- The company backed a 620 pence per share bid from US private equity group Thoma Bravo

- Proposed sale will deepen ‘existential crisis’ facing London stock market

- Exodus of listed companies absorbed or transferred abroad

Tech entrepreneur Mike Lynch will be paid almost £300m after Darktrace became the latest UK company to be targeted by foreign predators.

The FTSE 250 cybersecurity firm backed a 620p per share bid, valuing it at £4.25bn, from US private equity group Thoma Bravo.

The proposed sale will deepen the “existential crisis” facing the London stock market amid an exodus of listed companies being acquired or moving abroad.

Lynch, the company’s founding investor, is on trial in the United States on fraud charges related to his former company Autonomy, something he denies.

He and his wife Angela Bacares between them own just under 7 per cent of Darktrace, a stake valued at £290m under the terms of the deal with Thoma Bravo.

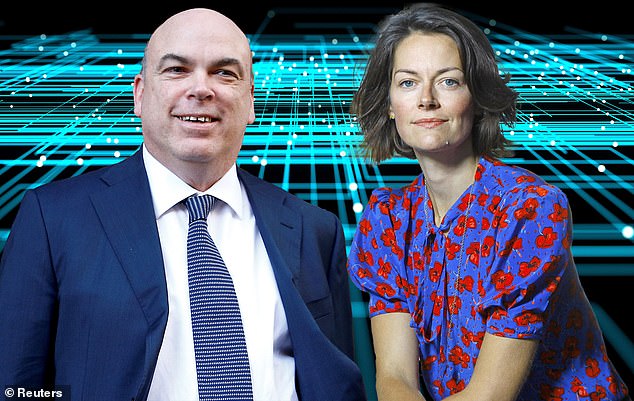

Bumpers: Mike Lynch, the founding investor of the cybersecurity company, and Poppy Gustafsson

A spokesman for Lynch, 58, declined yesterday to comment on whether he supported the deal.

Darktrace CEO Poppy Gustafsson will raise £24m for her involvement.

Charles Hall, head of research at Peel Hunt, said UK-listed companies with a combined value of more than £100bn were now subject to bidding processes or switching to other listing venues such as New York or Frankfurt. . He said: “The UK market has an existential crisis and needs urgent action to ensure it remains a leading listing venue.”

And in a letter to MPs published yesterday, City Minister Bim Afolami said he was working “every day” to accelerate reforms designed to help revive the sector.

Among the companies being targeted for takeovers is mining giant Anglo American, which yesterday rejected a £31bn approach from Australia-listed BHP.

Retailer Currys and insurer Direct Line have rejected foreign takeover offers.

But others, such as haulier Wincanton and packaging giant DS Smith, have been snapped up by foreign bidders.

At the same time, companies such as gambling group Flutter and travel company Tui are moving their main listings to places such as New York and Frankfurt.

Darktrace’s announcement yesterday echoed a common complaint among such companies that they are not sufficiently valued in the London market. It said: “Darktrace’s operational and financial achievements have not been proportionately reflected in its valuation and the shares trade at a significant discount to its global peer group.”

Darktrace shares rose 16.4 per cent, or 85p, to 602p.

Thoma Bravo, based in Chicago and run by Puerto Rican billionaire Orlando Bravo, 54, has more than £110 billion of assets under management with investments in more than 75 companies. Thoma Bravo said that he intended to keep Darktrace’s headquarters in Cambridge and that he would remain a “British tech champion”.

Founded in 2013, Darktrace employs approximately 2,300 people and operates in more than 110 counties, with more than 9,400 customers.

Gustafsson, 41, said yesterday: “Our technology has never been more relevant in a world increasingly threatened by AI-powered cyberattacks.”