<!–

<!–

<!– <!–

<!–

<!–

<!–

Millions of Australians have shivered through the coldest morning in months, with sub-zero temperatures and gale-force winds battering the country.

A low pressure system was forming off the New South Wales coast and bringing in south-westerly arctic winds on Wednesday.

Much of the state shivered during its coldest morning since October, with Sydneysiders waking up to 11.9C and Newcastle recording 13.6C.

The frigid conditions extended to Queensland, where Toowoomba recorded 8C, seven degrees colder than any other morning so far this year.

Residents along the New South Wales coast have been warned of damaging winds and dangerous waves as a low pressure system attracts southerly arctic winds (file image)

“So this is a shock to the system in the inland parts of southern Queensland,” Sky News Australia meteorologist Rob Sharpe said.

“Now we’re in for much colder weather.”

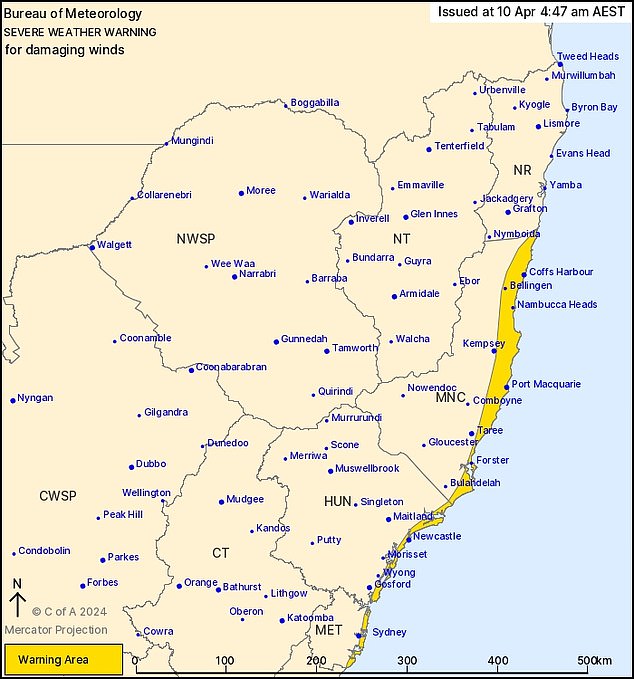

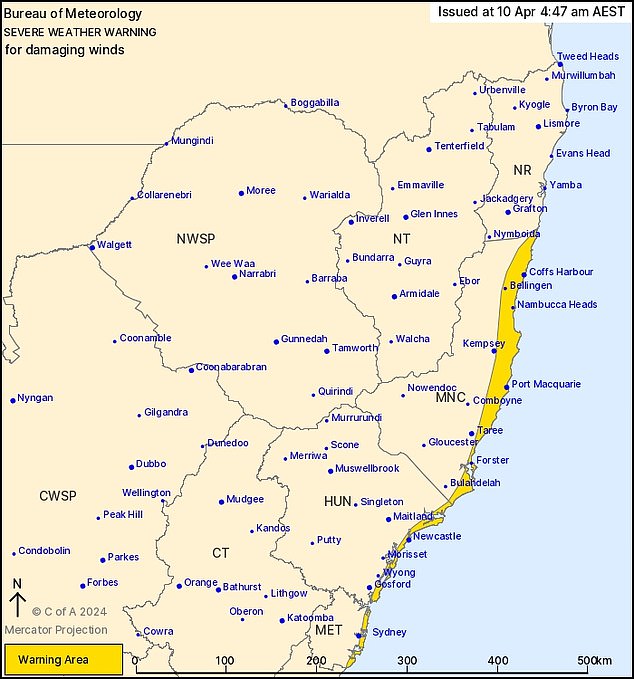

The Bureau of Meteorology (BOM) has issued warnings from Sydney to the state’s north coast for dangerous waves and damaging winds.

Weatherzone predicts winds could reach up to 100km/h around Sydney and the Hunter region coast.

Sydneysiders are also expected to shiver at 15C on Wednesday and Thursday, about seven degrees below the maximum temperature.

Winds reached 100km/h in Wattamolla, south of Sydney, at 2.30am, while Molineux Point and Sydney Harbor were hit by winds of around 80km/h early on Wednesday.

The BOM warning urged those from Sydney to Coffs Harbor to take preventive measures to limit injuries and property damage.

These include moving vehicles under cover and away from trees, and securing loose items around the house.

It is also suggested to stay “at least eight meters away” from downed power lines or any energized objects, such as electric fences.

The winds are also causing dangerous surf conditions on south-facing beaches from Sydney to Seal Rocks near Forster.

At Cronulla, in Sydney’s south, waves reaching 4.9m occurred just before 5am on Wednesday, which is forecast to fall over the weekend but will remain “rough” until Friday.

Other popular Sydney beaches, such as Coogee and Maroubra, will not be patrolled on Wednesday.

The Bureau of Meteorology has issued a warning about dangerous winds reaching 100km/h in some areas between Sydney and Coffs Harbor (pictured)

Several Sydney beaches will not be patrolled on Wednesday as south-facing shores are hit by strong surf.

A Weatherzone spokesperson told WhatsNew2Day Australia that conditions are expected to improve over the weekend as a rigid high pressure system moves into the area.

Temperatures are forecast to peak on Sunday and early in the week before another spell of cloud and rain hits the New South Wales coast.

The area is still recovering from last week’s deluge that brought a month of rain to Sydney, Port Macquarie and Taree on Friday.

Massive rain delayed trains and prompted evacuation alerts for thousands of residents along the Hawkesbury and Nepean rivers.

Bad weather on the east coast also prompted major flood warnings for residents along the Balonne, Condamine, Maranoa, Warrego and Barcoo rivers in Queensland on Wednesday.

A strong wing warning was also issued for the Central Coast, Central Gippsland Coast and East Gippsland Coast in Victoria on Wednesday.