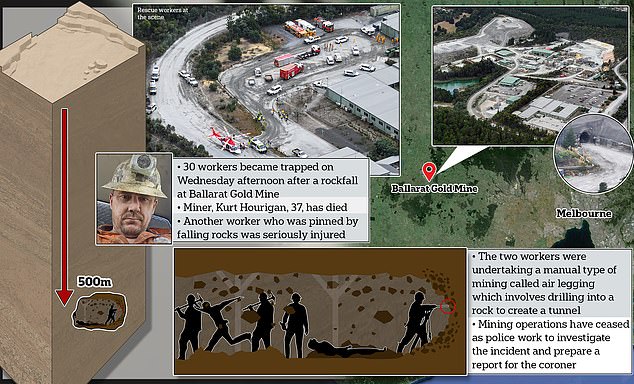

Big questions are being asked about the safety of a mine after a collapse killed one worker, seriously injured another and left dozens trapped for hours.

Father-of-two Kurt Hourigan, 37, was one of the 31 trapped miners 500m underground in the course of a collapse at the Ballarat gold mine around 4.30pm on Wednesday.

He died after being pinned under rubble along with another miner. His body was retrieved around 5.20am on Thursday.

The other injured miner was picked up by rescue teams and flown to The Alfred Hospital in Melbourne after suffering life-threatening injuries to his lower body.

The remaining 29 miners were able to find their way to an underground safety capsule during the collapse and were rescued around

Ronnie Hayden, the Victorian secretary of the Australian Workers Union (AWU), said Mr Hourigan’s death ‘could have been avoided’ and questioned the mine’s safety procedures.

Big questions are being asked about the safety of the Ballarat gold mine after Kurt Hourigan, 37, was killed in a collapse on Wednesday afternoon

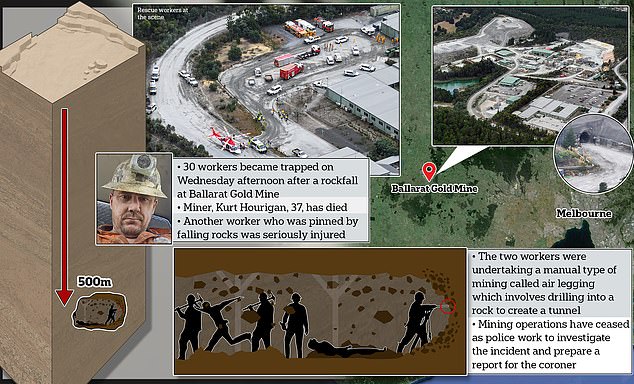

Speaking to the media on Thursday afternoon, Mr Hayden said union members were ‘furious’ that the mine had used the risky technique of ‘air laying’.

The mining method involves a manually operated drill bit that fires compressed air and water to break up a rock face.

The hand-held device was commonly used to extract thin gold veins, but has since been phased out in some mines due to a higher risk of injury as miners face the shaft walls.

Hayden said the miners were working under “unsafe ground” while using the technique to “create a tunnel to work in to hunt for gold”.

‘They shouldn’t have done that task in mine.’

He went on to claim that AWU members had voiced their concerns about air-legging “and it seems to have fallen on deaf ears”.

The union chief issued a stark warning to others using the ‘cheap, nasty way of mining’, saying they are ‘at risk’ of a similar outcome.

“Mining today is (mostly) done using large machines where the workers are far away from the (rock) face and any unsupported soil,” he told The Project.

‘Using an air leg is two guys holding on to a big drill with a single leg… and that’s physical mining.

Comparing the method to ‘using a pickaxe’, Mr Hayden said it was ‘just something that shouldn’t be happening today’.

He added that the union would “push hard to ensure industrial manslaughter laws are used”.

The collapse left Mr Hourigan and another miner, 21, pinned under rubble, while 29 others evacuated to a safety box about 500m underground (pictured, mine)

The 21-year-old was brought to the surface hours later and taken to a Melbourne hospital with life-threatening injuries to his lower body.

