Table of Contents

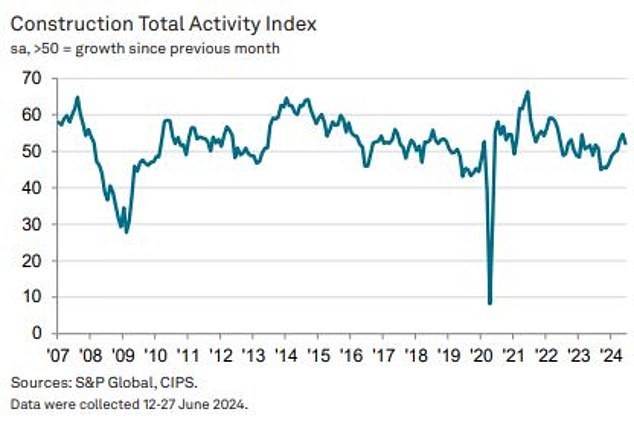

- S&P Global UK Construction Purchasing Managers’ Index fell to 52.2 in June

Growth in Britain’s construction sector slowed in June as house building fell, a closely watched survey showed.

The S&P Global UK Construction Purchasing Managers’ Index fell to 52.2 in June from 54.7 in May. A reading of 50 or above indicates growth.

The only category to record a drop in activity was housing, where output fell “solidly” after a first rise in 19 months in May.

The survey showed a slowdown in new orders as some companies adopted a wait-and-see attitude ahead of the general election.

Construction: Growth in Britain’s construction sector slowed in June, new data shows

Andrew Harker, economics director at S&P Global Market Intelligence, said: “While there were signs of a slowdown in the latest survey period, particularly around housing activity, businesses indicated that a slowdown in new order growth was partly related to election uncertainty.”

He added: “Therefore, we may see an improvement in trends once the election period concludes.”

The broader sectoral PMI, which includes results from the largest manufacturing and services sectors and was released earlier this week, fell to 52.3 from 53.1 in May due to slower growth in the services sector.

Within the construction sector, new orders continued to grow, but the increase was the slowest since February, S&P said.

Activity in commercial construction and civil engineering rose, but Thursday’s survey showed a further decline in residential construction work.

Businesses reported an increase in employment, with the fastest rate of job creation since August of last year.

On inflation, Harker said: “In terms of inflation, there are still few signs that cost pressures will increase significantly, encouraging businesses to expand their purchasing activity. Supply chain conditions also remained favourable.”

The Bank of England, which held interest rates at a 16-year high of 5.25 percent last month, is closely monitoring wage growth and service costs as it considers whether to cut interest rates this year.

S&P said the cost of some raw materials rose last month, although pressure on supply chains eased.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you