Table of Contents

The debate over whether there should be a £100,000 lifetime limit on Isa savings was reignited over the weekend.

The idea of putting a cap on the amount people can put into popular tax-sheltered Isas – potentially raising £1bn a year to help less well-off savers – was mooted earlier this year by the Resolution Foundation .

This sparked reactions at the time, including from This is Money editor Lee Boyce, arguing that Isas are a simple, well-understood and successful way to save.

The proposal came under scrutiny again after think tank boss Torsten Bell was adopted as the Labor candidate for Swansea West and removed a post made on X on the issue.

Does Isa squeeze? What are the chances of a government changing the Isa system?

There is no indication that Labor plans to adopt it as policy (the removal of the post suggests not), so it seems unlikely it will be in the pending manifesto.

However, a future government of either party will look to raise extra money without breaking promises not to increase the UK’s main tax rates – income tax, national insurance and VAT.

We have previously looked at how a new Government could look to cut pension tax relief, at least for higher earners.

Here’s a summary of what the Resolution Foundation proposed earlier this year, and finance experts William Stevens of Killik and Co and Rachael Griffin of Quilter explain how it could work in practice.

£100,000 lifetime limit on Isa savings explained

The current tax-free saving limit in an Isa is £20,000 a year, and tens of millions of people use them to store and build their wealth through interest rates and investment growth.

Last week we revealed how a record £11.7bn was piled up in cash Isas in April, showing that the popularity of tax-free accounts continues to grow.

The Resolution Foundation says £20,000 is a high amount, more than four times the average level of total savings – including current accounts and other savings products – per adult.

“It is largely people with higher incomes who benefit most from Isas, as they tend to have greater funds for such savings,” Resolution says in its January briefing on household savings.

‘For example, for working-age adults, around £3 in every £10 saved in Isas (29 per cent) is held by those in the top income decile and just under three quarters (74 per cent) cent) are in the hands of those in the top decile. top half of the income distribution.’

It says around 1.5 million people live in families with Isas worth more than £100,000 per adult, and the majority are aged 60 or over.

‘The problem is not just who benefits from Isas, but also who does not. Young people, women and those living outside the south of England – all characteristics associated with lower income and wealth levels – are less likely to benefit from the tax-free savings support provided by Isaa,’ she continued.

The Resolution Foundation says there is a long-standing and endemic problem: too many families have too little savings, and argues that more effective support could be funded by reducing the ineffective tax advantages enjoyed by the very rich.

“Policymakers have tended to focus too much on increasing levels of aggregate savings – a worthy goal, even if success has been limited to date – and too little on ensuring that more families have a decent level of savings,” Add.

The expert group suggests limiting Isa amounts, potentially in the following way.

- There is currently an annual limit of £20,000 on the amount that can be added to an Isa in a given tax year, but there is no limit on the total value you are allowed to hold in Isa accounts, nor on income.

- It would be administratively difficult to limit returns or income, so a simpler approach would be to limit the total value an individual can have in any Isas.

- When this limit is reached, as a result of active saving, savings income or capital gains, a person will no longer be able to add money to any Isa account.

- The additional income generated could be used to finance an increase in the generosity of the Help to save the schematic, which encourages low-income people to save and get bonuses for their money.

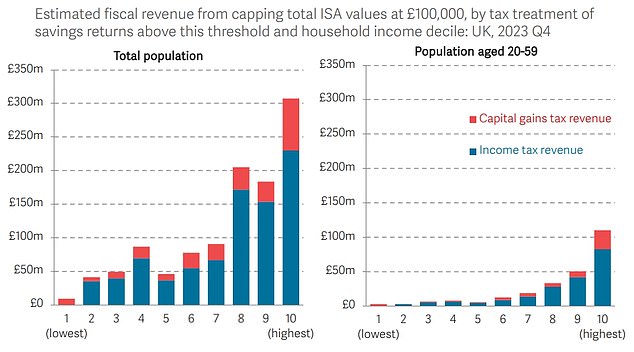

The table below estimates the income that could be raised by limiting existing individuals’ Isa holdings to £100,000.

This is based on taxing returns from cash Isas as income and taxing returns from stocks and shares Isas as capital gains, explains the Resolution Foundation.

Limiting Isa values to £100,000 could raise £1bn a year

Source: HMRC Resolution Foundation Analysis, Annual Savings Statistics 2022; OBR, Economic and Fiscal Outlook – November 2023; Bank of England, Bankstats; ONS, Wealth and Heritage Survey. (Read more on p36 of his report.t)

How might a £100,000 ISA lifetime savings limit work?

William Stevens, head of financial planning at Killik & Co, explains how it could affect savers and investors in practice.

We have strong precedent for how limits on tax-efficient wrappers could work with the now-defunct lifetime subsidy. (Read This is Money’s guide to the lifetime pension subsidy)

However, those who have already exceeded this amount would need to be considered, as retrospective taxation on those with large Isas accumulated during a period when there were no limits would likely face legal challenges.

(This) was the case of transitional protection for pension savers.

The reality of implementing a system would be complex, with quite a few questions for Isa providers and more administration required, which could increase costs for the companies providing them, which would likely be passed on to investors.

Careful consideration should be given to the impact this could have on savers, as uncertainty over ISAS may deter people from using them to save and invest for their future.

A limit would add complexity to what is a simple product.

Rachael Griffin, tax and financial planning expert at Quilter, gives her opinion.

Isas were introduced as a means of encouraging savings and, as the contribution level has been frozen for the past few years, there is essentially a ceiling already in place.

By limiting the amount, you can save into an Isa, particularly a stocks and shares Isa, and then end up taxing the return on the funds and not really the ‘input’.

It would be almost impossible to monitor who has breached the limit from a provider perspective, as you can have multiple Isas with different providers.

A cap would add complexity to what is a simple product and lead to strange behavior where people end up migrating to a portfolio that doesn’t match their risk profile to mitigate fund growth.

Similarly, these types of limits could serve to deter people from investing, which would be a blow to investment in the UK stock market and potentially cause problems for the proposed UK Isa.

People could be forced to repurchase more properties, which may not be a good outcome given that house price inflation has already priced out many first-time buyers.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.