Table of Contents

There’s nothing the city loves more than doing business, and that’s why it loves Halma.

The £10bn health and safety equipment maker is considering around 600 companies as potential takeover targets.

It typically buys three to five companies a year and said in its annual report that it was “constantly monitoring” potential targets and would play the long game.

The dealmaker: Halma is considering around 600 companies as potential acquisition targets

Many of them are not for sale, so Halma must “develop relationships with them” before making any offer. Halma unveiled its latest deal last month, for Global Fire Equipment, a Portuguese fire alarm manufacturer that it bought for £36m.

The FTSE 100 company posted a profit of £340m last year thanks to its wide range of products, from water leak detection to birth monitoring systems.

As the City Watchers try to keep an eye on those 600 potential targets, perhaps they should approach Halma and ask for one of her gadgets for the task?

Hutson has a problem at Diversified Energy Company

The Diversified Energy Company, run by former banker Rusty Hutson, is one of the largest operators of onshore oil and gas wells in the United States.

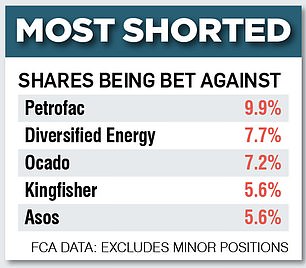

But the FTSE 250 company has faced questions about the cost of plugging such wells when they are dry, prompting short-sellers to pounce in January.

And a recent financial settlement that the firm had hoped would defend it from hedge funds has seen bets against the firm’s share price fall only slightly – it is second only to Petrofac in the “most shorted” charts.

Hutson, we have a problem…

Natwest is interested in rejoining CBI

Natwest is busy rebuilding its reputation since it infamously “debanked” Nigel Farage, and is looking to unravel another part of its former boss Alison Rose’s legacy: withdrawing from the Confederation of British Industry after sexual allegations there.

NatWest boss Paul Thwaite and chairman Rick Haythornthwaite are said to be keen to rejoin forces if the recent reconciliation between the CBI and ministers continues under the new government.

After all, lobby groups like the CBI can speed up talks with ministers.

And NatWest has plenty on its mind – including suspended plans for its Tell Sid-style share sale, which is subject to approval from Number 10.

Investors clamor to back ClickASnap

Aim, London’s junior stock exchange, is fast becoming the place where UK tech companies thrive.

That’s according to online photo-sharing site ClickASnap. The Dorset-based firm plans to float on the stock exchange this year and could be valued at £25m.

Chief Jason Hill believes Aim was “hijacked by oil, gas and mining companies” after the dotcom bubble, with a number of tech success stories going unnoticed.

Now he says the tide is turning, with investors clamoring to back ClickASnap, which allows users to upload photos and get paid for their use while retaining the copyright.

Oil, gas and mining minnows: you’re out of the picture!

Contributor: John-Paul Ford Rojas

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you