Traders who bet on Donald Trump’s victory in the US election have raised huge sums of money on the Polymarket cryptocurrency trading platform, including an anonymous financier who made approximately $85 million.

The crypto betting site beat pollsters and “called an election first and foremost,” founder Shayne Coplan, 26, declared on Nov. 6.

Among those who reaped the most rewards from the result was the so-called “Trump whale”, a French citizen who calls himself Théo.

The financier relied on predictions from specialized “neighbor polls,” including some he commissioned, meaning he effectively bet against the accuracy of US polling data.

He was so confident the Republican would win the race that he reportedly bet $30 million of his own money on it, just as Polymarket bucked traditional polls by leaning heavily in favor of a Trump victory.

The crypto entrepreneur, who dropped out of New York University, boasted that his app had helped Musk and others “go to bed early on election night” because of its “early call.”

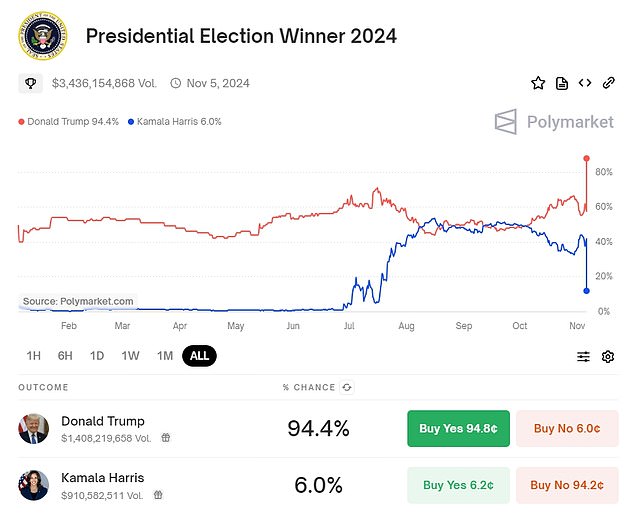

A screenshot of Polymarket odds predicting Trump’s victory

The ‘Trump whale’ was so sure the Republican would win the race that he reportedly bet $30 million of his own money on it.

According to the financier, traditional polls did not take into account the “shy Trump voter effect”: voters who supported the former president but were not willing to share their views publicly or with pollsters.

When he placed his bets, the odds of Trump winning were 40 percent, but his bet was in no way based on a gut feeling, he told the Wall Street Journal.

It had commissioned its own polls to measure what is known as the “neighbor effect,” asking people not who they vote for but who they think are next door.

Théo criticized polls published by mainstream media outlets, saying they underestimated Trump and were biased in favor of Democrats.

‘In France this is different!! The credibility of the pollsters is more important: they want to be as close as possible to the real results. The culture is different in this,” he told reporters.

He insisted that he was in no way trying to rig the election with his huge bet, telling the WSJ: “My intention is just to make money.”

Many election watchers kept their eyes on Polymarket during the race for the White House, with the odds spread by X and shared by Elon Musk as evidence of Trump’s momentum.

“More accurate than surveys as real money is at stake,” Musk said on X in October, sharing the latest data from the Coplan app.

The crypto entrepreneur, who dropped out of New York University, boasted that his app had helped Musk and others “go to bed early on election night” because of its “early call.”

“On election night, Polymarket was the first destination to broadcast that Trump had won,” he told CNBC. “They were two or three hours ahead of the media.”

“On Polymarket it seemed like a done deal, and if you were just watching TV, you’d think they were neck and neck,” Polymarket CEO Shayne Caplan says of the platform’s initial appeal to Trump on Election Day.

Despite backing from high-profile Trump supporters Musk and Peter Thiel, who was among the investors who helped the platform raise $70 million this year, Coplan has insisted that Polymarket is “strictly nonpartisan.”

Writing on X, he said the site is “not about politics.” The vision was never to be a political website, and it still isn’t.”

While Polymarket traders took the high road by betting on Trump’s victory, the majority favored Harris to win the popular vote, which she ultimately won.

Betting on Polymarket surged as traders rushed to bet on the US presidential election, with more than $3.6 billion in trading volume for predictions on the winner, according to data shared by the platform.

Bookmakers have been betting on election results for centuries – Polymarket is different because it operates more like a financial exchange, where traders buy and sell digital contracts between each other.

While gambling markets have historically been effective at indicating election results, they have sometimes been dramatically wrong, including during the Brexit vote in 2016.

The site has humble beginnings: Coplan shared a photo of his ‘office’ four years ago that was actually in his bathroom, with his laptop propped up in a washing basket.

Polymarket and other betting platforms have quickly emerged as a way to legally invest money in elections and gauge who is ahead, after successive cycles in which pollsters’ forecasts crashed and burned.

People make ‘trades’ for a candidate and get paid if they support the correct outcome. More and more bets on a favorite increase that candidate’s odds, while reducing people’s returns.

Direct betting on elections is restricted in the United States.

But platforms like Kalshi, PredictIt and Polymarket aren’t strictly betting sites: They avoid restrictions by serving as places to trade contracts on future outcomes.

Kalshi became the first legal prediction market in the US thanks to a federal appeals court ruling last month.

Polymarket says it restricts participation to US-based users and has a large number of users abroad, in countries such as France. However, many users in the country avoid this by using a tool known as a VPN, which can hide your location.

Tarek Mansour, CEO of betting platform Kalshi, said the results validated his fledgling industry, which predicted a Harris loss weeks earlier, and also correctly called the race for Trump on major news networks Wednesday morning.

‘The markets were right. The markets outperformed,’ Mansour told DailyMail.com.

‘Markets will be what people look at in the next cycle. They’re not coming back.’

Donald Trump with his wife Melania and son Barron on election night. Prediction Markets Eyed Trump’s Lead Among Voters Ahead of the Polls

Markets are “not a crystal ball,” Mansour said, but they are better than pollsters at gathering the wisdom of the crowd.

It quickly became clear that the betting markets were betting on the money.

The polls, which involve polling voters on how they plan to vote and then processing that data, had suggested a close race, even in the seven swing states that decided the race.

But they underestimated Trump’s support nationwide, and by as much as four percentage points in battlegrounds like North Carolina, Nevada and Arizona, according to Friday’s count.