It was one of the strangest claims in a list of demands made to Keir Starmer by a fringe Muslim group, which earlier this month threatened to stand against Labor MPs in the general election.

The pro-Gaza activist group, Muslim Vote, handed the opposition leader an extraordinary list of 18 demands in early May, which it said he must agree to carry out to win the support of the four million Muslim voters in the United Kingdom.

Included in this list was Sir Keir ensuring that people with the name Muhammad did not pay more for insurance than others simply by virtue of their name.

For years, it has been widely known that insurance customers are priced differently based on various factors, including their age, zip code, and medical history.

Insurance companies have taken this personal data into account when calculating premiums, using them as tools to assess the risk they take in providing a policy.

More pasta? Muslim Vote group demands Labor leader Kier Starmer ensure men called Muhammad do not pay more for insurance than others

But can it really be true that a person’s name can influence the amount they are charged?

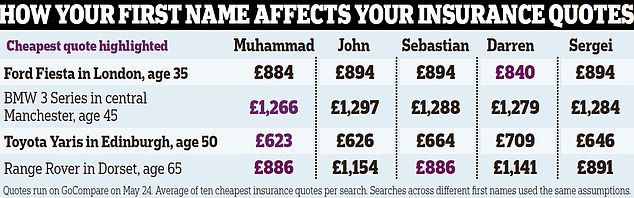

Money Mail investigated and tested the claim to see if two people with identical details (living at the same address, same car and job) but different names would be quoted different premiums for the same level of insurance cover. car. .

We found that, contrary to what the Muslim Vote claims, people with the name Muhammad pay the same as those with other common names and, surprisingly, in many cases, less on their car insurance than people with the name John .

In the dozens of quotes we posted on the price comparison website GoCompare, someone named John Smith generally paid a little more than someone with the name Muhammad Smith.

We used identical details in our searches in four different scenarios, changing only the name. The first names we used were Muhammad, John, Sebastian, Darren and Sergei.

In the most shocking example, Muhammad was charged £553.89 less than John and Darren for the same level of cover.

When Muhammad Smith, 65, from Dorset, requested a quote for cover for his Range Rover, he was charged around a third less than John Smith in five of the ten cheapest quotes.

In another test, we looked for a 35-year-old man with a Ford Fiesta, who worked as an IT consultant and lived in Hammersmith, west London.

Of the ten cheapest quotes on comparison website GoCompare, seven were cheaper for Muhammad than John, while two charged the same and only one was more expensive. Meanwhile, John was quoted at the same levels as Sebastian and Sergei.

Sometimes performing multiple searches from the same computer can generate fraud alerts; however, Money Mail conducted the name searches in random order to ensure there was no bias. GoCompare has been contacted for comment.

On comparison site MoneySuperMarket, John Smith and Muhammad Smith were quoted the same premiums in most of our searches.

However, in one case, Muhammad, 35, who drives a Ford Fiesta in Hammersmith, was charged £188 less than John. A MoneySuperMarket spokesperson says: ‘We are a price comparison site that collects customer information.

Results: Of the 10 cheapest quotes on GoCompare, seven were cheaper for Muhammad than John, while two charged the same premium and only one was more expensive.

‘This information is shared with insurers who use their own pricing models to calculate insurance premiums. The pricing models used by insurers are commercially sensitive and typically include information such as location, car type and driving history.’

Mark Wilkinson, CEO of Norton Insurance Brokers, says using names to calculate a premium could be considered discriminatory.

He adds: ‘I have been in the industry for over 20 years and have never come across an occasion where someone’s name has been questioned for a quote. We deal with all nationalities and that doesn’t exist: everyone receives the same treatment, regardless of their name.’

However, it suggests that the areas where people with the name Muhammad live could play a role.

‘What I think might be happening is that it might be the case that certain areas where people with the same name or a certain ethnicity live may have a higher frequency of claims.

‘So instead of your name having an effect, it’s your home address and insurers could be charging more for that. The name could be a consequence rather than the cause.

When creating a quote, insurance companies use details about you, your vehicle, and your driving. Your personal information is used to predict the likelihood that you will file a claim and therefore how much you will be charged for coverage.

Personal details: It has been known for years that insurance customers are quoted differently based on various factors, such as their age, zip code and medical history.

According to the insurer RAC, living in a built-up area will increase the chances of suffering an accident due to pure probability, as there will be more vehicles on the road.

It says: “If you live in an area with a high crime rate, you could see the extra risk to your car reflected in your premium, as vandalism and theft may be more common.”

The weather in your area could also play a role. For example, if you live on the coast or near a flood-prone river, your insurance payments will consider the cost of potential water damage.

Favorite: Activist group Muslim Vote handed Kier Starmer an extraordinary list of 18 demands

Similarly, your occupation will influence your final premium, the RAC says. ‘Occupations associated with high levels of stress are considered “higher risk,” so while a high-level position may indicate responsibility, some insurance providers may charge high-level professionals a more expensive insurance premium. .’ Jobs that involve a lot of driving also tend to raise charges.

Price comparison website Comparethemarket says even similar jobs can command different premiums. For example, construction worker and bricklayer, or chef and kitchen staff.

It says: ‘If the job fits into more than one category, it may be worth checking quotes for all of them. But remember that the details you provide must be as accurate as possible and not misleading, otherwise it could invalidate your policy.’

A spokesperson for the Association of British Insurers says: ‘Insurers will consider a wide range of risk-related factors when calculating the price of a car insurance policy, such as age, driver experience and vehicle type.

‘First and last names themselves are not used as a scoring factor, but a person’s full name can be compared to other databases to understand their driving history or claims history. Insurers do not and cannot use ethnicity as a factor when setting prices and our members comply with the Equality Act 2010.’

The city’s watchdog, the Financial Conduct Authority, says it wrote to insurers last year “making clear that they must ensure their pricing is not discriminatory in accordance with the Equality Act 2010”.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.