Table of Contents

A woman who used to work in car sales shared several dealership secrets that can help buyers get the best deals on vehicles.

Kaitlynd Burtchell posted a video on TikTok on January 29 explaining why each of her tips will be helpful to consumers.

Burtchell’s tips include financing, what someone should not tell a car dealer, and the best time to buy a vehicle.

So far, Burtchell’s viral video has received at least 2.5 million views and counting.

It’s unclear when Burtchell worked in car sales and what dealership he worked at, but countless people mentioned in their comments how helpful his advice was.

Kaitlynd Burtchell posted a video on TikTok on January 29 explaining why each of her tips will be helpful to consumers after working in car sales.

Burtchell’s tips include financing, what someone should not tell a car dealer, and the best time to buy a vehicle.

This is when a consumer should buy a car

According to Burtchell, the best time to purchase a vehicle from a car dealership is at the end of the month due to the dealer’s monthly fees.

It has received around 2.5 million views so far and has its viral TikTok video.

According to Burtchell, the best time to purchase a vehicle from a car dealership is at the end of the month due to the dealer’s monthly fees.

“They have quotas and other things they’re trying to meet, so they’ll probably get a better deal because they’re desperate,” he said.

Car dealers make money primarily from commissions on vehicle sales.

An average trader earns almost $56,000 a yearbut that number can change depending on the number of cars they sell per month.

Hiration indicated in a 2023 blog post that the salary of a car dealer “It will largely depend on how you present the sale to customers and how many cars you can sell in a month.”

Consumers who can’t buy cars near the end of the month could also try buy a vehicle on Mondays or Tuesdays or at the end of the calendar year.

Car Buyers Can Negotiate Their Interest Rate

The average dealer makes almost $56,000 a year, but that figure can change depending on the number of cars they sell per month.

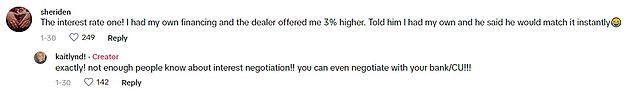

Burtchell said in his video that a consumer can negotiate the interest rate. interest rateespecially if your bank can offer you a lower one than what they offer at a dealership.

“The bank will give them an interest rate and they can easily raise the percentage so they can make money off of you,” he said.

In addition to credit scores, the interest rate may depend on the type of car someone wants to buy.

The updated annual percentage rates have been increasing since 2022 and a recent study shows that the rate for used cars can range from 9 percent to almost 14 percent in the United States.

The interest rate for new cars is substantially higher in the study and is almost 30 percent higher in states like Texas and Colorado.

Consumers should not say how much moneyThey want an exchange

People walk into dealerships hoping to trade in their cars for a great price, but the number may be fewer than they expected.

Burtchell’s advice on how to make sure this doesn’t happen is that consumers should not tell a car dealer what they are looking for as a potential price for their business.

The TikToker said there are some dealers who would consider purchasing the car for a great price, possibly even higher than what the seller expects.

However, if the dealer is offered a lower initial offer than he had planned to offer to a prospective buyer who wants to trade in his current car, he will generally “go lower.”

Don’t count yourself

Burtchell stated that one of the things a car dealer does is “quietly touch small dents and dings” on the car.

“When they give you a low offer, they can use (dents and scratches) against you,” he said.

According to Dent Wizard, “Appraisers typically rate used vehicles on a four-point scale.”

Vehicles can be rated as Excellent, Good, Fair or Poor condition.

One thing potential buyers can do to lessen “dents and dings” is to have the car professionally washed.

Burtchell’s advice on how to make sure this doesn’t happen is that consumers should not tell a car dealer the price they are looking for for a trade-in.

Stay quiet about the trade-in until the car dealer gives the numbers.

Burtchell advises consumers not to tell car dealers that they do trade-ins.

The TikToker explained that the person should wait and tell a car dealer until they find a great price on a newer vehicle.

Buyers who do this can, in Burtchell’s words, “get a better deal.”

Beware of the ‘finance guys’

Car dealer financiers will try to get the buyer under warranty because they are “going to make money” off the individual.

Drivers can make use of the warranty, but Burtchell revealed how they can eventually get their money back.

You can use that to your advantage. “I’ll buy the collateral if they give me a lower interest rate, yada, yada, yada,” she said.

“After you buy the car, simply cancel the warranty and you will receive a refund and enjoy your discount.”

Before financing, Burchell also suggests that consumers not pay the manufacturer’s suggested retail price (MSRP).

Request the invoice which will show what the dealer paid for the car.

Instead of the MSRP, Burchell told TikTokers that people should ask to see the invoice for what the dealership paid for the vehicle.

“You’re going to pay that or less of the bill if they’re desperate,” he said.

According to Road Trach, the price difference between MSRP and actual invoice can be a game-changer.

“The difference between the invoice and the manufacturer’s suggested retail price (MSRP) is essentially the profit margin for the dealer,” they wrote today.

Car dealer financiers will try to get the car buyer under warranty because they are “going to make money” off the individual.

“That’s the difference between the manufacturer’s wholesale cost and the retail cost.”

Although it’s unclear if this happens all the time, the dealership has offered buyers cars for a few thousand dollars more than they paid the manufacturer for them.

This may be one of the factors why dealers can “manipulate” buyers from focusing on the “overall price of the car.”

If the sale with the dealer doesn’t work out successfully, Burchell warned buyers that there could be “a dealer down the road” who will get them a better deal.

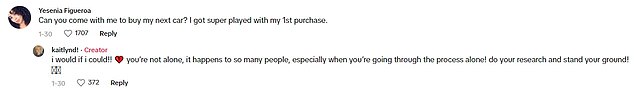

Burchell spoke to other TikTokers about her advice, and one commenter even asked if he could go with her to buy her next car.

Social media users have appreciated Burchell’s advice and have even given their own advice. She has responded to several commenters over the last month.

The commenter admitted that she was “very gambled” on her first purchase, but Burchell pointed out that it can happen often.

‘You’re not alone, it happens to a lot of people, especially when you’re going through the process alone! Investigate and defend your position!’ she wrote.

She also agreed withand some commenters who gave their own advice.

“Just get pre-approved at your bank/credit union before you even go to the dealership,” one TikToker wrote.

Burchell agreed “100 percent” and also advised him not to be fooled by “special offers.”