Property prices are falling across the board in half of Australia’s capital cities as borrowers struggle to keep up with rising mortgage repayments, new data shows.

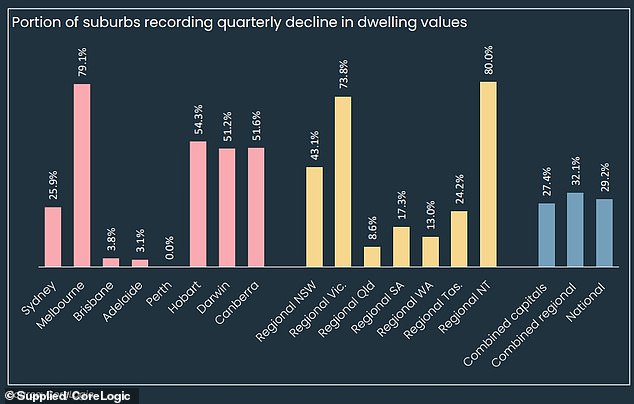

Australia is now a two-speed housing market, with house prices falling in most suburbs in four of the eight capital markets in the three months to August, CoreLogic figures showed.

But in the other four cities, property values continue to rise almost everywhere, reaching new record highs.

CoreLogic economist Kaytlin Ezzy said 12-year high interest rates, a cost-of-living crisis and affordability constraints had caused house prices to fall in more Australian suburbs.

“While values continue to rise nationally, albeit at a slower pace, below the headline figure, we are starting to see some weakness, particularly in Victoria,” he said.

Melbourne is Australia’s worst-hit capital market, with 79.1 per cent of suburbs experiencing a decline in three months.

Property prices are 1 percent lower than a year ago, despite a large influx of foreign migration.

The median home and unit price of $776,044 is now 4.9 per cent below its peak in March 2022, shortly before the Reserve Bank began raising rates 13 times.

In the most exclusive area of the Mornington Peninsula, 100 per cent of suburbs saw a drop in property values during the quarter.

Property prices are falling in half of Australia’s capital cities as borrowers struggle to keep up with rising mortgage repayments, new data shows (pictured is a Melbourne auction)

Australia is now a two-speed housing market, with house prices falling in most suburbs in four of the eight capital markets in the three months to August, CoreLogic figures showed.

Victoria is Australia’s worst-performing property market, following the introduction of a $975 flat investor levy in January.

In Geelong, 97.8 per cent of its suburbs saw a drop in prices, which rose to 100 per cent in Ballarat.

Hobart is Australia’s second worst capital market, with 54.3 per cent of suburbs declining in the August quarter.

The median house price in Tasmania’s capital of $655,114 is a whopping 12.2 per cent lower than the March 2022 peak, with prices down 1.2 per cent over the past year.

Canberra is another underperforming market, with 51.6 per cent of suburbs declining over the quarter.

The median house and unit price of $845,875 is 6.1 per cent below the peak in May 2022, the month the RBA raised rates for the first time since 2010.

Darwin, by far Australia’s most affordable capital, saw a price drop in 51.2 per cent of suburbs.

The median home price of $504,367 is 6 percent lower than its peak in May 2014.

Hobart is Australia’s second worst housing market, with 54.3 per cent of suburbs declining in the August quarter

But at the other end of the spectrum, Perth saw house prices rise across all suburbs.

Home and unit prices have soared 22 percent over the past year to a record $785,250.

Western Australia’s capital is also benefiting from large-scale interstate migration: Perth house prices have rebounded during the pandemic after years of stagnation following the end of the mining boom a decade ago.

Brisbane is another strong market, based on interstate migration flows, with only 3.8 per cent of suburbs experiencing a decline in value.

Over the past year, property values have risen 15 percent to $875,040.

Adelaide has not seen the same level of interstate migration, but only 3.1 per cent of suburbs suffered a price loss in three months.

Home values have risen 14.9 percent in a year to an all-time high of $790,789.

In Sydney, Australia’s most expensive major city, home values fell by 25.9 per cent in the suburbs (pictured are homes in Oran Park in western Sydney).

In Sydney, Australia’s most expensive urban market, home values fell by 25.9 percent across the suburbs.

But the median price of homes and residential units has risen 5 percent over the past year to a record $1.18 billion.

Nationwide, 29.2 percent of the 3,655 suburbs analysed by CoreLogic saw their values decline in the three months through August.

The Reserve Bank last month kept the cash rate unchanged at a 12-year high of 4.35 percent, but Governor Michele Bullock said relief would be unlikely in 2024 following the most aggressive rate hikes since the late 1980s.