Table of Contents

A dividend is basically a reward for owning shares and you can receive it in cash or reinvest it in more shares.

Many investors depend on income from dividends. It can generate big profits, especially if you keep reinvesting them in more stocks.

A dividend is basically a reward for owning shares, which is paid according to the number of particular shares you own.

This payment will be made at intervals chosen by the company, such as monthly, quarterly, semi-annual or annually, and you can choose to receive it in cash or reinvest it in more shares.

However, the Government inevitably wants its share of this wealth, and in recent years has cut allocations and taken increasing amounts of dividend tax from investors.

Wealthier investors and small business owners, who often choose to pay themselves through dividends, are hardest hit by the dividend tax.

But the increasingly stingy regime means it is also taking an increasing toll on low-income individual shareholders who hold investments outside of Isas and pensions.

Below we discuss the rules and how to protect yourself from dividend tax.

How much is the dividend tax?

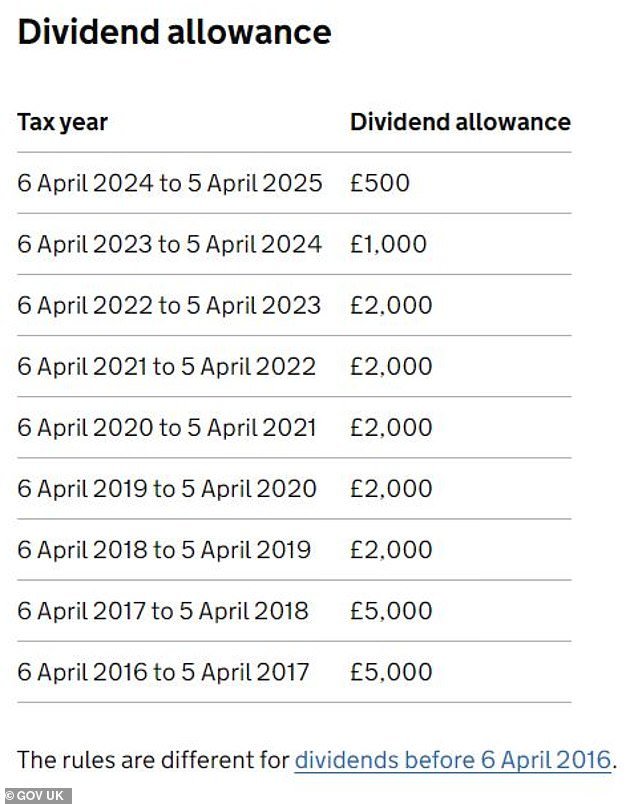

Tax-free allowance for dividend income reduced to £500 from April 2024, below £1,000 in the previous tax year.

If your dividend income is greater than your personal allowance (which also takes into account all your other taxable income) plus your tax-free dividend allowance, you will pay dividend tax in accordance with your income tax bracket.

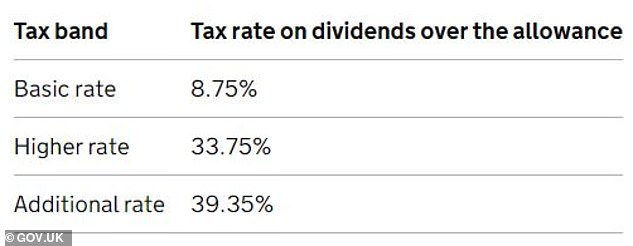

Tax rates on dividends are currently 8.75 per cent for basic rate taxpayers, 33.75 per cent for higher rate taxpayers and 39.35 per cent for additional rate taxpayers.

Rates increased from 7.5 percent, 32.5 percent and 38.1 percent as of April 2021.

As financial experts noted at the time, because the 1.25 percent increase was imposed across the board regardless of income tax bracket, this change fell most heavily on shareholders who were basic rate taxpayers.

Former chancellor Kwasi Kwarteng announced in his ill-fated autumn 2022 mini-budget that the 1.25 per cent rate rise would be reversed from April 2023, but Hunt quickly abandoned that idea again.

As for the dividend allocation, it was introduced at £5,000, but saw a drastic 60 per cent cut in 2018 and, as noted above, was reduced to just £500 in spring 2024.

It is worth noting that the pre-April 2016 regime was more generous to lower income, or basic rate, taxpayers due to a ‘notional tax credit’ which effectively meant that they paid no taxes on dividends.

Meanwhile, under that old system, higher-rate taxpayers only paid a 25 percent dividend tax.

The £5,000 allowance was initially created to compensate people for missing out on this valuable benefit and was primarily aimed at personal investors.

The Government explains more about dividend tax on your website, including how to pay for it.

When you sell your shares, you may also have to pay tax – read our guide to capital gains tax here.

How to protect yourself from dividend tax

Use your Isa allowance of up to £20,000 a year by switching your investments to the tax-free wrapper of stocks and shares Isa.

This can be done by selling your investments and buying them back in a process known as a Bed & Isa.

Couples can also transfer assets between them tax-free to make the most of this.

Financial experts suggest you might consider prioritizing investments that pay high dividends when deciding which one to switch to your Isa.

However, if you keep growth shares out of your Isa, you also need to consider capital gains tax. You may want to seek professional advice on the best way to handle this. Capital gains tax was reduced from £12,300 to £6,000 in April 2023, and again to £3,000 from April 2024.

You can also invest more through your pension, where contributions are topped up by Government tax relief and your investments can grow tax-free.

But in a pension your money is locked in until age 55, reaching age 57 in 2028, and any withdrawals above a 25 per cent tax-free lump sum are subject to income tax.