A price gouging law passed last year by California could skyrocket gas prices in the neighboring state of Nevada.

The law, which went into effect in June 2023, gives the California Energy Commission (CEC) the authority to set a profit cap for gasoline refiners in the state.

If the CEC takes its mandate to the extreme, one expert said a domino effect could cause prices at Nevada pumps to rise as much as $10 a gallon.

Even with the law in place, the CCA has not yet decided on a specific profit limit, although it plans to present a concrete plan later this year, Las Vegas Magazine reported.

“The potential impact could be severe enough if (Nevada) doesn’t get gas, or if gasoline flowing into Nevada could theoretically cost $5 or $10 a gallon,” said Patrick De Haan, chief oil analyst at GasBuddy.com. “The degree to which prices rise depends on how much they adjust the market.”

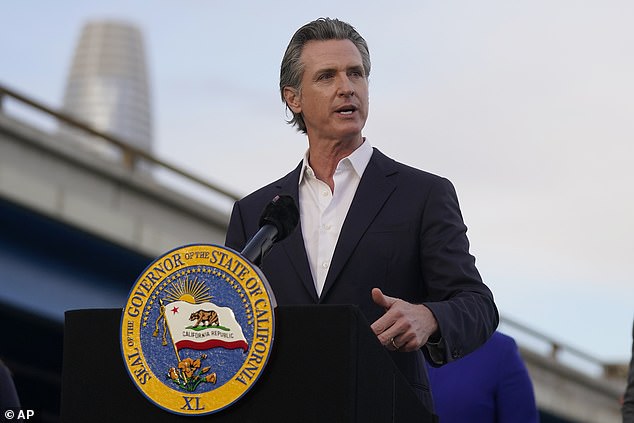

Nevada Gov. Joe Lombardo, pictured, wrote a letter to California Gov. Gavin Newsom in May expressing deep doubts about instituting price caps on gasoline refiners.

People living in California and Nevada already have to endure some of the highest gas prices in the country. As of Saturday, the average price per gallon was $4.84 in California, while it was $4.05 in Nevada, according to AAA data.

Nevada is especially affected by this new regulation, as the state gets about 88 percent of its fuel from California refineries, as Gov. Joe Lombardo noted in a May letter to Gov. Gavin Newsom.

The Republican, a former Clark County sheriff, expressed concern about the “unintended consequences” of the new law and added that prices could also rise for Californians under this new regime.

“I am concerned that this approach could lead refiners to limit fuel supplies to avoid a profit penalty or even abandon our shared fuel market entirely,” he wrote to Newsom. “Either scenario would likely lead to limited supplies and higher fuel costs for consumers in both of our states.”

Newsom’s office responded to Lombardo’s letter by calling it a stunt to appease his “big oil donors who contributed tens of thousands of dollars to his campaign,” adding, “he knows full well that oil refineries are raising gas prices and making massive profits, harming residents of both of our states.’

Shell, along with other oil giants, posted huge profits in the first quarter of 2024 thanks in large part to strong gasoline margins.

Gavin Newsom responded to Lombardo, saying he is simply appeasing his ‘big oil donors’

Peter Krueger, state director of the Nevada Association of Convenience Stores and Petroleum Marketers, believes Nevada is completely at the whim of California regulators as things currently stand.

He said that even if the state wanted to look at alternative fuel sources, that would not be a viable option since Nevada’s largest fuel pipelines are already connected to California. Trucking gasoline from another state would likely be even more expensive.

According to him, the only viable option for Nevada would be to build more refineries and become more like California, where 90 percent of the gasoline consumed comes from state refineries.

“We’re stuck with what’s happening in California,” Krueger told the Review-Journal. “If it’s just based on price, then we’re going to have to suck it up and pay the price they deliver it to us.”

Legislators in Arizona They are equally concerned about this.as his state also gets a large portion of its gasoline needs met by California refineries.

Experts attribute the CEC’s impending decision on benefit limits to the simple concept of supply and demand.

“The long-term game is that if refiners are discouraged from refining, we will end up with less supply,” De Haan said.

De Haan added that even if the CEC sets a profit cap for this year, it will take several years for consumers to feel the impact on gas prices.