Animal rights activists have expressed their displeasure over the light punishment a Wyoming man received for killing a wolf after parading it through a bar.

Activists from states across the United States showed up at the Wyoming Game and Fish Commission to share their feelings about the video showing the wolf being tortured before being killed.

One of the activists, Lorraine Finazzo, said Wednesday that the wolf video had left her unable to sleep.

Finazzo, who according to Cowboy State Diary had traveled from South Carolina for the meeting, told the commission: “Those pictures, I couldn’t sleep.”

Roberts, of Daniel, Wyoming, had captured an injured wolf after hitting it with his snowmobile and paraded it through a bar before killing it.

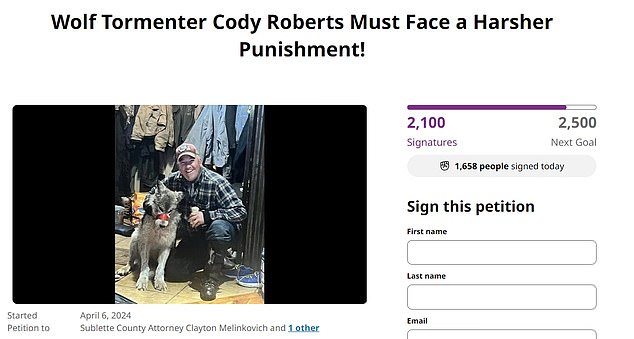

Roberts, 42, captured an injured wolf after hitting it with his snowmobile and paraded it around a local bar before killing it. He is photographed with the animal.

Finazzo was allowed two minutes to address the commission along with dozens of others who spoke during the two-hour public comment session.

During his testimony, he said his family had visited Wyoming frequently, but might not return to the state unless it changed its policies toward wolves.

And he added: “The incident [with the wolf] in Wyoming it has given me nightmares.

‘Unless there are changes to these laws, we cannot continue to support tourism in Wyoming. Laws change a lot, the world is watching.

Jim Laybour, a Wyoming native, told the outlet that the wolf images had affected him as well.

He said, “I can’t get those images out of my head,” adding that he wouldn’t “give another penny” to the state until they changed wildlife management laws.

During his testimony, he told commissioners, “Wyoming hunters will always be associated with people like Daniel’s wolf torturer, and I refuse to be associated with that.”

The outlet reported that many others criticized the practice of hunting animals with snowmobiles or other vehicles.

University of Wyoming professor Donal O’Toole said at the meeting that he was horrified to learn about this practice from a work colleague.

He said, ‘He told me about chasing coyotes with a snowmobile and running them over. I think we have a cultural problem.’

Video released Wednesday by the Wyoming Game and Fish Department shows the clearly injured animal lying in the corner of the bar as patrons discuss its fate.

During the commission meeting Wednesday, one audience member said the images of the wolf left her unable to sleep.

Montana resident Dave Stalling, who represents Hunters and Anglers for Wildlife Management Reform, said there is widespread “wolf hatred” among hunters.

He told the meeting: ‘It is an irrational hatred of wolves. They talk about ‘shoot, shovel and shut up’.

‘The way we manage wolves is not based on science. It is based on fear, lies, misconceptions and hatred.

Others noted that the incident could ruin Wyoming’s reputation as a leader in wildlife management.

Wyoming Game and Fish Department Director Brian Nesvik told attendees he had had “dozens and dozens” of conversations about the incident.

Nesvik added that he would hold talks with Gov. Mark Gordon and the legislature about possible next steps.

Roberts, 42, was fined $250 for being in possession of a live wolf, sparking outrage among animal activists.

Witnesses said Roberts dragged or carried the animal through the Green River Bar while patrons watched. She was fined $250 on February 29 for his actions.

He was not punished for the death of the year-old animal, since it is legal to kill wolves in Wyoming.

Video posted Wednesday by Wyoming Game and Fish shows the clearly injured animal lying in the corner of the bar as patrons discuss its fate.

Animal rights groups are calling for the Sublette County sheriff and prosecutor to file felony animal cruelty charges against him.

Lori Wynn, chief executive of Guardians of Wolves, previously told DailyMail.com: ‘The gray wolf is a misunderstood creature.

‘Wolves are not mindless killers. “They balance their own populations by coming into conflict with other herds,” he said, adding that they also avoid humans whenever possible.

“The innocent wolf that Cody killed mattered,” Wynn added. “She was vital to our environment.”

The group has called for Roberts to be punished more harshly. He has obtained more than 100,000 signatures.

Roberts’ social media accounts show that he is an avid hunter who frequently hunts wild animals along with his children.

Others, however, conveyed just the opposite, as the director of the Wyoming Game and Fish Department told Cowboy State Daily on Monday that the agency is keeping no secrets about the tormenting and killing of the wolf.

Wyoming Governor Mark Gordon weighed in on the incident, saying on social media: “Our office has received considerable communication regarding the actions of an individual involving a wolf that occurred earlier this winter in Wyoming County. Sublette.

‘I want to make my position on this matter absolutely clear. Cruelty towards any wild animal is absolutely unacceptable. This is not the way anyone should treat any animal.

“I am outraged by this incident, as are thousands of ranchers, farmers, sportsmen and others in Wyoming and others across the state,” Gordon added.

“I would be disappointed if someone painted Wyoming with a broad brush and suggested that the citizens of Wyoming condone the reckless, thoughtless and egregious actions of one individual.”

In a statement from the commission, they said: ‘Through this statement, the Commission denounces the actions that were revealed following the Department’s (Game and Fish) investigation of the incident.

‘The defendant’s actions do not represent the value that the people of Wyoming and our Commission have for our incredible and invaluable wildlife resources.

‘This incident perpetrated by one individual does not represent a failure in wildlife policy or management.

‘We want to be clear: we support the investigation carried out by the Department.

‘We recognize and appreciate the work of the Department and the work of the Guardians involved.

‘We are satisfied that all the tools we have available have been used, and that they have been used to the best of our ability. The Department has acted transparently and in accordance with Wyoming law.’