Woman whose sister died left furious after A pregnant friend suffered an unimaginable loss herself, raising concerns about the inconvenience she would experience traveling by plane to attend the funeral.

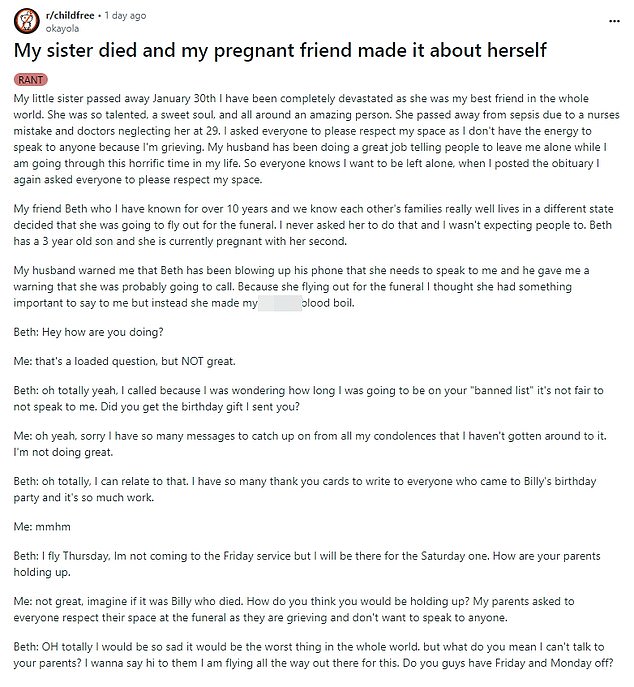

The anonymous woman, believed to be from the US, took to Reddit’s “childless” thread with a post titled: “My sister died and my pregnant friend did it on herself.”

She went on to explain that her younger sister had died at age 29 from sepsis caused by a rare cancer on January 30, and that she was “completely devastated because she was my best friend in the whole world.”

But the woman’s grieving process was interrupted when she was contacted by an old family friend, called Beth, who was pregnant as well as having three-year-old son Billy.

A woman whose sister died was left furious after a pregnant friend suffered an unimaginable loss for her, raising concerns about the inconvenience caused by flying to attend the funeral (file image)

The post explained how Beth was apparently flying to attend the funeral, even though she wasn’t asked to.

‘My husband warned me that Beth had been blowing up her phone and that she needed to talk to me and warned me that she was probably going to call me. “As she flew in for the funeral, I thought she had something important to tell me, but instead she made my bloody blood boil,” the furious woman said.

Instead of offering her condolences, Beth began pestering the woman to go out with her while she was in town for the funeral.

‘Hello how are you?’ Beth began.

“That’s a trick question, but NOT a very good one,” the woman responded.

Beth replied: ‘Oh, totally yes, I called because I was wondering how long I was going to be on your “banned list.” It’s not fair that you don’t talk to me. Did you get the birthday gift I sent you?

The woman explained that “I had received so many messages to catch up with all my condolences that I haven’t been able to do it,” and then repeated that “I’m not doing very well.”

Beth chimed in: ‘Oh, I can totally relate to that. “I have so many thank you cards to write to everyone who attended Billy’s birthday party and it’s a lot of work.”

The anonymous woman, believed to be from the US, took to Reddit’s “childless” thread with a post titled: “My sister died and my pregnant friend did it on herself.”

Beth then explained her travel itinerary and said she will “fly out on Thursday” and will not attend the Friday service, but will attend the second service on Saturday.

—How are your parents doing? Beth probed.

The woman replied: ‘Not very well, imagine if it was Billy who died. How do you think you would be handling it? My parents asked everyone to respect their space at the funeral because they are grieving and don’t want to talk to anyone.

Beth replied: ‘Oh totally, I would be so sad it would be the worst thing in the world. But what do you mean I can’t talk to your parents? I want to greet you. I’m flying there for this. Are you free on Friday and Monday?

The woman emphasized: “I don’t know, they just want to be left alone and they hope people respect that.” Yes, I have Friday and Monday off.’

Beth then turned the conversation back to her own schedule: ‘I have Monday off, thank God because having to fly to this funeral and everything, I’m going to be so exhausted that I’m glad I have Monday off for myself.’ .

“I hate being away from Billy because this weekend is going to be a lot of work for me,” she added of her temporary separation from her young son.

At that, the distressed sister quickly ended the conversation.

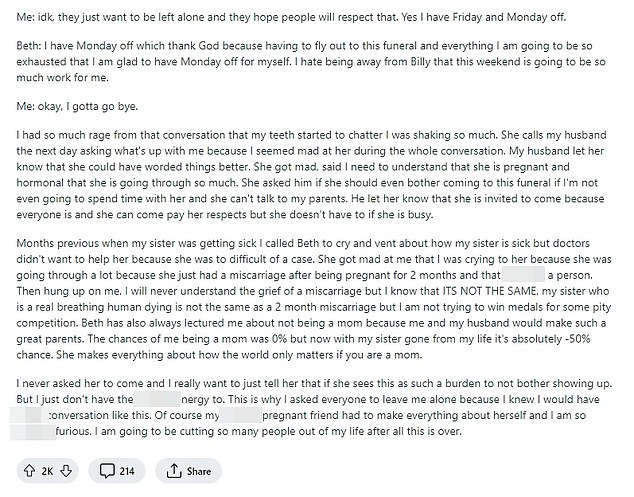

“I felt so angry from that conversation that my teeth started chattering. I was shaking so much,” the woman admitted.