The Ballarat gold mine had stopped using air coatings before it was reintroduced by its new owners, Victory Minerals, in December 2023, according to Mr Hayden.

“It is with great sadness that we confirm the passing of one of our own,” said a spokesman for Victory Minerals.

‘Our deepest sympathies and thoughts go out to his family and all our people at this time.

“Our absolute priority is to support the well-being of our team members and their families and loved ones as we all come to terms with this tragic news.”

Victory Minerals also denied allegations that it had recently made its senior security officer redundant.

‘No safety staff working underground in the mine were made redundant in the recent restructuring. In fact, we increased security resources in the underground, said the company spokesman.

‘The roles and responsibilities of the redundant business leadership role were transferred to the health, safety, environment and community manager, who reports directly to the chief executive.’

All operations at the mine have since been halted as a report is prepared for the coroner and the state’s workplace health and safety watchdog, WorkSafe, investigates the incident.

WorkSafe chief executive Narelle Beer said safety concerns raised before the incident will form part of the investigation.

“If as a result of that there is a prosecution that will follow, then that case will be prosecuted accordingly,” she said.

‘We are very keen to understand how we can ensure that a tragedy like this never happens again.’

A rockfall at the Ballarat gold mine in 2007, operated by different owners, led to 27 miners being trapped underground for several hours before being brought to safety.

The mine’s former owners were notified after another collapse in 2021 resulted in 600 tonnes of rock falling into sections that miners had been working on just hours before.

Australian Workers Union Victorian branch secretary Ronnie Hayden has called for Victoria’s workplace manslaughter laws to ‘come into force’ in lieu of the 37-year-old’s death

Hayden claims AWU members at the mine (pictured) raised concerns about risky mining employed at the mine had ‘fallen on deaf ears’

The technique known as ‘air legging’ has miners standing meters away from the wall manually operating a drill bit that fires compressed air and water at the rock face

Sir. Hourigan’s death sparked an outpouring of grief shared by loved ones, friends and colleagues.

He has been remembered as a devoted father of two and keen handyman.

“Val dog, I still can’t believe you’re gone. I’ve always looked up to you,” his brother Reece wrote on Thursday.

‘Thank you for all the good and bad memories we have shared together. I love you so much brother.’

Another loved one Stephanie Coleiro added: ‘Our brother, our best mate, our son Kurt… we are so broken here without you.

‘You were the best mate I could ask for. All the good and bad advice. The crushes when I bawl my eyes out or just to sit with me and have a stump on the sofa.

‘Our children loved you as much as you loved them. Love you and miss you so much mate.’

A close friend wrote: ‘The best mate anyone could ask for, you can never be replaced and I will miss you every day.’

Sir. Hourigan’s social media is filled with photos of him enjoying himself with his young children during the school holidays and DIY projects he had been working on around the home.

Just a week ago, the proud dad shared photos of his children enjoying a beach holiday at Lake Tyers in Victoria’s Gippsland region.

Miner Kurt Hourigan was remembered as a proud dead who loved spending time with his young children and the best mate anyone could ask for

All operations at the mine have since been halted as Worksafe Victoria representatives (pictured) investigate the deadly disaster

WorkSafe investigators will take into account past safety issues and decide whether to lay charges against the mine’s owners, Victory Minerals

The state’s prime minister, Jacinta Allan, described the collapse as a terrible accident.

“If there is advice where the laws can be strengthened, we stand ready to do that work and support workers across all industries who deserve the right to come home from work each and every day safely to their families and loved ones,” said she.

Federal Resources Minister Madeleine King said it was too early to have a solid idea of what caused the incident.

Minerals Council of Australia chief executive Tania Constable said safety was the most important issue for the industry.

“This tragic event is a reminder of the need to always prioritize safety above all else,” she said.

The mine’s website states that it has an extensive network of tunnels and operates deep beneath buildings, streets and homes.

Ballarat Mayor Des Hudson said the miner’s death was devastating news.

“We are a very resilient community,” he said.

‘There will be great community concern and support from the local community for those involved.’