Anglo American could list its diamond business in London as part of a breakup plan designed to fend off takeover interests.

Experts at the mining giant believe De Beers, famous for coining the phrase “diamonds are forever”, could be worth £4bn or more.

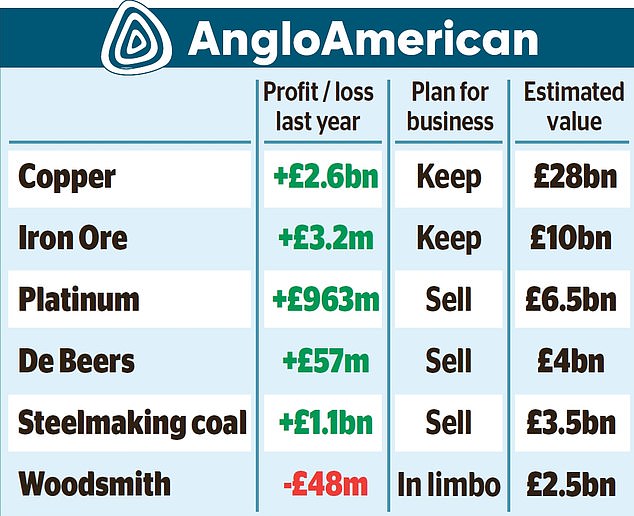

Having rejected two takeover bids from rival BHP (worth £31bn and £34bn), London-listed Anglo yesterday revealed plans for a radical overhaul that included ditching De Beers as well as of its platinum operation in South Africa, its coking coal and nickel businesses.

The restructuring also put the future of the Woodsmith polyhalite fertilizer mine in North Yorkshire in doubt.

Sources told the Mail that options for De Beers included a sale or an IPO in London, a major coup for the City.

Diamond Performance: singer Rita Ora wearing De Beers jewelry. Experts believe the business could be worth around £4bn.

Anglo boss Duncan Wanblad said his restructuring plan marked “the most radical changes” at the 107-year-old company in decades.

It was forced to reveal the proposals ahead of schedule after BHP’s two bids put pressure on Anglo to fight back.

But the future of the entire company remains in doubt as BHP mulls a third approach.

Competitors Glencore and Rio Tinto may also throw their hats in the ring.

AJ Bell investment analyst Dan Coatsworth said the plan could “make Anglo even more attractive to potential bidders”.

BHP boss Mike Henry came out on top, saying yesterday that Anglo shareholders will have to decide which management team is “more capable” and has a “better track record” to secure its future.

Both rejected offers from BHP included a demand for Anglo to sell its South African businesses, seen as a major obstacle to a deal.

This was partly addressed by Anglo’s plan to spin off Johannesburg-listed platinum unit Amplats.

Under the proposals, Anglo would retain its coveted copper mines as the metal is in high demand due to its role in the green energy transition.

Anglo would also retain its premium iron ore business and Woodsmith mine, although investment at the site near Whitby will be cut.

This week, Anglo said BHP’s second bid still “significantly undervalued” the business after it rejected the £31bn first bid last month.

But Henry argued that BHP’s latest proposal is “quite compelling” despite being worth less than the £40bn that analysts said a deal could fetch.

At a mining conference in Miami, he said: ‘At the end of the day, it will be up to the shareholders.

‘They have to look at the plans and decide which one they think will create the most value as soon as possible.

He added: “Shareholders know that opportunities don’t present themselves like this very often.”

Wanblad was expected to attend the event, but decided not to fly to the United States. Calling the conference from London, he said: “Every decision will safeguard shareholder value.”