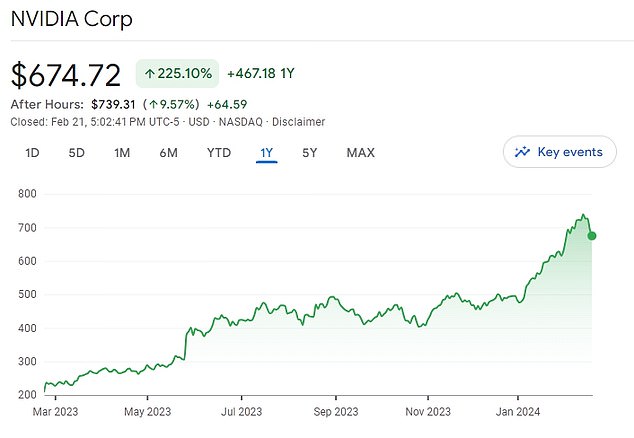

Nvidia beat Wall Street’s earnings expectations Wednesday night, with revenue rising a whopping 265 percent.

The company inched closer to a market value of $2 trillion – and is poised to reclaim its place as the third most valuable company – as shares rose as much as 13.5 percent before the bell rang. Thursday.

It marks yet another triumph for the giant chipmaker, which has become a poster child for the rise of artificial intelligence.

Some wonder if stocks have risen too much too fast, or wonder if it’s too late to buy after parabolic rises of 36 this year.

But James Demmert, chief investment officer at Main Street Research, told Bloomberg: “Some investors have been afraid to buy because they think stocks are too expensive, but that’s been a big mistake.”

“Every time you report, the price-earnings ratio gets lower because the earnings end up being much stronger than people expect.”

Nvidia beat expectations for fourth-quarter earnings on Wednesday, sending shares up 10 percent in after-hours trading.

Nvidia president Jensen Huang holds the Grace hopper superchip CPU used for generative artificial intelligence

“The people who made the most money in the gold rush of the mid-19th century were those who provided the tools to do the work, not those who searched for the precious metal,” said Russ Mold, chief investment officer at AJ Bell.

“Nvidia is effectively playing the same role today in this technological revolution.”

Rising demand for Nvidia chips used by companies racing to improve their AI offerings helped the Silicon Valley company forecast a whopping 233 percent growth in revenue for the first three months of 2024, above market expectations of a 208 percent increase.

AI requires significant processing power, creating huge opportunities for companies that make computer chips. The company’s revenue has soared in the past year, as it won new contracts and demand for its chips increased.

During its earnings report on Wednesday – for the October-December quarter – it reported $22.1 billion in sales in the current quarter, about $2 billion more than analysts expected.

It forecast revenue of $24 billion in the current quarter, also $2 billion above expectations.

“Accelerated computing and generative AI have reached the tipping point,” CEO Jensen Huang said in the statement. “Demand is increasing around the world in companies, industries and countries.”

Nvidia said its strong sales were led by its AI chips used in servers, particularly its ‘Hopper’ chips, including the H100.

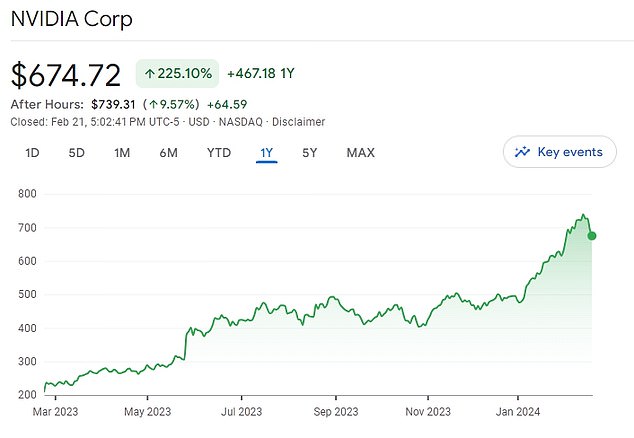

Nvidia’s stock price closed Wednesday at $675, up about 40 percent so far this year. In pre-market trading on Thursday, they were up 13 percent at $762 as of 8 a.m.

Last Friday, a third of the S&P 500’s gains so far this year were attributed to Nvidia, according to S&P analyst Howard Silverblatt. Its share price has nearly quintupled since the end of 2022.

“This is just the beginning,” said Philip Kaye, co-founder and director of Vesper Technologies, which specializes in data center infrastructure.

“As AI models become more complex and more widely adopted and companies collect and analyze more data, computing hardware requirements will only increase,” he added.

“Looking ahead, Nvidia’s earnings growth trajectory shows no signs of slowing,” he said.

Nvidia’s stock price closed Wednesday at $675, up about 40 percent so far this year. Exceeded $740 in after-hours operations

Analysts warned before the report that its huge valuation could make the stock vulnerable to a sharp pullback if the company delivered anything less than a spectacular report.

There were fears that this, in turn, could dampen enthusiasm for other AI-related stocks that have helped fuel the market’s rally from its October 2022 low.

“It’s been driven by excitement and excitement around AI, and of course the AI favorite in the room is Nvidia,” said Jason Ware, chief investment officer at Albion Financial Group in Salt Lake City, Utah.