Retirement age is a hot topic. When I talked about it here in May, the response was remarkably polarized.

My suggestion was that working longer, beyond the retirement age to which most of us aspire, was not necessarily such a bad thing.

I was primarily targeting those who feel overwhelmed by meeting their rigorous savings and retirement goals; those intimidated by the popular ultra-frugal FIRE approach to living and saving: Financial Independence, Retire Early.

The opposite option I suggested was RELAX, an approach where professional happiness can inspire longer lives. It’s about putting more emphasis on directing your life toward a career you enjoy.

Skipping retirement: Continuing to work after retirement age will help boost your pension

Opinion was divided. Some were vehemently opposed and determined to leave the rat race as soon as possible to reach a seeming nirvana in which they did nothing or, at least, did whatever they wanted.

Others see the Great Un-Retirement as a positive. For them, continuing to work can maintain their purpose and help them stay physically and mentally sharp. For some, the appeal is simply the company of colleagues.

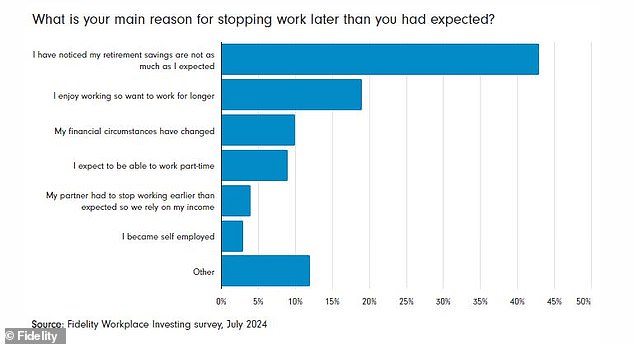

I was intrigued by a new survey, conducted among a small sample of the hundreds of thousands of people who have their company pensions through Fidelity’s Workplace Investing. It found that 27 percent of people aged 55 and over expect to work longer than planned.

The main reason was financial: 44 percent said they had not saved enough, but another 19 percent said they enjoyed their work and wanted to continue.

To say it again, one in five who continue to do so do so because they love their job.

Whether you want to work longer or have to, staying in a job can dramatically change your retirement savings. But by how much?

Shortfall: The most common reason for staying in a job is not having enough savings for retirement

Working for a pension increase: the numbers

A good starting point is to consider how to achieve an income of £30,000 in retirement – the figure people are aiming for, on average, according to our survey.

To reach that figure with an annuity, where you hand over your retirement savings in exchange for a guaranteed income, you would need around £400,000.

That amount, based on Best Buy’s latest rates*, would put a 65-year-old on £18,508 a year, rising with inflation. Add to that the full state pension (£11,502 from age 66) and that’s ten pounds more than the desirable £30,000.

To save that £400,000 over 40 years, you would need to save £262 a month, based on an average annual return of 5 per cent after charges. Do your own maths with This is Money’s long-term savings and investment calculator.

Now let’s suppose you have adopted the CHILL method and instead of retiring completely you continue working one day a week.

A simple way to look at it is that if you needed £400,000 to reach your savings goals, you would need a fifth less (£320,000) now that you continue to work 20 per cent of the time.

And with the target reduced by £80,000, you may need to save less – £210 a month instead of £262.

If you decide to work two days a week, then the pension pot needed might be £240,000, not £400,000.

Now, I accept that these scenarios are very theoretical and should be taken with a grain of salt: you are unlikely to work forever; it depends on what you can earn from ongoing work; you don’t know whether you will want to continue working; and, on the plus side, you could continue contributing to your pension from your part-time job, with tax relief available until age 75.

The list of “what ifs” is long.

The figures, for the sake of simplicity, also overlook the fact that at these levels 25 per cent can be taken as a tax-free pension lump sum.

So perhaps the target figure should be £534,000 rather than £400,000, of which £134,000 should be deducted tax-free.

But then you could invest that money to earn more income.

The many scenarios don’t end there: instead of buying an annuity, you could keep the money invested and try to live off the investment income, the “retirement drawdown” route… the twists and turns continue. Read This is Money’s guide to annuities and retirement drawdowns to find out more.

So yes, retirement planning is complicated and should always be personalized. It is up to your financial advisor to determine how this should be done.

But I imagine they would enjoy the challenge of incorporating continuous work into those scenarios.

But there is a broader point I am trying to make that goes to the heart of the CHILL philosophy.

That is, if you’re panicking at headlines saying you’ll need to build up a £300,000, £500,000 or £800,000 pot to retire, consider this: by cutting one day into five working days, you reduce your pension savings needs by a fifth, regardless of the size of your pot.

It’s a very simplistic way of putting it, but it’s broadly true. And it’s an idea that makes the CHILL approach to work and retirement even more attractive.

*Best Buy prices as of July 5. Source: williamburrows.com

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.