Table of Contents

There are several factors behind the poor performance of the shares of this member of the Magnificent Seven of technology.

Increased competition has forced the £535bn electric car maker (led by Elon Musk) to cut prices globally. As a result, the company’s second-quarter earnings were disappointing.

Chinese manufacturers such as BYD and Geely are challenging Tesla’s dominance, especially in China, the world’s largest electric vehicle market.

In Europe, BMW has overtaken Tesla in the electric vehicle sector. BMW could maintain this lead after the EU imposed a 9% tariff on cars made in China, where 51% of Tesla’s production is made.

How does Tesla compare?

The prices of these giants faltered in the fall earlier this month. But the other members of the gang have revived. Nvidia, the name behind the microchips that power generative AI (artificial intelligence), is now up 169 percent since the beginning of January.

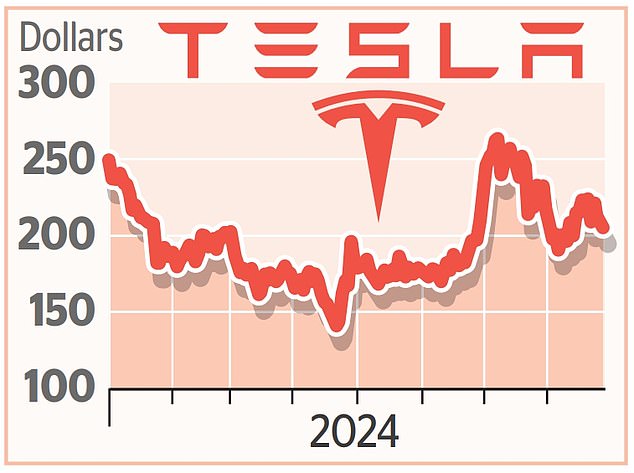

However, Tesla’s fall in 2024 must be seen in context. Shares of the company, which Musk has led since 2008, are trading at $220, 1,463 percent above their 2019 level.

In 2013, when hedge fund Scottish Mortgage started buying Tesla shares, the price was $11.

The stock peaked at $407 in November 2021.

How does Musk fight back?

Musk says self-driving “robotaxis” (promised to debut on Oct. 10) could turn Tesla into a $5 trillion company, though opinions differ on that promise.

Musk polarizes opinion. Some consider him the greatest business genius of our era, while others argue that he has become a threat to all his companies, including Space X and Twitter, now known as X.

But there is general consensus that Musk has been the driving force behind Tesla’s rise and must now address its problems. As the recipient of a $56bn (£44bn) pay package, it is the least he can do, though he may be under even more pressure than before if Donald Trump becomes president. Musk has backed Trump and could act as an adviser, although a cabinet post has been ruled out.

Is it worth buying shares?

Only seven of the 47 analysts who follow this stock recommend investors sell it. Another 20 rate the stock as “hold,” while 11 rate it as “buy.”

One reason for this confidence is Tesla’s energy storage business, which is seen as a giant in providing batteries essential for clean energy. Tesla’s futuristic-looking, $100,000 cybertruck may be making headlines, but batteries may play a bigger role in its future.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.