It is estimated that around 3 million pensions worth a staggering £65 billion will be lost, meaning many people are missing out on thousands of pounds.

According to financial journalist Claer Barrett, speaking in Lorraine today, with a simple trustee you can find out if one of your pensions is among them, which could be worth more than £20,000.

He told Lorraine that pensions can be lost when people move house or change jobs, and now that people are changing jobs more than ever, their pensions can be forgotten.

He added: ‘If you think about how employment has changed since our parents had one job for life or a very small number of jobs, today the average worker performs seven or eight roles within their working life.

‘If you are younger, it will be even more so. Since they changed the law 12 years ago, his employer has to give him a pension as long as he earns more than a minimum amount of around £10,000.

According to financial journalist Claer Barrett (pictured), it’s worth doing a little admin work to find out if you’re short on pensions, which could be worth thousands of dollars.

“So it’s a lot of little pension pots that we collect throughout our working lives and often it’s not until retirement, or maybe when we hit a milestone birthday, that we really think, ‘Wow, what have I got?’ ‘”.

According to Claer, it can be “worse for women” because “it is more difficult for companies to find us because we are more likely to change our name, married, divorced and, in addition, women tend to have less in their pensions because we do not earn so much and we take breaks to have children, so it’s even more imperative that women do the detective work.”

He added that the good news is that with the pensions lost, the money will still be there and will still be invested, so hopefully it should have increased over time.

So how do you find your missing pension funds?

Claer said: ‘There are lots of free resources we can use to find out where our pensions are.

‘So check your CV and find out where you used to work. Plus, it’s a great excuse to get in touch with former colleagues, because they might know who your company’s pension provider was, because we’ll be talking about workplace pensions.

“Then you have to contact the company or, if the company no longer exists, the pension provider.”

Claer noted that there are three websites to mention.

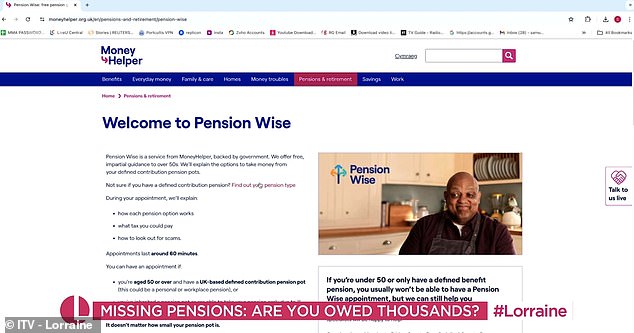

Claer shared a number of resources that can help you find missing pensions, including the Pension Wise website (pictured).

She listed them and said, ‘First of all, Money Helper. That’s the government money website. They have a great section on their website on how to track down a lost pension. It also connects to another service called the pension tracking service, which again is provided by the government.

‘You can now create a template letter in Money Helper once you know the details of who your pension might be.

‘There’s also another private service that’s free called Gretl, like in Hansel and Gretel… which doesn’t just look for pensions, it looks for all kinds of lost things, lost bank accounts, lost investments, trust funds for lost children. , which are another thing that tends to disappear.

‘Then we also have another one to mention, which is Pension Wise. Now, once you find all your pension funds, you would go to Pension Wise; if you are over 50 you will get a one hour appointment.

‘Again, it is a government-backed service. It gives you guidance on what you could do with those pensions. ‘

Financial journalist Claer Barrett (pictured left) discusses how to find your missing pensions during Lorraine this morning (Lorraine pictured right)

Depending on where you live, it could be an online video call or an in-person meeting.

Finally, according to Claer, there is another thing to keep in mind.

She said: ‘Pensions are outside our control. If we die and there is money left in our pension, who receives it depends on who we have named as our beneficiary at that time, usually when we start the pension.

‘If you are a young worker, you may have left your mum and dad, and they may no longer be with you. You may have named an ex-partner whom you have since divorced.

“So that’s something you have to do with every single pension you make: locate and trace, make sure you’ve completed that form and the nominated beneficiary form.”