Beth then called the woman’s husband to ask “what’s wrong with me because (the woman) seemed mad at her the entire conversation?”

“My husband let him know he could have worded things better.”

But Beth then “got angry” and demanded that the woman had to “understand that she’s pregnant and that she’s going through so many hormonal things.”

“She asked him if she should bother coming to this funeral if I’m not even going to spend time with her and she can’t talk to my parents,” the woman became even angrier.

The husband then reminded her that “everyone” is invited to come pay their respects, but if she is “busy” then she doesn’t have to.

To make matters worse, the woman remembered that she had actually called Beth when her sister was in the middle of her illness, and Beth had hung up on her for crying because the mother had just suffered a miscarriage two months into her pregnancy.

‘She got mad at me because I was crying to her because she was going through a lot because she just had a miscarriage after being two months pregnant and that screws a person up. She then she hung up on me.

‘I will never understand the pain of a miscarriage, but I know it IS NOT THE SAME, my sister, who is a true human, dying is not the same as a two-month miscarriage, but I am not trying to win medals for some competition pitying. ”the woman insisted.

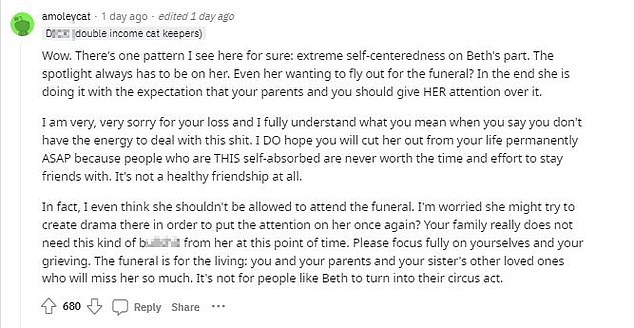

Other Reddit users were quick to post comments in support of the woman, also expressing shock and disgust and Beth’s self-centeredness.

The poster also added that Beth had “lectured” her and her husband in the past about not having children of their own, reasoning that they would be “such good parents.”

“She makes everything about how the world only matters if you’re a mother,” the woman added about Beth.

“I never asked you to come and I really want to tell you that if you see this as a burden, don’t bother showing up.” But I just don’t have the damn energy to do it.

“That’s why I asked everyone to leave me alone because I knew I would have a shitty conversation like this.

‘Of course, my fucking pregnant friend had to do it all herself and I’m so fucking furious. I’m going to eliminate a lot of people from my life when this is all over,’ the woman promised.

Other Reddit users were quick to post comments in support of the woman, also expressing shock, disgust, and Beth’s self-centeredness.

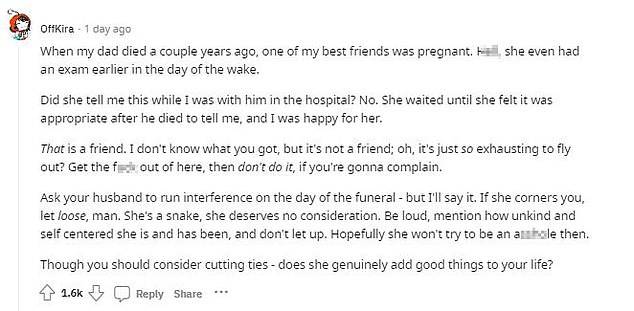

One shared an anecdote after his father’s death that also involved a pregnant, but much more supportive, friend.

‘When my father died a couple of years ago, one of my best friends was pregnant. Hell, she even had an exam earlier on the day of the wake.

‘Did he tell me this while I was with him in the hospital? No. She waited until she felt it was appropriate after he died to tell me, and I was happy for her.

‘That’s a friend. I don’t know what you have, but he’s not a friend; Oh, is it so tiring to fly? Get out of here and don’t do it if you’re going to complain.

A second agreed: ‘I’m sorry for your loss. Beth is horrible. It’s not about hormones, it’s about personality.’

Ask your husband to interfere on the day of the funeral, but I will say it. If she corners you, let go, man. She is a snake, she does not deserve any consideration. Be loud, mention how cruel and self-centered she is and has been, and don’t stop. Hopefully then she doesn’t try to be a jerk,” she concluded.

Another put it bluntly: ‘Cut that bitch.’ That’s not a friend. He wants extra points for doing things a friend would do (flying to the funeral), but he has no idea how to BE a friend.’

And another repeated: ‘I’m sorry for your loss. Beth is horrible. It’s not about hormones, it’s about personality.’