Table of Contents

- Sarah Breeden said sharp rise in carbon costs could keep inflation high

Policies designed to combat climate change “probably” had a bigger impact than expected on the inflationary turmoil of recent years, the Bank of England’s deputy governor has said.

Sarah Breeden, who is in charge of the bank’s financial stability efforts and sits on its Monetary Policy Committee, said in a speech on Friday that a sudden and sharp rise in the cost of carbon as a result of UK policies could make inflation higher for longer.

The Russian invasion of Ukraine in 2022 was the crucial catalyst for an inflationary spiral led by energy prices, which pushed Britain’s consumer price index up to 11.1 percent in October of that year.

Breeden told an audience at the University of Edinburgh Business School that the rise in wholesale gas prices coincided with a “material” rise in the cost of carbon.

This, he said, was driven by a reduction in the supply of carbon permits, a declining proportion of permits given out for free and “an expansion of sectoral coverage” under the UK’s emissions trading scheme.

Carbon permits, also known as carbon credits, can be purchased by companies and individuals to offset carbon-emitting activity.

Cost of carbon: Bank of England deputy governor Sarah Breeden

The ETS sets a limit on the total amount of certain greenhouse gases that covered sectors can emit.

This meant carbon prices roughly doubled to around £100 per tonne of carbon dioxide equivalent by summer 2022.

Breedon said: “These carbon costs are non-trivial in the sectors most exposed to the scheme, such as the energy sector.”

He explained that while wholesale gas prices were the dominant factor in high electricity prices in 2022, carbon costs, which account for about 50 percent of fuel costs for gas electricity producers, were “an important factor in prices.”

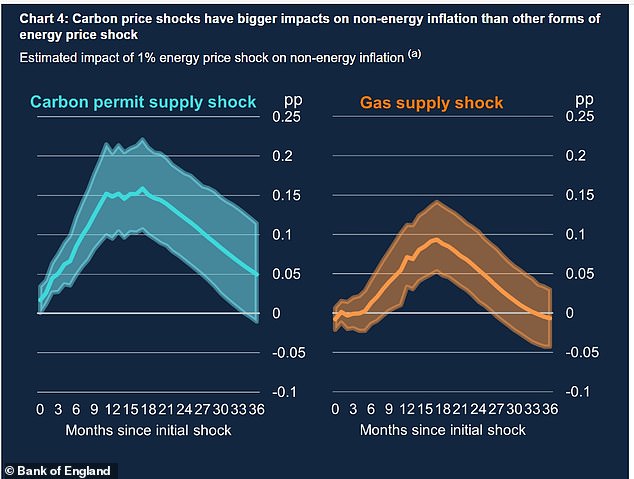

The Bank of England compared the impact of the gas supply shock and the carbon permit supply shock

Breeden said: ‘The source of a shock to energy prices could affect its impact on inflation.

‘Specifically, if energy prices rise due to a shock to the supply of carbon permits, the impact on non-energy price inflation could be around 1.5 times greater at its peak – and last for several months. more – than if the increase were driven by a gas supply. shock.

“That seems plausible if shocks of this type are expected to be longer lasting, given that the stringency and scope of the carbon permitting scheme could increase over time.”

The ‘new shocks’ to the economy are not so bad

Breeden added that the Bank of England needs to “build more sophisticated analysis of climate policy into its core monetary policy work”, highlighting “growing evidence that it is important for price stability”.

It came as the lieutenant governor, who is planning a broader speech on the impact of climate policy “later this year,” outlined her near-term economic outlook.

Breeden, who has been with the bank since 1991, said he expects “a continued recovery from past shocks, as lower headline inflation gradually translates into lower wage growth and this relieves pressure on price setters.” to pass on higher labor costs to prices.

He warned that there are “new shocks” affecting the economy, such as the fall budget’s impact on the labor market, but said they “are likely to be considerably smaller than the large shocks of the recent past.”

This suggests the BofE is willing to consider resuming interest rate cuts if inflation moderates, having paused at 4.75 per cent amid fears of a resurgence in price pressures.

Breeden said: ‘Recent evidence further supports the argument for removing restrictive policies and I hope to continue to gradually remove restrictions over time.

‘The important questions as I look to the future are what combination of shocks explains the recent slowdown in activity and how employers will respond to higher labor costs.

“The answers to those questions will affect the medium-term inflation outlook and therefore the speed at which restrictions need to be removed.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.