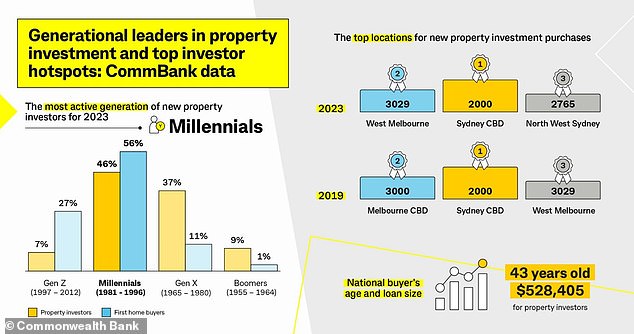

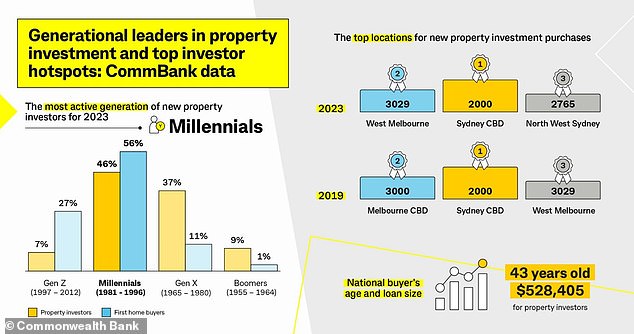

Almost half of all property investors taking out a loan are Millennials and homeowners typically borrow more than $500,000, the Commonwealth Bank has revealed.

Australia’s largest property lender has revealed that Millennials, or those born between 1981 and 1996, will make up 46 per cent of homeowner investors by 2023.

By comparison, Generation

Of the Millennials who took out a home loan, a third did so alone.

Commonwealth Bank executive managing director of home buying Dr Michael Baumann said younger investors also tend to choose to rent close to the city rather than be owner-occupiers in a distant, outer suburb.

“Interestingly, what we continue to see in many Australians is the inclination to ‘rent-invest’ – buying property where they can afford it and then renting it where they want to live,” he said.

Almost half of all investors taking out a loan are Millennials and homeowners typically borrow $500,000, Commonwealth Bank has revealed (pictured, young spectators at Sydney’s Royal Randwick Racecourse).

Commonwealth Bank executive managing director of home buying Dr Michael Baumann said younger investors also tend to choose to rent close to the city rather than be owner-occupiers in a distant, outer suburb.

“Rentvesting offers Australians the opportunity to get their foot on the property ladder as soon as possible and purchase a property in a lower cost area without having to give up the lifestyle they have become accustomed to when renting.”

The average age of property investors was 43, with an average loan amount of $528,405, which is less than Australia’s average loan amount of $598,624.

With a 20 percent deposit of $132,101, a mortgage of $528,405 would buy a home worth $660,506.

Banks can now only lend up to 5.2 times a person’s pre-tax salary, meaning the average investor borrowing at maximum capacity would earn $101,616, or slightly more than the average full-time salary of $98,218.

Melbourne’s west is proving to be a hotspot for investors, with Hoppers Crossing having a more affordable median house price of $628,711, CoreLogic data showed.

Craigieburn, in Melbourne’s north, with a median house price of $686,049 was also on the list, with both suburbs being significantly cheaper than Melbourne’s median house price of $935,049.

Australia’s largest property lender has revealed that Millennials, or those born between 1981 and 1996, will make up 46 per cent of homeowner investors by 2023 (pictured, a Melbourne auction).

Inner-city areas are also popular, with North Melbourne having a median apartment price of $512,983, which is less than half the suburb’s median house price of $1.374 million.

In Sydney, where property is much more expensive, Millennials on an average salary would need to purchase with their spouse.

Haymarket, with a median apartment price of $1,077, was on the hot list, along with Sydney’s inner city, where $1.144 million is the midpoint for units.

In Sydney’s northwest, investors were also particularly interested in Marsden Park, where $1.188 million is the median house price, and Kellyville, where $1.895 million is the midpoint.

Both suburbs sit on either side of the Sydney metropolitan area median house price of $1.414 million.

First home buyers

When it comes to first-home buyers, Commonwealth Bank data also showed that Millennials made up 56 per cent of first-home buyers, or double the figure of 27 per cent of Generation Z buyers. born since 1997.

Western Melbourne is proving particularly popular, with Hoppers Crossing having a median home price of $628,711 (pictured is a home with a price guide of $570,000 to $590,000).

New financial data on lending released this week showed that first-home buyers accounted for 36.9 per cent of new loans in February.

The value of first-home buyer loans rose 20.7 percent in a year, despite the Reserve Bank of Australia raising interest rates for the 13th time in 18 months in November, pushing the rate effective at a maximum of 12 years of 4.35 percent. .

Construction activity

Last year, Australia built 168,690 new homes, including 113,072 houses and 55,618 units, the Australian Bureau of Statistics revealed on Wednesday.

In the year to September, Australia’s net immigration level increased by 548,800 people and 111,000 babies were born.

The net population increase of 659,800 meant the number of new homes built fell 238,075 short of the population increase, taking into account that Australia has an average household size of 2.5 people.