Table of Contents

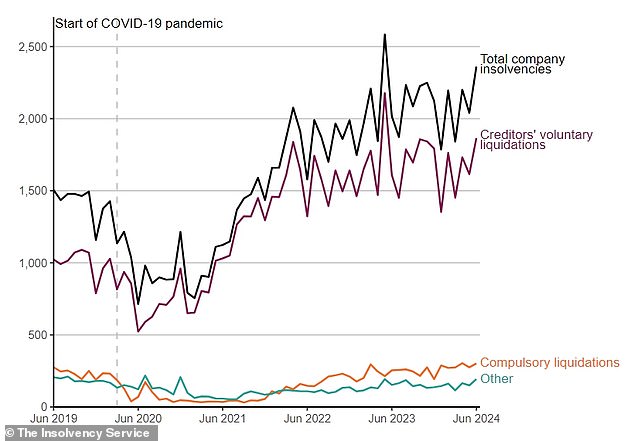

Business insolvencies in England and Wales rose 16 per cent last month as companies continue to struggle with cost pressures and lower consumer spending.

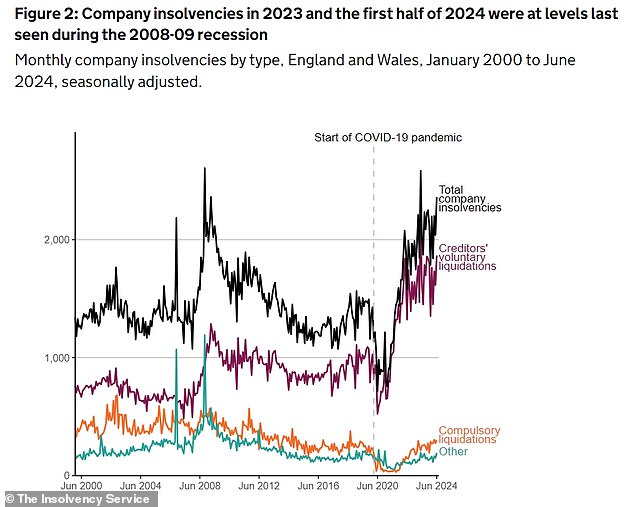

In June, 2,361 companies became insolvent, according to government figures, and corporate insolvencies since the start of 2023 are at levels not seen during the 2008-2009 global financial crisis.

The number of corporate insolvencies of all types was higher than in May and the same period last year, with 302 compulsory liquidations, 1,866 voluntary liquidations of creditors, 170 administrations and 23 voluntary company agreements.

Business insolvency cases of all types were higher than in May and the same period last year

David Hudson, restructuring advisory partner at FRP, said: ‘Insolvency levels are rising again as historic cost pressures continue and businesses face still-challenging conditions, marked by persistently high interest rates.

‘While business confidence has reached an eight-year high following the election, and consumer confidence is improving on the back of more stable inflation levels, these tailwinds are likely to prove too little, too late for many struggling firms.

“We expect insolvency levels to remain elevated as the economy recovers under the new government’s leadership and overcomes the full impact of what has been four years of punishing conditions.”

All types of insolvency increased last month

One in every 179 companies on Companies House’s effective register became insolvent between July 1, 2023, and June 30, 2024, the insolvency service said.

At a rate of 55.8 per 10,000 businesses, this figure has increased from the lows of 2020 and 2021, when businesses received financial support from the government thanks to taxpayer aid.

It is still much lower than the peak of 113.1 per 10,000 companies registered during the 2008-09 recession, but only because the number of companies on the Companies House register has more than doubled during that time.

Corporate insolvencies have remained at 2008/2009 levels, but more companies are registered in total

Jennifer Lockhart, partner and insolvency specialist at law firm Brabners, said: ‘With consumer confidence steadily improving and stimulating demand, there was hope for a second consecutive fall in insolvency levels.

‘However, the health of UK businesses is likely to remain volatile as firms continue to bear the brunt of high interest rates and the legacy impact of inflation.’

He added that the Bank of England’s interest rate decision in August had become “even more important” with struggling companies hoping to see borrowing costs ease from multi-year highs.

The chances of a 25 basis point base rate cut to 5 percent next month are understood to be “on a knife edge”, with high services and wage inflation data potentially forcing the BoE to wait until September before lowering rates.

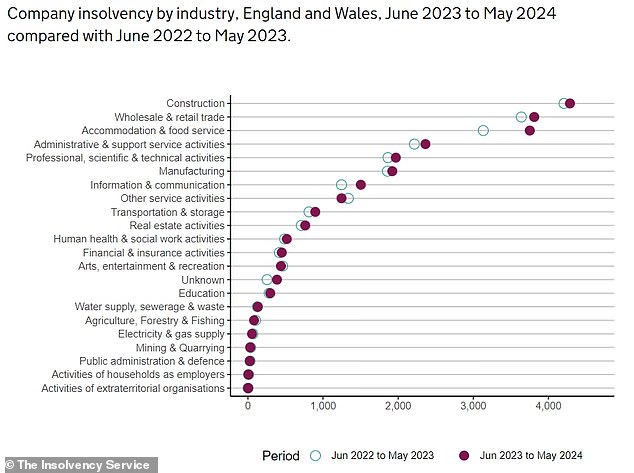

The construction sector has seen its highest level of insolvencies in the 12 months to May, with 4,287 failed companies accounting for 17 percent of the total.

This is followed by motor service companies with 16 percent, while companies in the hotel sector account for 15 percent of the total.

Construction and hospitality, among the most affected sectors

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.