but you have to follow the program.”

Making a very cheeky confession, Linda joked: “I know, you got me a friend,” as her fellow panellists burst out laughing.

When Charlene White questioned whether celibacy had helped her focus and given her clarity, she responded: ‘Well, I haven’t had a choice, I haven’t in two years!’

Last year, Linda revealed that she never got naked in front of her husband and goes to the bathroom to change into her pajamas.

The TV presenter opened up about her private life on an October 2022 episode of Loose Women and admitted that her Catholic upbringing influenced her views on nudity.

Linda said: “I find it quite difficult, I’ve never dressed badly in front of my husband, so when I put on my pajamas I go to the bathroom.”

“My children have seen me naked, but not my husband or my former partners because my mother was Irish Catholic.”

In 2017, Linda revealed that she and Mark went through a rough patch where they almost got divorced.

She explained: ‘I love him. We’ve had some tough years where we could have easily ended it, but we didn’t.’

She revealed that their problems began when children Lauren and Louis were subjected to traumatic events, which put a strain on Linda and Mark’s marriage.

Things got tough when Lauren was diagnosed with bulimia and Louis was diagnosed with PTSD after witnessing his friend’s murder.

“People always said (Lauren) looked like Kate Moss,” she said, first speaking about her daughter’s ordeal. “We went to the agency and they took a lot of pictures of us, but someone said, ‘You need to lose a little weight.’

‘I said, ‘No, it doesn’t,’ and we left. “It was ridiculous.”

It was after this incident that Linda noticed Lauren losing weight, losing weight dramatically, but eating normally in front of her.

He deduced that it was because she was bulimic, vomiting the food she had eaten, and took her to get help.

Lauren overcame the condition after two years, when she was 19; But in 2008, more pain ensued when Ben Kinsella was stabbed to death.

Ben was a friend of Linda’s son Louis and was murdered at the age of 16 when he was stabbed 11 times while celebrating the end of his GCSEs.

Louis watched Ben die on the street, causing him to suffer from post-traumatic stress disorder and frequent severe panic attacks.

‘Louis is very well now. He really likes music and writing all the time,” Linda said of her oldest son, who, 10 years later, came out the other side.

Linda’s marriage was also tested when she lost her father to lung cancer in 1997.

He was still a young man (57) and died a week after diagnosis.

Her mother died in 2012, also from cancer, this time stomach cancer, aged 75, which Linda admits was traumatic but she died peacefully and painlessly.

Linda and Mark met when they were young when she used to take care of him.

Family: Linda and Mark share children Louis, 31, and Roberta, 27 (pictured: Linda with her daughters in 2011)

Struggles: Before marrying Mark, Linda was in a relationship with Tony Tyler for 11 years and they welcomed their daughter Lauren in 1983, but he cheated on her several times.

She revealed her story on Loose Women and said: ‘I used to look after Mark; He was a couple of years younger than me.

He was only two and a half years younger than me! I was 16 and he was 13 and a half, and to be honest, it was a bit annoying. And we lived on the street, next to each other.

The star firmly believed it was fate that brought Mark to her, after she and her three-year-old son bumped into him while walking in a local park years later.

During the unexpected encounter, Linda revealed that her daughter asked Mark if she could take them home.

And then he took us home and then he asked me out. So that was fate that day because I had known him my whole life and I had never seen him that way before,” he added.

After that, Mark asked Linda out, but she revealed that she wasn’t sure if it was a suitable date or not, and the duo went to a local Italian restaurant.

Before marrying Mark, Linda was in a relationship with Tony for 11 years and they welcomed their daughter Lauren in 1983.

However, their relationship was plagued with problems and she told the Loose Women audience in 2017: “I caught my ex cheating on me several times, including when I was pregnant with Lauren.”

‘One time I was out and Lauren was out with me. When I returned, everything seemed fine in the apartment. But when I went to bed that night, I moved the pillow and there was a handkerchief with lipstick and long blonde hairs.

Linda said: ‘I remember saying to my ex ‘what is this?’, and he said ‘one of my friends stayed and her partner, it must be hers’. But do you know when you know?

She explained how she did her own detective work as she was determined to find out what was going on.

Linda said: “When I found out it was like a relief because you know it’s over and you won’t go crazy.”

The star continued: ‘I found letters, I followed him. I also caught him with someone while she was pregnant with Lauren. I was waiting outside the house and he walked into this girl’s house.