Table of Contents

I have had a 55-year career in the toughest Fleet Street newsrooms, including Robert Maxwell’s Mirror. But that was easy compared to my struggles with useless companies that prevented me from accessing my OWN retirement savings…

We cannot choose the day of our arrival into this world, nor (legally at least) the day of our departure.

In fact, I’ve come to the conclusion that there are really only a couple of big events that directly influence our life decisions.

One: when to get married, although this decision can be made more than once. One of my former bosses is Rupert Murdoch. Five at the time of writing!

Journalist: Charles Garside had a 55-year career in Fleet Street’s toughest newsrooms (pictured), during which he amassed a wealth of different pension pots.

Two: when to collect the pension. This is, I would say, the only guaranteed, unique and unrepeatable decision we make, and it has enormous consequences.

I was lucky enough to be able to “retire” at 65, when the state pension started, although now people have to wait longer.

But I deferred the pension payments I had accumulated, having worked in many Fleet Street titles.

Nearly eight months on, I seriously wonder whether the pensions industry is doing everything it can to frustrate, delay, obfuscate and generally raise the anger levels and blood pressure of its customers in the hope of hastening the demise of pensioners by shortening their remaining lifespan.

It would obviously save them money, but right?

Maybe I’m the same cynical journalist I’ve been for 55 years. However, I now intend to live a lot longer just to spite them.

After giving the advisor written permission to pool disparate funds from eight or nine companies, some acted as if it were their own hard-earned money.

I understand that in this terrible time of scams there is a real need for security, but there is no need for complete non-response or delays in sending letters saying they included “questionnaires” when in fact they did not include the questionnaire in question.

Potluck: Journalist Charles Garside

Another delay occurred because the returned questionnaires were “lost” in the mail, even though the copies were sent in the same way and on the same date as they arrived at their destination.

The emails went unanswered for weeks, came from generic email accounts or from people who worked three days a week, or worked from home, or were on vacation and “didn’t read emails.”

The real problem was (and I suspect many readers will find the same) that most of my pots were no longer with the company I had dealt with, having been acquired.

When I investigated one, I found that it was clearly at the top of the list of complaints received by the Financial Ombudsman, according to the latest figures I could find.

Most complaints focused on delays, lack of response, loss of correspondence, etc.

Sound familiar? To be fair, a couple of companies were efficient while taking the proper precautions, and a couple of them only had enough money for an annual fish and chips dinner, but hey, it’s my money!

In 1978, I moved to London from the north of England to become chief news editor of the London Evening News, which closed less than two years later, despite selling 550,000 copies a night. It was losing £17m a year and had laid off an incredible 1,700 people.

For many young people, the idea of pensions seemed like a distant memory at a time when finding a job and performing it conscientiously was the top priority.

Pensions were only discussed once in labour negotiations. In 1991 I was offered the post of deputy editor of The European, run by Robert Maxwell.

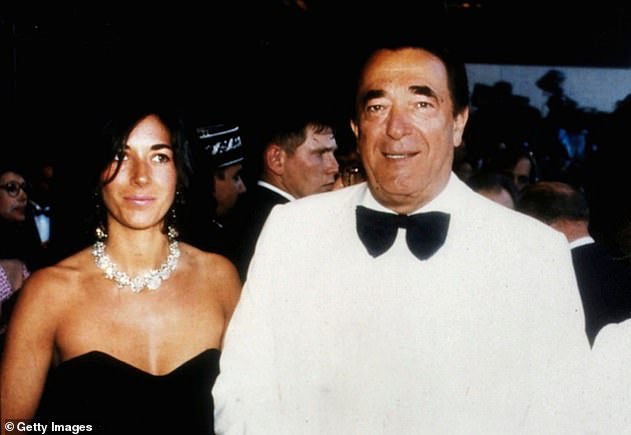

Tycoon: In 1991, Charles was offered the job of deputy editor of The European, run by Robert Maxwell (pictured with his daughter, Ghislaine).

I had worked with his new editor, John Bryant, at The Times and agreed to be his deputy. The appointment was confirmed in Maxwell’s vast office in Holborn.

He was in his shirtsleeves, mixing drinks. He asked me about my pension and waxed lyrical about the quality of its fund, suggesting I go and see the man in charge: the sinister Mr Tombs. I declined.

When Maxwell mysteriously fell off his boat that year, pension payments had not yet been made to my private fund, as agreed.

Maxwell had looted millions from pension funds in the biggest pension fraud in UK history. Thank God I didn’t transfer anything through Mr Tombs.

So my advice is this:

- The time to retire comes sooner than one thinks.

- Always send documents by mail with tracking.

- Stay calm and breathe deeply.

- Remember: it’s your money, not theirs.

Charles Garside edited the London Evening News and later The Standard. He was editor and managing editor of The European, deputy editor of the Sunday Express, editor-in-chief of the Daily Mail, assistant editor of The Times, The Standard, The Mirror and managing director of Radio Riviera in Monte Carlo. He also owned the Miller Howe hotel and restaurant in Windermere for ten years.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.