- Korbin Albert reposted a video of a church preaching against homosexuality.

- Albert issued a public apology on March 28 following fan backlash.

- DailyMail.com provides the latest international sports news.

<!–

<!–

<!–

<!–

<!–

<!–

USWNT stars Alex Morgan and Lindsey Horan said Korbin Albert failed to uphold the team’s integrity by sharing his anti-LGBTQ post on TikTok in late March.

On Wednesday, Horan and Morgan appeared at the team’s press conference ahead of their game against Japan on April 6. The couple was not initially listed for the call, but showed up to address Albert’s social media activity.

“We are very sad that the standard was not upheld,” Horan said. ‘Our fans and followers feel that this is a team they can support. “It is very important that they continue to feel undeniably heard and seen.”

“We maintain a safe and respectful place, especially as allies and members of the LGBTQ+ community,” Morgan added. “This platform has given us the opportunity to highlight causes we care about, something we never take for granted.”

“It is also important to note that we have had internal discussions regarding the situation,” Morgan continued. ‘And that will remain within the team. But one thing to keep in mind is that we never avoid difficult conversations.’

Lindsey Horan and Alex Morgan Addressed Korbin Albert’s Anti-LGBTQ Post on Wednesday

Albert reposted a video preaching against homosexuality and transgender people on TikTok

