- New paper claims tax benefits on retirement plans only benefit the rich

- It would save the government $200 billion a year, which could cover the social security deficit

- Report co-authored by a right-wing economist and former undersecretary of the Treasury during the Clinton presidency

Tax benefits on 401(K) plans should be eliminated in favor of higher Social Security payments, says a report co-written by a former aide to President Clinton.

Alicia Munnell, who was deputy secretary of the Treasury from 1993 to 1995, claims that tax-exempt retirement funds disproportionately benefit the wealthy.

She made the claim in the report co-authored by right-wing economist Andrew Biggs, where she says such benefits have done little to incentivize workers to save more anyway.

Cutting benefits from 401(K) plans and Individual Retirement Accounts (IRAs) could save the government nearly $200 billion, they argue, and that windfall would be better used to plug shortfalls in Social Security payments. .

He paper – “The argument for using retirement plan subsidies to fix Social Security” – has generated widespread backlash, with one retirement expert calling it an “absurd idea” since its publication last month.

Alicia Munnell, who served as deputy secretary of the Treasury from 1993 to 1995, alleges that tax-advantaged retirement funds disproportionately benefit the wealthy and had done little to incentivize workers to save more.

The paper, “The Case for Using Retirement Plan Subsidies to Fix Social Security,” released in January, has sparked widespread backlash, with one retirement expert calling it an “absurd idea.”

Traditional defined contribution (DC) retirement plans, such as 401(Ks), are not subject to taxes on your own or your employer’s contributions. Instead, the tax is deferred until you withdraw the funds in retirement, at which time it is taxed as ordinary income.

By comparison, workers who save in an IRA take a tax hit up front, but can withdraw the savings tax-free in their later years.

Both plans significantly reduce the amount a worker pays in taxes over his or her lifetime compared to what he or she would pay in ordinary investments.

In theory, the benefits are intended to increase the country’s retirement savings by incentivizing workers to contribute more.

But they come at a cost. According to US Treasury estimates, the tax benefits of such plans cost the government between $185 billion and $189 billion in 2020.

And Munnell and Biggs, from the right-wing American Enterprise Institute. They argue that generous tax breaks have had minimal impact on retirement plan participation rates.

The report was co-authored by economist Andrew Biggs of the right-wing American Enterprise Institute, pictured.

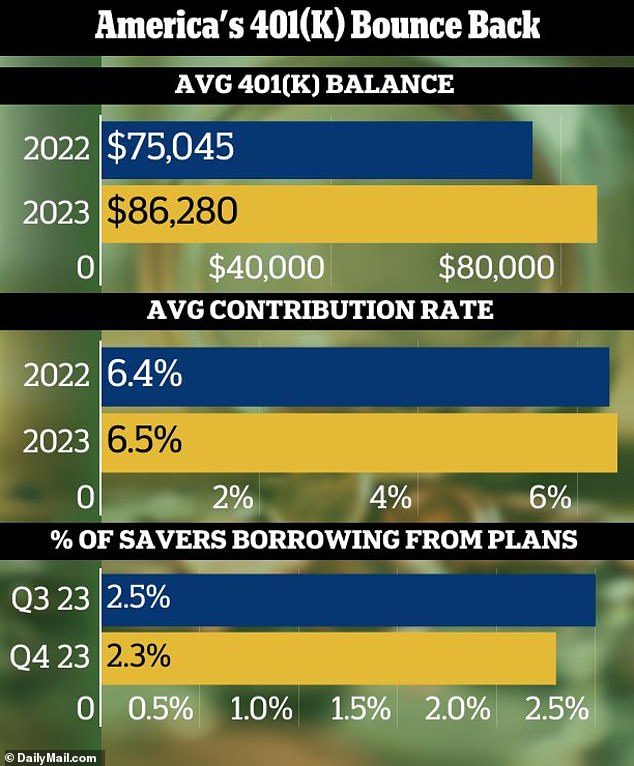

It comes after a Bank of America report found that the average 401(K) balance soared 15 percent in 2023 thanks to a booming stock market and an increase in workers contributing to their plans.

The researchers found that between 1989 and 2022, the share of workers ages 25 to 64 contributing to employer-sponsored retirement plans had increased just two percentage points, from 51 percent to 53 percent.

What’s more, they say the plans disproportionately benefit higher-income taxpayers who are more likely to participate in employer-sponsored retirement plans.

They estimate that by abolishing these benefits the money could be used to address approximately three-quarters of Social Security’s long-term funding gap.

An earlier Congressional Research Service report found that the Social Security office would not be able to make full benefit payments as early as 2034 without intervention.

After Biggs posted the report on X, formerly Twitter, it garnered more than 723,000 views.

One user wrote: ‘If we take away the tax benefit, who the hell is going to keep saving in a 401(K)? This would make people save less and depend more on the government.”

Meanwhile, Brian Graff, CEO of the American Retirement Association, shared the article on LinkedIn with the caption: “No, it’s not April 1…and I personally can’t think of a more absurd idea.”