- The CMA’s findings follow a 12-month study of the UK housebuilding sector.

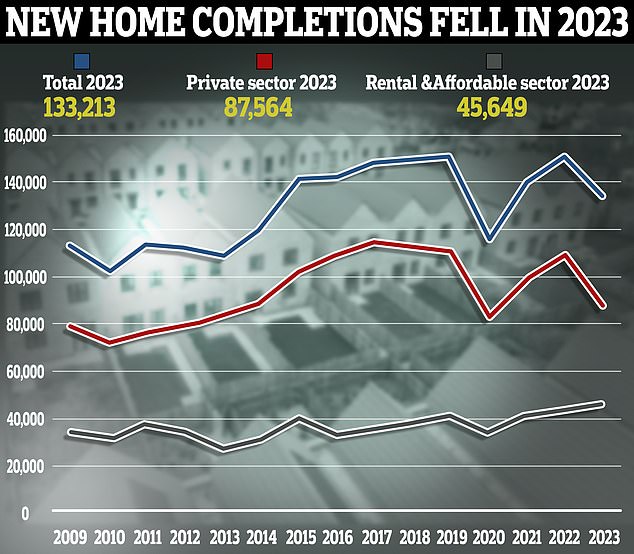

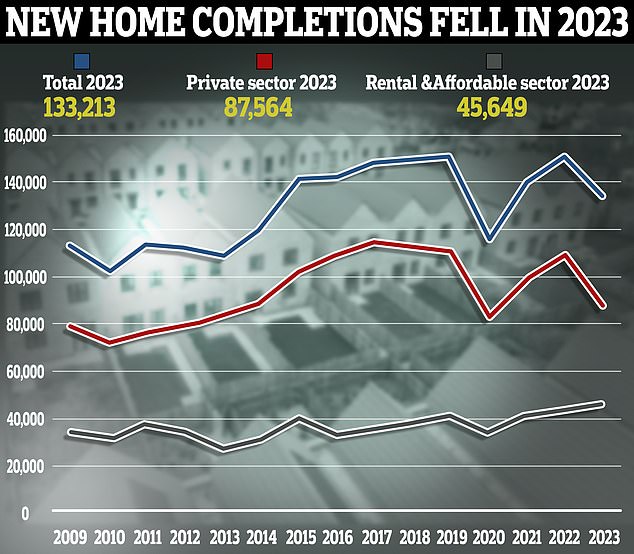

- Only 212,570 new homes were built in Britain during 2022/23

<!–

<!–

<!– <!–

<!–

<!–

<!–

The British property market needs “substantial intervention” to ensure more high-quality properties are built, the competition watchdog has advised.

The Competition and Markets Authority said the shortage of new homes was due to a “complex and unpredictable” planning system and “limitations” on private speculative development.

And Britain’s eight biggest housebuilders – Barratt, Bellway, Berkeley, Bloor Homes, Persimmon, Redrow, Taylor Wimpey and Vistry – now face an investigation into whether they are sharing commercially sensitive information.

According to the CMA, potential anti-competitive behavior is not believed to be the main driver of the market problems, but the regulator is concerned that such behavior may be harming competition and influencing new home prices.

Findings: The CMA said the shortage of new homes was due to a “complex and unpredictable” planning system and the “limitations” of private speculative development.

The findings follow a 12-month study of the UK housebuilding sector, which was launched amid major concerns about housing costs and availability.

According to the Department of Levelling, Housing and Communities, only 212,570 homes were built in Britain in 2022/23, well below the government’s target of building at least 300,000 homes a year.

In its study, the CMA said planning rules were leading to “unpredictable outcomes” and a “long amount of time” that companies had to go through before starting to build.

It noted that many planning departments lacked up-to-date plans or incentives to build the required volume of housing in a particular area and had to consult multiple stakeholders with the power to delay approval of a project.

Housebuilders themselves have been openly critical of the British planning system, blaming it for being the root cause of Britain’s crippling housing deficit.

New home completions fell in 2023

Additionally, researchers found that private developers assemble and sell homes based on price without diversifying the types and number of homes built.

The CMA also revealed that 80 per cent of new homes sold by Britain’s largest builders impose estate management charges.

These payments cost around £350 on average, but the regulator noted that homeowners could sometimes pay thousands of pounds in one-off additional charges for repair bills.

Many also receive shoddy maintenance work and direct reporting, and face “unclear administration or management positions.”

Sarah Cardell, chief executive of the CMA, said: “Housing building in Britain needs significant intervention so that enough good quality homes are delivered in the places where people need them.”

The CMA’s recommendations to reform the housing market include the creation of a New Homes Ombudsman and a mandatory consumer code to help Brits pursue builders over any quality issues.

The regulator also wants councils to adopt services in all new developments and allow owners to switch to a “more competitive” management business.

Following this announcement, shares in many of Britain’s largest housebuilders were some of the biggest fallers on the FTSE 350.

Redrow shares were 2.3 percent lower at 647.5 pence, while Bellway Stock were down 2 per cent to £27.06, and both taylor wimpey actions and Persimmon Stock fell 1.8 percent.

Sophie Lund-Yates, senior equity analyst at Hargreaves Lansdown, said: “Seeing simplified rules could help some of the big listed names move more homes, but it could also increase competition.”

“Allegations of poor construction quality and anti-competitive practices will be of more immediate importance, as findings against any of the strikes could lead to a degradation of margins in the short term, but this is far from guaranteed.”