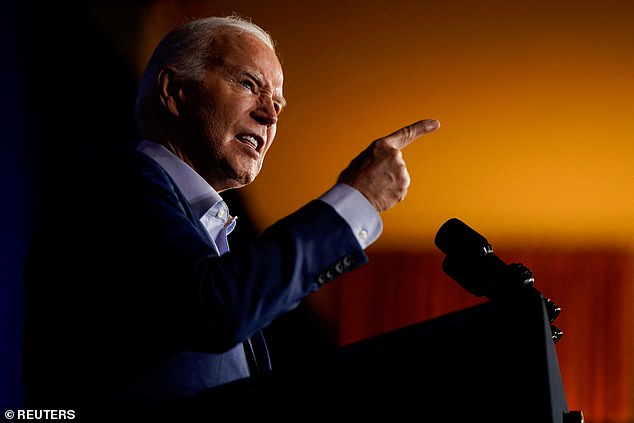

President Joe Biden will call for tripling tariffs on Chinese steel to protect American producers from cheap imports, an announcement he will make while courting steelworkers in Pennsylvania on Wednesday.

He will make the announcement in a key state for his re-election campaign and will address an industry angered by the planned purchase of US Steel by a Japanese company.

It is also a measure intended to counter his Republican rival.

President Biden to announce tariff increases on China in speech to American steelworkers

Donald Trump, as president, imposed sweeping tariffs on China and has threatened to impose even more if he wins another term in the White House.

Now both men have talked about how they will counter China as they make their pitch to voters for a second term, particularly when speaking to blue-collar workers who may decide the November election.

Biden is pushing an economic plan to combat inflation that has raised the cost of food, goods and gas across the country. Voters have given him low marks for his handling of the economy.

Meanwhile, Trump reminds voters that the economy was stronger during his time in office.

“When a country just rips us off like China, then what I did was tariffs and tariffs were forcing companies to come back to the United States,” Trump told CNBC in March.

This week, Biden is on a three-day campaign tour in Pennsylvania that began in Scranton on Tuesday and will include a visit to Philadelphia on Thursday.

As part of his announcement on Wednesday, Biden will ask US Trade Representative Katherine Tai to increase tariffs to 25 percent on certain Chinese products – including aluminum and steel – that have 7.5 percent tariffs. or no tariffs, administration officials said.

Furthermore, it will reiterate his opposition to the proposed sale of US Steel to Japan’s Nippon Steel.

“It is important that US Steel remain a domestically owned and operated company,” a senior administration official told reporters Tuesday.

‘The president will make that clear again. He has told the steelworkers that he will have their back and he means it.”

At a rally last weekend in Pennsylvania, Trump criticized Biden over Nippon Steel’s efforts to buy US Steel, ignoring Biden’s objections to the merger.

“I wouldn’t let that deal happen,” Trump said.

Biden will reiterate his opposition to the sale of US Steel to a Japanese company, above US Steel’s Mon Valley Works Clairton plant in Clairton, Pennsylvania.

Donald Trump has also promised to increase tariffs on China if he is re-elected.

Biden will also announce an investigation into China’s aggressive support for shipbuilders and other related industries, which unions have complained about. And he will announce an initiative to work with Mexico to prevent China from evading US steel tariffs by routing its exports through that country.

Biden has worked to thaw relations with Beijing, which became strained under Trump. She met with Chinese President Xi Jinping in November in San Francisco. And she has sent her top administration officials to visit the country.

China, however, is working to counter its own economic crisis. Its exports, which receive subsidies from Beijing amid a low-cost labor market in that country, have helped propel its economy to faster-than-expected growth.

While in Beijing last week, Treasury Secretary Janet Yellen expressed the administration’s concern that China’s excess manufacturing capacity would push more products into the global market at artificially cheaper prices, which could stifle competition.

“When markets weaken, prices fall and it is our companies that close, and those that are our allied countries,” he said Tuesday. “Chinese companies continue to receive support to remain.”

And the Biden administration wants to make clear that they are standing up for American workers.

“China’s policy-driven overcapacity poses a serious risk to the future of the U.S. steel and aluminum industry,” National Economic Council Director Lael Brainard told reporters in a conference call Tuesday.

‘China cannot export its way to recovery. China is simply too big to follow its own rules.