Table of Contents

<!–

<!–

<!– <!–

<!–

<!–

<!–

Forget the choice between milk, dark or white; This year’s trend is salty Easter eggs.

But even though sweet and sour can be a successful flavor combination, do you really want to enjoy cheese, pork or even caviar on your usual piece of chocolate? SARAH RAINEY puts them to the test.

CREAMY WHITE CHOCOLATE CAVIAR

King’s Oscietra Caviar, £16.70 for 10g, kingsfinefood.co.uk

Blacksticks Easter W’egg’dge, £4, butlerscheeses.co.uk

It is said that pairing earthy-tasting caviar with a white chocolate egg (purchased separately) enhances the creaminess of the chocolate.

I’m skeptical because seafood isn’t my favorite, but it’s delicious, even with my cheap Milky Bar egg: the salty, tangy bubbles from the caviar add flavor and texture, making the chocolate smoother. 5/5

SALTED MISO DARK CHOCOLATE

Cox & Co Cacao Miso Caramel Dark Chocolate Egg, £7.20, waitrose.com

This 47% Colombian cocoa egg is flavored with natural caramel for added sweetness and white miso powder, the Japanese soy paste.

Unfortunately, the dark chocolate is thin and too bitter to counteract the tasty miso, so the whole thing tastes more like a health food than a treat. 2/5

THE ULTIMATE “CHEES-TER” TREATMENT

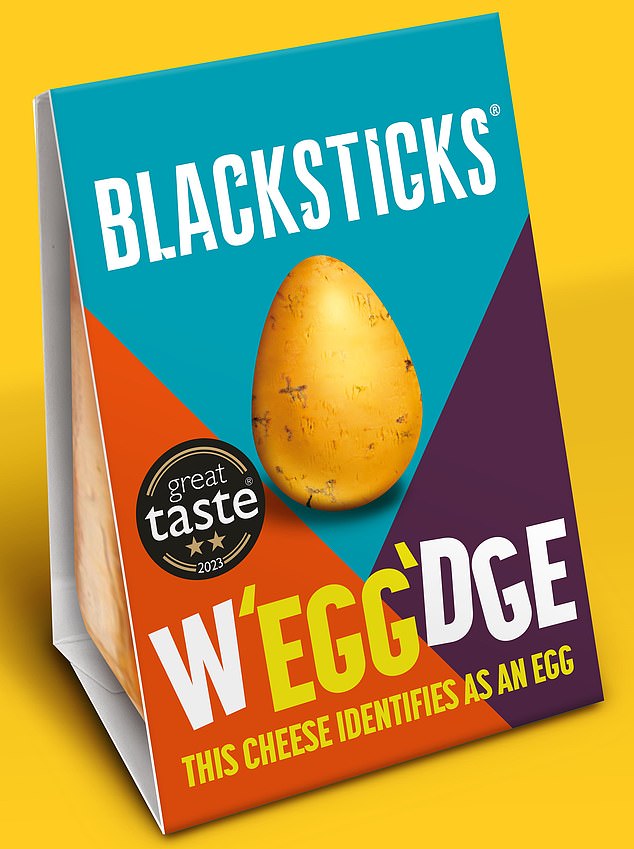

Blacksticks Easter W’egg’dge, £4, butlerscheeses.co.uk

There’s something wonderfully indulgent about enjoying this piece of Blacksticks creamy blue cheese, packaged to look like an Easter egg.

Eggstra Porky Easter Gift, from £19.95, snafflingpig.co.uk

The flavor is both tangy and buttery. I recommend pairing it with a slice of intense dark chocolate. 4/5

DELICIOUS PORK PICK-ME-UP

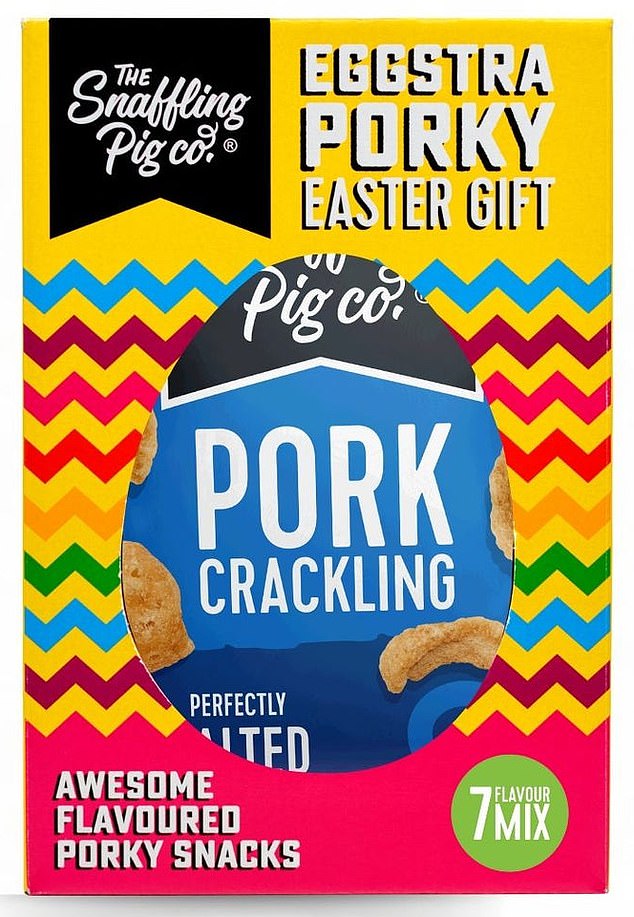

Eggstra Porky Easter Gift, from £19.95, snafflingpig.co.uk

A perfect choice for snack lovers, there’s no chocolate here, just seven 40g packets of pork scratchings, in flavors including mustard and barbecue.

The maple syrup flavor reminds me of honey roasted ham, and I would happily choose it over a classic chocolate egg. 5/5