Retired USWNT star Megan Rapinoe led backlash toward Albert over post

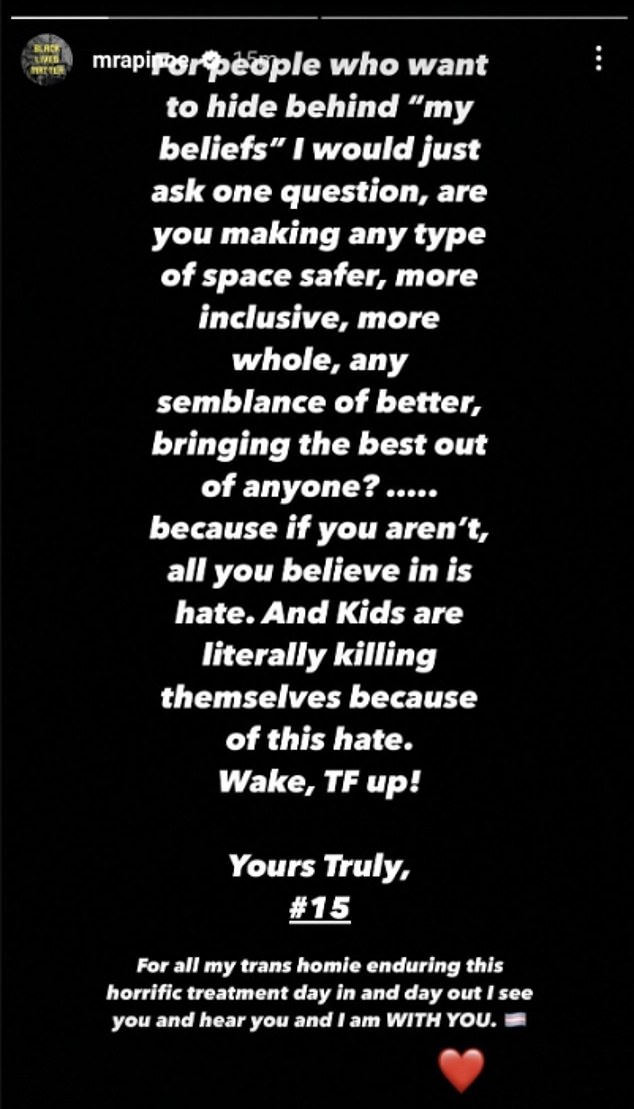

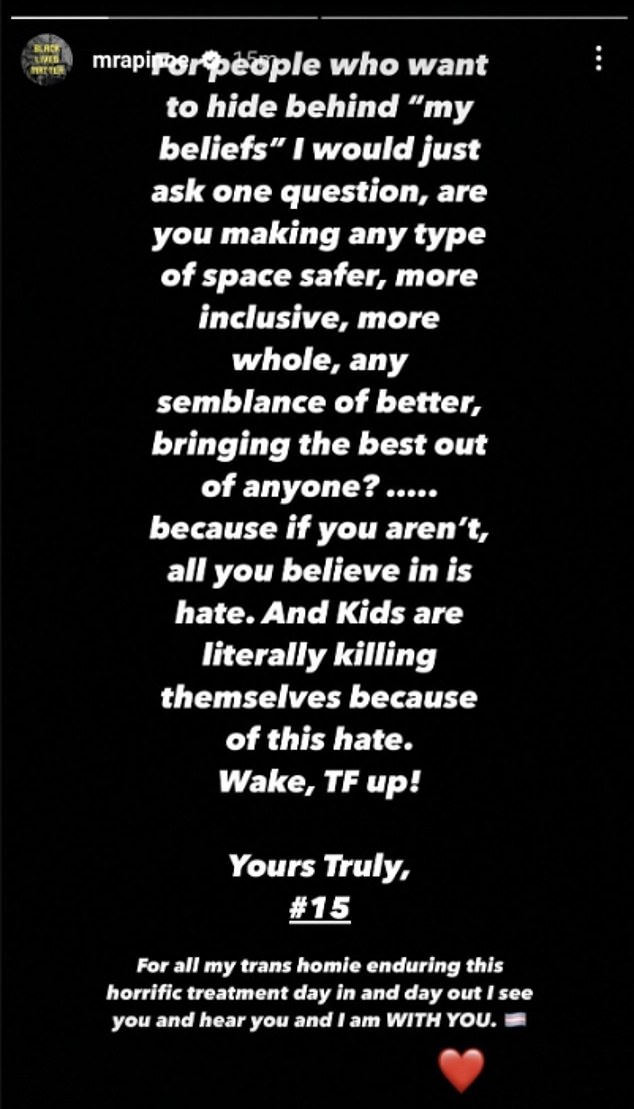

Rapinoe did not specifically name Albert, but challenged her to stop “hiding behind ‘my beliefs.'”

Albert was criticized for reposting a now-deleted video from a Christian worship space that preached against homosexuality and “feeling transgender.”

Without naming Albert, retired USWNT star Megan Rapinoe took to Instagram and wrote, “To the people who want to hide behind ‘my beliefs,’ I would just ask one question: Are you making any moment in space more safe, more inclusive, more well-rounded? Any semblance of better, bringing out the best in someone? …because if you’re not, the only thing you believe in is hate. And children are literally killing themselves because of this hate. Wake up TF! Sincerely, #15.’

Several senior national team players, including captain Becky Sauerbrunn, Lynn Williams and Kristie Mewis, shared Rapinoe’s post in solidarity.

The Paris Saint Germain midfielder and USWNT rising star previously posted similar content on social media. In another TikTok post, which has since been deleted, Albert showed his family saying “his pronouns are US,” over the Fourth of July weekend.

Additionally, Albert liked an Instagram meme post that read, “God took some time off to work miracles to make sure Megan Rapinoe sprained her ankle in her last game.”

