Credit card customers at a number of large retailers must pay $1.99 if they still want to receive a paper statement.

Synchrony Bank, which offers dozens of co-branded cards for businesses from Amazon to Walgreens, has been rolling out the fee in recent months.

The charge also affects cards the bank provides to American Eagle, Dick’s, J Crew, JCPenney, Lowe’s, PayPal, Sam’s Club, Venmo and Verizon.

While there are no laws prohibiting fees for paper statements, companies must obtain customers’ permission before switching them to digital billing.

For many Americans, digital statements are unwelcome: Some seniors may be uncomfortable with the technology, while others prefer paper statements to manage their finances.

Synchrony Bank, which offers dozens of co-branded cards for businesses from Amazon to Walgreens, has been rolling out a $1.99 fee for customers who want paper statements.

Business professor Elaine Luther of Point Park University warned about Boston 25 that online statements and payments can expose users to potential data breaches.

He also noted that low-income consumers may have difficulty with digital payment systems.

For example, Alicia Galowitsch and her husband Mark are on a fixed income and meticulously monitor their budget.

“It’s very close to when we had to start going to a food bank,” says Galowitsch. told NBC Los Angeles.

The couple, who live in Palmdale, have six credit cards with Synchrony Bank and were recently told they would have to pay a $1.99 fee for each one.

“That will add up to $11.94,” Mrs. Galowitsch explained.

She emphasizes the importance of paper statements to keep her finances organized, particularly when she’s not at home. ‘

‘If I’m not here, payments will be delayed because Mark won’t know what to do. With the extracts on paper, everything is written for him,’ he said.

Frustrated, Galowitsch approached Synchrony to request a fee waiver, especially since she pays the bank about $450 a month in interest.

‘If you earn enough money with interest, why charge anything more?’ she asked.

However, the bank stood its ground. ‘All they said was that that’s what they decided to do. “No ifs and buts,” he said.

Synchrony Bank indefinitely waived fees for paper statements for the Galowitschs after NBC contacted the company.

The bank said it had exclusions to accommodate those with various special situations.

Chi Chi Wu, an attorney with the National Consumer Law Center, argues that charging consumers for paper financial statements is unfair

“Frankly, that’s one of the worst consequences of statements made solely online,” he told NBC.

‘People just overlook the email telling them they have a statement. (They) don’t open it, they don’t go to the website, or maybe they forgot their password and they don’t make a payment. Now you have to pay a late fee,” he said.

Reddit threads have also been growing as customers discuss the $1.99 fee.

‘Close my account’ one user wrote in a thread titled: Synchrony to start charging for paper statements,

‘They also raised the rate to almost 32%. It’s not that it has a balance, but the greed of this company is astonishing.-

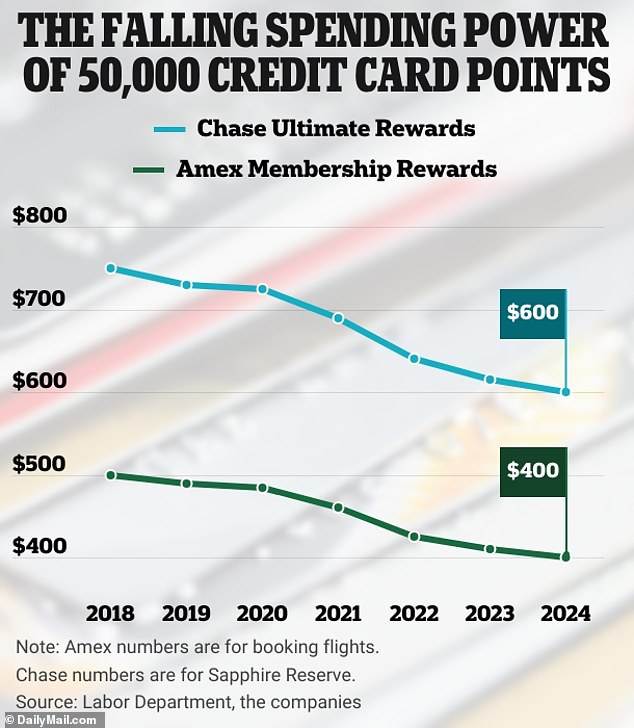

Meanwhile, a recent report showed how the value of credit card rewards points has been gradually falling as inflation has taken hold.

The points conversion rate changes when you transfer points from the bank’s portal to a frequent flyer or other points program.

Inflation begins to affect the value of points if users redeem them directly through a bank’s portal or online app.

For some time now, a point redeemed through online banking has been worth around one cent.

But a penny has lost about 20 percent of its purchasing power since 2018, according to the Bureau of Labor Statistics.

This means that a point has also lost value by approximately the same amount, depending on The Wall Street Journal.

If you accumulated 50,000 points with a major credit card issuer in 2020 and haven’t spent them yet, they are now worth about 41,300, according to the outlet.