Table of Contents

- Forecasts that interest rates will remain higher and a boost for tech stocks and bitcoin

Expectations of Donald Trump’s imminent US election victory have sent the dollar higher in early trading, with Treasury yields rising as so-called Trump trading returns.

Trump, whose Republican Party is also on track to reclaim both Congress and the Senate, has already declared victory.

Data from overnight and early polling in the UK showed Trump leading in several key states, with the Republican candidate leading Democrat Kamala Harris by 266 to 194 electoral college votes as of 7.30am GMT. just shy of the 270 needed to win.

The Federal Reserve is still expected to cut interest rates at its meeting that begins today. The Bank of England is also expected to reduce the base rate by 0.25 percentage points to 4.75 percent tomorrow.

Donald Trump has declared victory for a new term as president of the United States

But markets believe Trump’s second-term policies would be inflationary, potentially greatly reducing the size of future interest cuts from the Federal Reserve.

Interest rate forecasts have been cut in recent weeks.

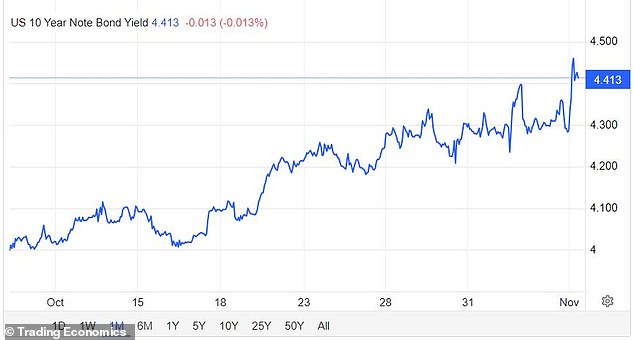

This perception caused Treasury yields to restart their rise, with the 10-year bond rising as much as 18 basis points to 4.47 percent, its highest level since July.

The 10-year bond yield had already soared more than 40 basis points in the month before the US election.

The US dollar also soared, adding 1.3 percent against the pound to 0.777 pounds sterling and 1.8 percent against the euro to 0.931 euros.

Trump is seen as good for stock markets dominated by US big tech companies and the FTSE 100 responded to the sentiment and the fall in the pound, which favors UK shares, jumping 1.13 per cent to 8,365 in the first operations.

So-called Trump trade has sent Treasury yields higher over the past month

Francesco Pesole, currency strategist at ING, said: “The bearish deepening and broad sell-off across the entire Treasury yield curve reflect widespread expectations of an inflationary mix of Trump’s domestic (fiscal and immigration) and external (tariffs) policies.” .

‘We are also seeing some action in near-term USD swap rates linked to an aggressive reassessment in Fed rate expectations.

‘In line with our expectations and consensus, markets are clinging to expectations of a 25bp (Fed) cut to 4.75 percent tomorrow, but the OIS curve has seen a repricing of more than 10bp within the deadlines of 2025.

“That implies a policy rate close to 4 percent in June 2025, almost 100 basis points higher than the mid-September price.”

U.S. stock markets had posted their best day in six weeks on Tuesday, which many market commentators had thought was an indication that investors were pricing in an imminent Harris victory.

Shares of Trump’s social media company, Trump Media & Social, soared more than 15 percent on Tuesday before falling to end the day down 1.1 percent.

Meanwhile, Bitcoin soared to another all-time high of $75,371.69, surpassing the previous record of $73,797.98 in March. Trump and the Republican Party are perceived to be more positive for cryptocurrency markets.

Lindsay James, investment strategist at Quilter Investors, said: “While the long-term US election has had minimal impact on stock markets, investors will likely view the Trump presidency as a positive for many share prices. of American companies.

‘With proposed corporate tax cuts combined with strong tariffs on imports, US corporate profitability is expected to improve, although the tariffs will provoke an international response and far-reaching consequences.

‘In fact, in our recent survey of some of the world’s largest asset managers, a Trump presidency was judged to be mildly positive for markets, compared to no change for a Kamala Harris administration, although highlighting its nature volatile, the spread of opinions about Trump was much greater.

“Volatility is likely to be the defining characteristic of this presidency.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.