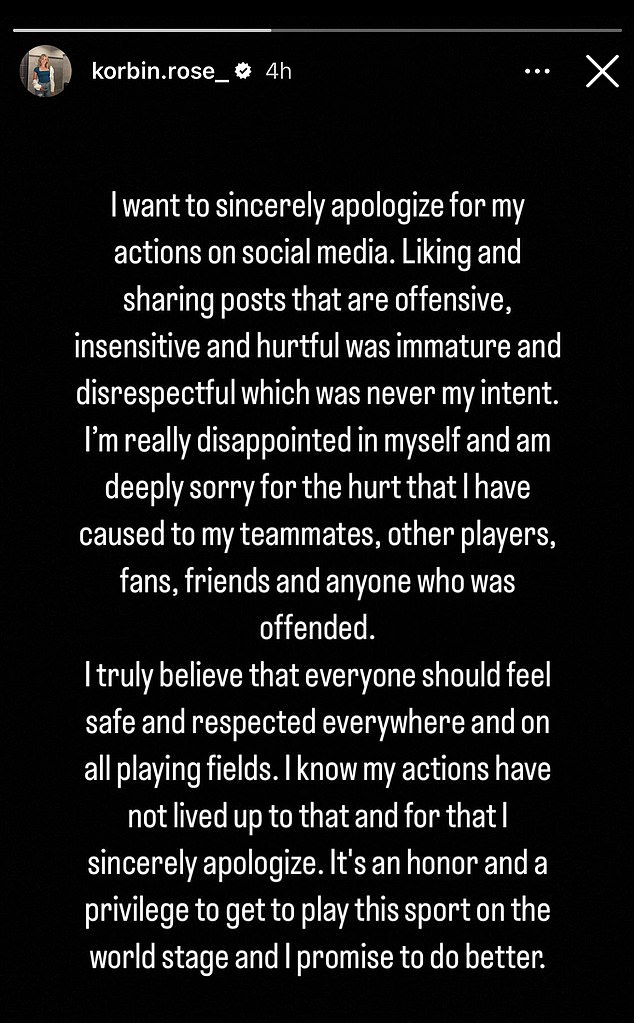

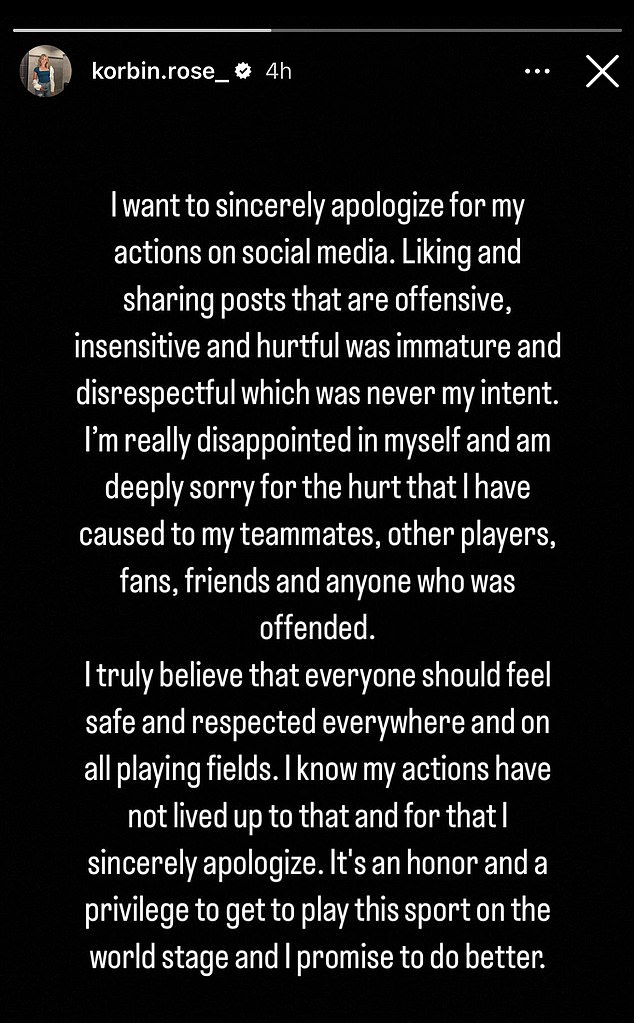

On March 28, Albert publicly apologized and acknowledged his “hurtful” actions.

Albert, who wears the number 15 that Rapinoe wore with the USWNT, previously liked an Instagram post that mocked the midfielder for an injury she suffered in the final game of her career in 2023.

The meme was referring to Rapinoe tearing her Achilles tendon in the 2023 NWSL Championship match in just the third minute when her team, OL Reign, lost to Gotham FC on penalty kicks.

On March 28, Albert publicly apologized and promised to “do better” following the backlash.

“I am truly disappointed in myself and deeply sorry for the hurt I have caused to my teammates, other players, fans, friends and anyone who was offended,” she wrote.

‘I truly believe that everyone should feel safe and respected everywhere and on every field of play. I know that my actions have not been up to par and for that I sincerely apologize.

“It is an honor and a privilege to be able to play this sport on the world stage and I promise to do better.”